The Right Survey to Measure Each Touchpoint of the Customer Journey

GetFeedback

JANUARY 19, 2020

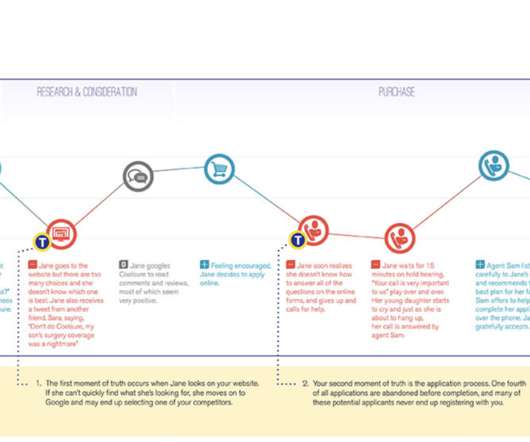

After my trip was over, I received one final request using a Net Promoter (NPS) rating scheme. This is the right time to use NPS. . type question works well when evaluating a relationship or complete experience, but it can be confusing if asked after individual touchpoints. Think “Survey+” for Customer Feedback.

Let's personalize your content