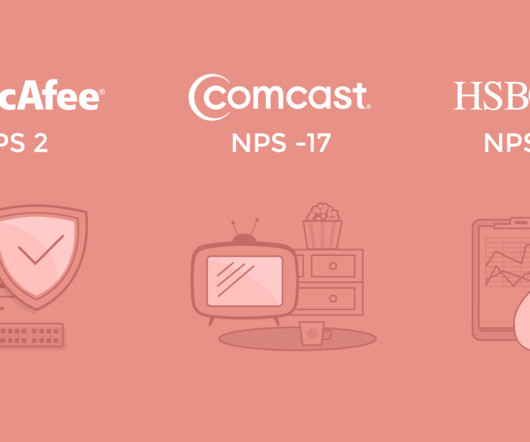

What Do Companies With Low Net Promoter Score Have in Common?

Retently

MARCH 23, 2023

Since not all NPS® data is public, and most brands aren’t eager to publish their low Net Promoter Score, we’ve taken several steps to find reliable customer satisfaction data that we can use to compare brands: Whenever possible, we’ve sourced data from various NPS benchmarks to gain a picture of the general NPS range within an industry.

Let's personalize your content