Bringing Emotion into the Credit Union Member Journey

CloudCherry

JANUARY 18, 2018

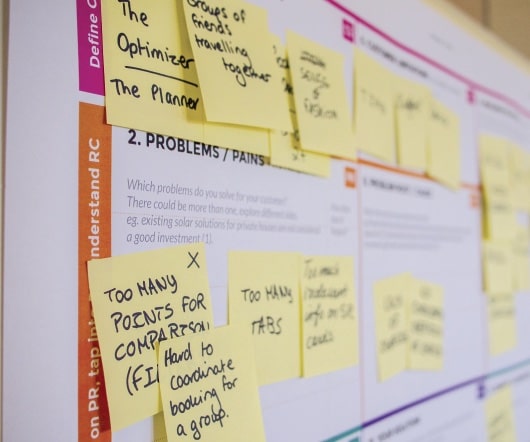

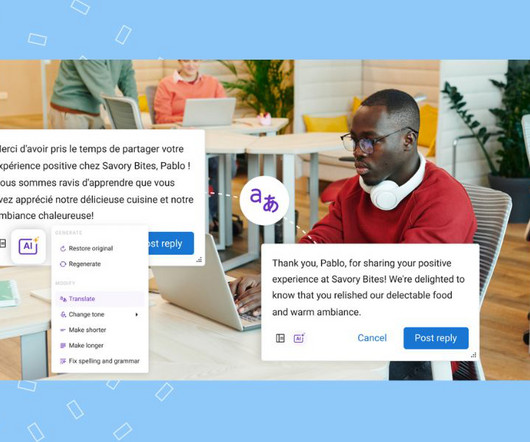

But great experiences are often the ones that connect with members at an emotional level. Create an omni-channel framework based on journeys. Your members today are omni-channel. So much so that being omni-channel has become a pre-requisite today. Let’s take a look! The answer lies in emotion!

Let's personalize your content