How to Improve Credit Union Member Engagement

Comm100

MARCH 2, 2022

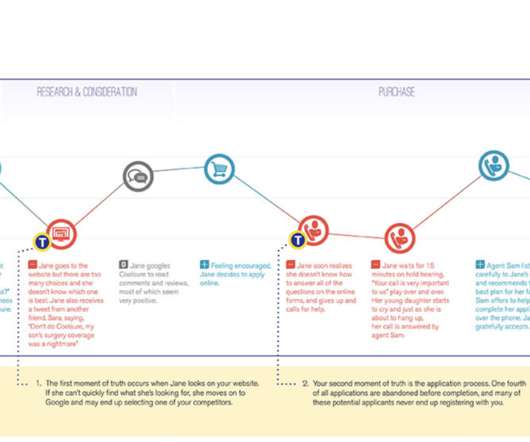

Credit unions are not-for-profit and are owned by the people who use its services – their members – rather than shareholders or investors like banks typically are. This means that while making a profit is a bank’s priority, credit unions’ overriding goal is to provide the best service to their members. Table of contents.

Let's personalize your content