Bank loyalty: stay top-of-wallet through the next decade

Consumers used to show loyalty to their main bank more or less by default. Now, forward-thinking banks are urgently considering how to keep their payment cards top-of-wallet and expand the stickiness of their relationships with customers over the next decade.

The urgency is due to mounting downward pressure on banks’ revenue streams, and changes in customer behavior.

On the revenue side: fintechs such as Wise, Revolut, AliPay, WeChat, and now Google Pay and Apple Pay, among others, are nibbling away at the dozens of services a bank traditionally provided.

Meanwhile, customers are also now more likely to use aggregators to find the best deals on credit cards, loans, mortgages, insurance, financial advice, etc. – which many banks also provide. In the case of a typical middle-income customer, this would mean the bank is missing out on hundreds, if not thousands of dollars of incremental revenue per year.

Furthermore, younger consumers now like incurring far less debt than older generations, so banks are now earning less revenue from credit card fees and loans.

Back in 2017, when interchange fees were slashed by the European Union, most banks’ response was to simply to give up on their loyalty program; this was lazy and a huge strategic mistake. And globally, there is regulatory and merchant pressure for interchange fees to decline further over time, so no bank can assume they will have significant margin to fund loyalty points over the next decade.

And as other ‘easy money’ has dried up, banks have finally realised that loyalty investment is actually indispensable in differentiating and growing their businesses.

Clearly, it’s unacceptable for any business to watch existing revenue streams slip away, while failing to take advantage of readily available incremental revenue.

Every bank needs a loyalty strategy – even if they don’t have a points-based loyalty program.

The purpose of this article is to set out the four pillars of an effective loyalty program over the coming decade in retail banking:

- improved customer profiling with a view to increasing customer lifetime value (LTV)

- building out an ecosystem of partners to improve data insights, increase earn/burn opportunities, and enable merchant funded offers

- enabling points liquidity, (i.e., the frictionless earning and burning of points) throughout the ecosystem, leveraging the bank’s experience in payment processing, reconciliation and settlement

- modernizing the martech stack, so that loyalty engagement can be introduced as widely as possible throughout many different customer journeys, incorporating dynamic pricing and the ability to measure long-term ROI.

We’re publishing this partly because the number of banks using Currency Alliance has quadrupled in the past year and we want to see them succeed – and also because I think we can help them plot a clear course towards more productive loyalty marketing.

Banks, just like travel companies, are emotionally important in peoples’ lives. This is evident from the frequent depiction of vacations, weddings, new homes, and sending the kids to college in their TV commercials.

And, just like grocers, banks are an everyday necessity, with very high levels of customer frequency.

With those natural advantages, banks should be operating some of the world’s most popular loyalty programs. With a further natural advantage in payment processing, the opportunity is there for the taking.

The most forward-thinking banks are aware of the need to break away from the noise and create a clearer value proposition for their many customer segments – keeping in mind that they have many customer types who value very different things.

Increasing bank customer lifetime value through improved customer profiling

Customers value recognition. This is a leading factor in emotional loyalty, and its why improved personalization is one of the major trends of modern marketing.

Unfortunately, most banks do a fairly poor job of making most customers feel recognized and valued. Some banks do this successfully for high-income customers; Bank of America/Merrill Lynch, for instance, providing their elite customers with special treatment and offers.

But most people, of most income levels, would like lounge access, access to special concerts or events, a periodic thank you, a reduced interest rate, or a travel voucher from someone like DragonPass. There should also be a significant degree of flexibility in how the customer redeems their reward value so that most customers, with their highly varied preferences, can find something of interest.

These characteristics are becoming more prevalent in retail and travel loyalty programs, but it’s a far cry from those operated by most banks whose loyalty programs and service offerings are fairly similar.

Outside Europe, where bank loyalty programs mostly disappeared in 2017 when the European Union slashed interchange fees, the majority of bank loyalty programs basically give the customer 1% of their credit card spend in the form of points. For a consumer spending about $2,000 per month on their card, they are getting about $20 worth of loyalty value (in the bank’s loyalty program, or cashback – that is credited to their bank account).

This is standard – and pretty boring, so it doesn’t make the customer feel valued, or create a reason to choose one bank over another.

I’ll come onto how customers should be rewarded later on, but the first step to getting this right is to improve customer profiling so that you know how to recognize and motivate different customer segments.

