Loyalty programs: should you issue your own points or miles?

Currency Alliance

APRIL 15, 2024

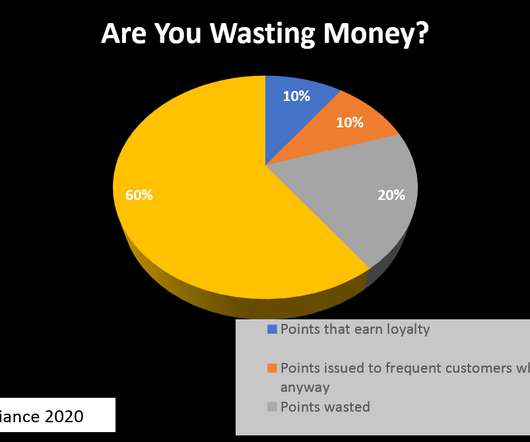

Many people assume that operating a loyalty program necessarily implies issuing your own loyalty points or miles. Points and miles are a dominant and popular form of loyalty value. The golden benchmark is about $25 USD per year in loyalty value. This actually is not true.

Let's personalize your content