Customer Self Service – What the Future Holds

TechSee

SEPTEMBER 10, 2019

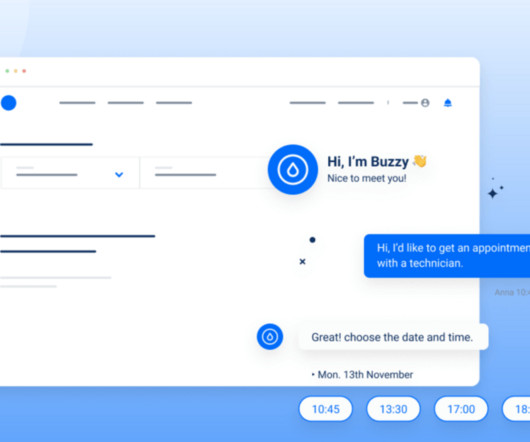

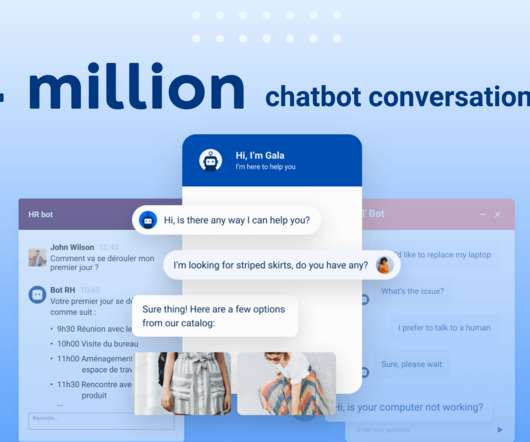

Research indicates that by implementing AI in their customer-facing operations, companies can expect to save approximately 30 billion customer service hours and realize $8B in savings thanks to customer self service. As self-service technology becomes more sophisticated, both consumers and enterprises are feeling the benefits.

Let's personalize your content