Calculating likely incremental margin for different customers

The real value of a customer is based on the incremental margin they will generate for the business over the span of time they remain engaged. This variance in predicted incremental margin should be a leading factor in customer segmentation, because you would want to focus more of your energies on the (potentially) more valuable customers.

But while most banks probably have 10-20 different customer segments who need (and perhaps expect) different types of service, the current level of segmentation at most banks is insufficient.

Consider, for example, two customers who spend $2,000 each per month on their personal credit card and earn $90,000 per year.

- ‘Joe’ is an office worker with 2 children, who flies 1-2 times a year for vacation, plus Christmas and perhaps another holiday to visit family.

- ‘Sarah’ is a small business owner without children – who hardly travels at all but whose business turns over $1m per year.

If the bank gave both Joe and Sarah 1% cashback on their credit card spend, they would earn $240 in value per year – if they use a credit card from their main bank. $240 is valuable to some people, but not that interesting to people of Joe and Sarah’s income levels. They could probably earn the same value with any other bank or card issuer, so it isn’t really a factor in their loyalty.

Whereas these two customers’ personal finances are identical, the incremental margin they could generate for the bank is completely different.

Both may be interested in a similar mortgage product and checking account, but Sarah’s personal finances are likely to be more complicated, and her company could be a highly valuable additional customer for the bank.

Joe might appreciate being able to redeem on travel – and since his children may one day attend private school or university, he could also be interested in savings products that mature over 10-20 years. For Sarah, children may not materialize – but she might well appreciate discounted accounting software or tax advice, or a preferential rate on a business loan.

Of course, the same bank will also have customers with $30,000 in annual income, as well as high net-worth customers that have entirely different needs. The same standard marketing materials across all these customer types just won’t resonate.

This is why banks should have loyalty propositions at the customer-segment level and not force all customers to accept one set of features at the bank-wide level. The bank could still have a single loyalty program, but it needs to tailor features and services to the various desires of each customer segment.

So, predicted incremental margin should not be based on an ‘average’ customer and applied to all customers. To be more precise, you would want to estimate lifetime value based on customer segments, since different types of customers will have different spending or savings or investment patterns. With modern technology, you can even calculate this for each customer.

Obviously, when you engage a customer for the first time, you will have to predict which type of customer they will turn out to be in order to estimate LTV, but as you start capturing actual transactional data for each customer, the estimates can become much more precise as you apply models based on the various segments of customers already monitored.

Artificial intelligence (AI) and machine learning (ML) are now quite accessible technologies that can greatly help in customer profiling. They can take into consideration the nuances of differing customer purchase patterns, risk profiles, accumulated debt, late payment information, and family characteristics, to improve personalization and targeted offers.

The bank will have a fair amount of earned data from its own interactions with the customer, but they can amplify the dataset by agreeing to share additional data with partners in their ecosystem – as the next section explains.

Understanding lifetime value across the partner ecosystem

The examples of Joe and Sarah above are profiling efforts which most banks can do using data from their own, direct customer interactions.

But in bank loyalty, this concept is much more interesting for those banks who build a broad ecosystem of partners around a loyalty program. This can serve the following objectives:

- collecting data for personalization

- increasing ‘earn’ opportunities for the customer

- creating further revenue opportunities for the bank.

Around data collection: the bank will only know where the customer shops when the bank’s payment card is used, and even then, they won’t know exactly what the customer has bought. There’s a big difference between two people who both spend $2,000 in a single transaction with American Airlines – one, on a single business-class ticket to Paris; the other on 4 economy seats to visit family in Texas.

But, if the bank uses its loyalty program to facilitate consumers doing more business with their merchant customers, the bank should get detailed transaction data back from the partners when its points are earned or redeemed.

That would include partners in categories such as utilities, telcos, fashion retailers, pharmacies, grocery stores, mechanical services, construction/remodelling products and services, food and beverage, entertainment, etc., as well as travel.

