10 Customer Effort Score Tools in 2022 – Free & Paid

SurveySensum

JULY 27, 2022

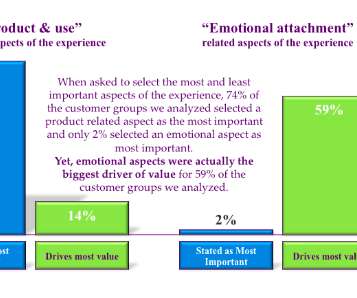

But, it then became evident that customer loyalty also resembles the effort your customers put in to acquire your products and services. And, that means the more extra effort they need to put in to interact with your business, the more disloyal they become. . Explaining CES tools and CES score. A good CES score.

Let's personalize your content