Defining the Value of Customer Experience: A Guide for Creating CX ROI in A Constantly Changing World

Experience Investigators by 360Connext

APRIL 23, 2024

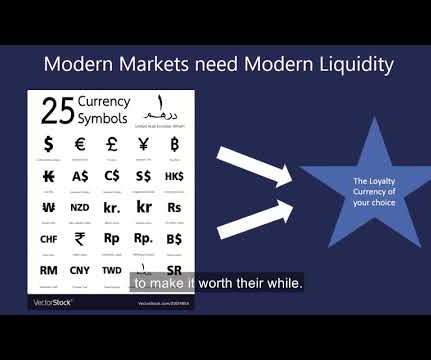

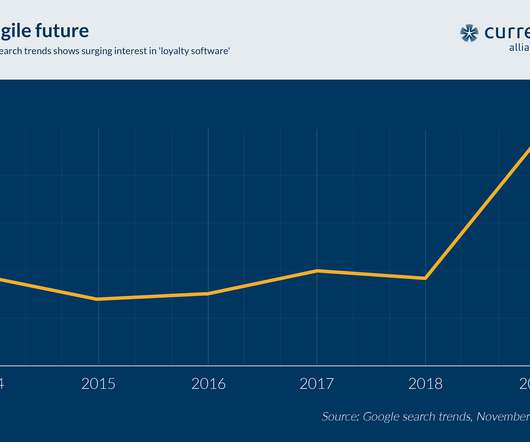

This loyalty translates into substantial financial benefits, as loyal customers are not only more likely to make repeat purchases but also to advocate for the brand, thereby increasing referrals and sales. For instance, referred customers at a German bank were found to be 25% more profitable than those acquired through other channels.

Let's personalize your content