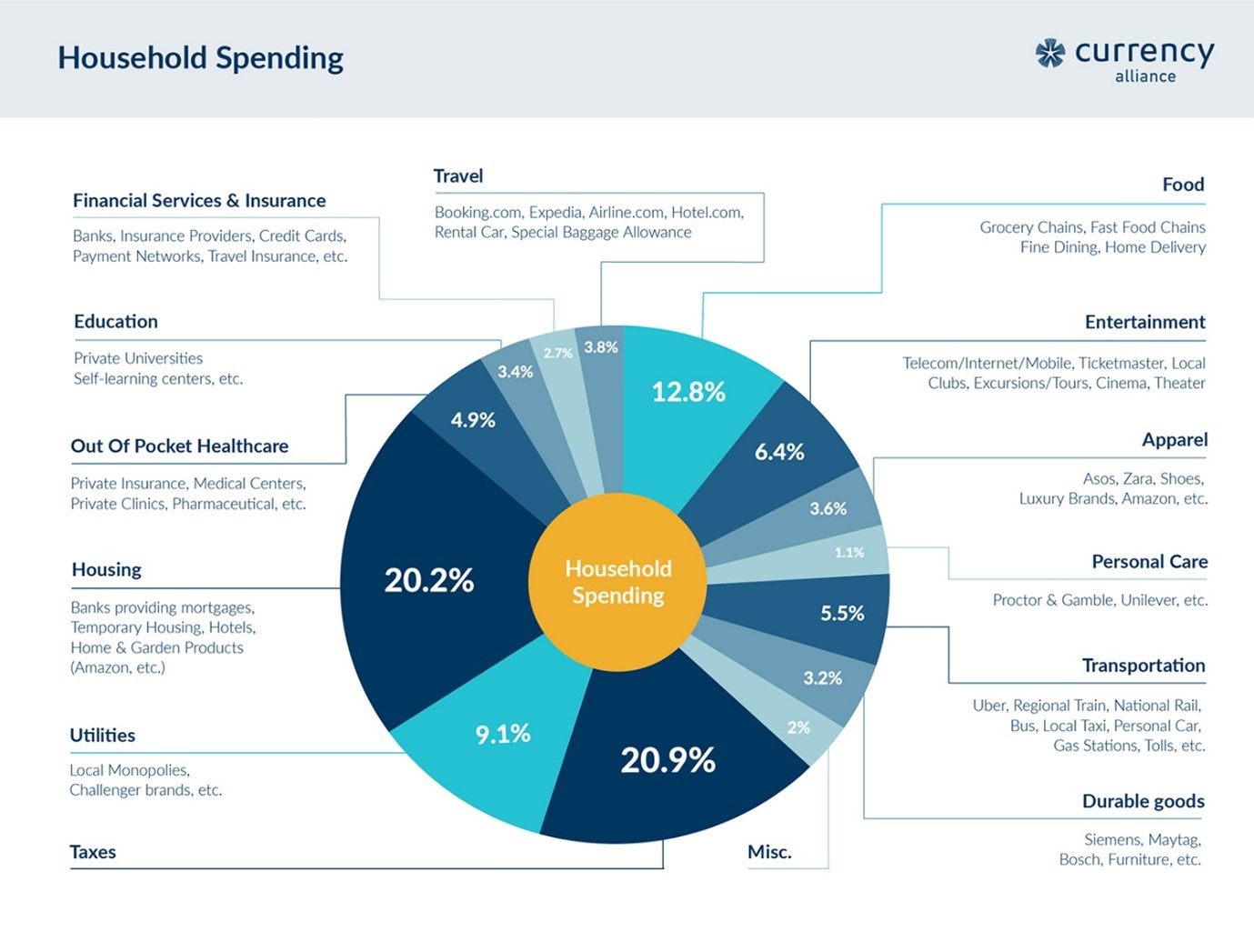

The following chart shows typical spending patterns by category; banks would be wise to have multiple partners in most of those categories.

A well-designed mix of partners across most spending categories might capture 60-70% of a customer’s monthly discretionary spending. In developed economies that could easily reach $2,000 per month.

If the bank’s loyalty ecosystem is delivering 1% to 2% in loyalty value, that is nearly $500 per year in value for the customer – who will be less likely to churn to another bank if it means leaving that loyalty value behind. Therefore, the number of years used in calculating LTV can also be extended further into the future, multiplied by an exponentially higher number of transactions across the partner network.

Of course, the margin the bank earns directly from the customer is only one source of value here. It also includes any margin that is earned across the ecosystem of partners, since the bank can earn a small transaction fee for those thousands of accrual or redemption transactions.

When a bank compares the LTV of their customer in their current standard loyalty program with the huge LTV that is possible from a bank-sponsored loyalty ecosystem of many partners, they will want to get started immediately.

