AI in Financial CX: The Future of Banking Experiences

InMoment XI

JANUARY 22, 2024

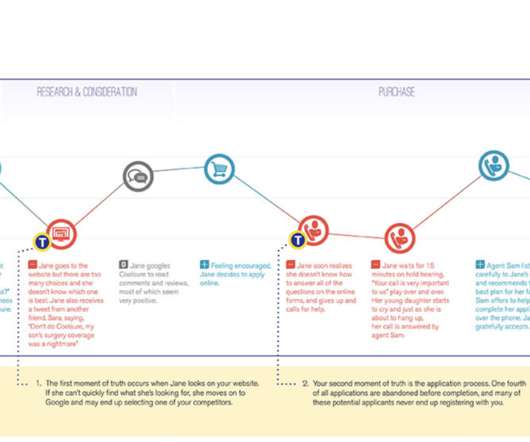

CX will be forever changed in the world of retail banking in the coming years by the unstoppable wake of AI. Hyper-personalization at Scale AI’s role in personalizing the banking experience is, in a word, profound. Efficiency and Accessibility The efficiency and accessibility of banking services is changing, too.

Let's personalize your content