A further benefit is the ability to use these richer customer insights to better price the bank’s own products and services.

Most customers are offered the same rates for loans, savings and other products which are set nationally or perhaps regionally, usually based on central bank interest rates. But with this more sophisticated data, a bank could apply actuarial formulas, much like an insurance company estimates future costs before setting the price for an insurance policy. That would allow the bank to set a price that promises the greatest ROI for each segment, or even each customer.

Banks are in prime position to orchestrate a loyalty partner ecosystem

Every bank wants its cards to be top-of-wallet; indeed, the purpose of loyalty programs is to make the brand the customer’s first choice among competitors.

Discounts and giveaways are certainly part of the mix in winning customer preference – so banks are highly motivated to provide incentives like lower interest rates, cashback, loyalty points, monthly/quarterly rewards based on spend, etc.

The problem is that today, nearly every one of these bank loyalty programs looks exactly the same: little differentiation and little innovation. Banks have realised that customers usually want to redeem their rewards on aspirational experiences or travel – which is a step in the right direction – but there is currently too much dependency on airline partners. Banks do a poor job of aggregating their own, interesting redemption options, so they expect customers to simply exchange out into airline points/miles or gift cards.

Standard and expected redemption options are bad because customers end up taking these offers for granted, and so they cease to have much impact on customer behavior.

If the customer has 2-4 credit cards all offering the same thing, it doesn’t really influence which card is top of wallet. At the end of the day, the customer is accumulating loyalty value that subsequently they can exchange into the same popular airline loyalty programs, or redeem for gift cards from the same leading retailers.

This means the customer perceives no special recognition from any of the banks, which have not bothered to arrange merchant funded offers that are more exclusive to the bank’s partner ecosystem. American Express Membership Rewards and Chase do a slightly better job than most because they have monthly and quarterly special earn promotions across some partners, but those are still generic in that the same offers are applied to most customers during a stated period of time.

The world’s leading loyalty programs have solved this problem – or are at least are making strides towards solving it. As a result, banks’ loyalty programs are falling behind.

As we explained in a previous article on partner loyalty, the partner network is now a primary differentiating advantage for a loyalty program.

The grocery sector is a useful point of comparison, to the extent that both grocers and banks are perceived as fairly utilitarian brands with high levels of customer frequency.

Customers may show loyalty to a grocer, despite the presence of many very similar competitors, because that grocer’s loyalty program makes it easy for them to earn towards aspirational rewards. They can accrue points with the grocer directly or with the grocer’s ‘earn’ partners, and spend the points with the grocer’s ‘burn’ partners (such as rail network operators, theme parks, restaurants, etc.).

This makes the grocer a default choice in the customer’s everyday spending, with the grocer collecting crucial zero-party data along the way.

Banks should be able to do the same thing. This would put them in the driver’s seat in their local market to deliver tremendous value to customers, while enhancing their importance as a financial partner to both consumers and the bank’s retail merchant customers.

In most cases, however, the banks’ existing programs lack the fundamental elements of the loyalty partnership ecosystem described above. The bank’s loyalty currency (if it has one) cannot usually be issued by other brands. And while the currency may be accrued on card-linked offers, this is usually via a third-party service provider that is also not sharing much information between the partners and the bank.

And, as mentioned, the value of points issuance is usually too low for the customer to reach a worthwhile level of reward value – unless they are a very high-spender.

Where this gets very interesting, though, is in the domain of merchant-funded offers.

Merchant-funded offers have taken off in some parts of the world and stagnated in others. However, I believe this has the greatest potential for banks to differentiate themselves. The key is in how the banks collaborate with the merchants.

Historically, banks gave customers points out of their interchange margin and rarely asked merchants to contribute toward the value given customers. But many of the merchants in the loyalty ecosystem would happily offer 3-10% in bonus points to attract more business – and in lieu of discounts.

Many of these merchants are already paying for cashback schemes, affiliate marketing solutions, offering deep discounts, or paying Google for search traffic. Offering some points in the bank’s loyalty program will probably have more impact on customer behavior and will certainly be a less expensive channel for customer acquisition and retention than the alternatives just mentioned.

A restaurant, for example, might offer 30-50% in extra value for customers who dine with them on a Monday, Tuesday, or Wednesday evening because their restaurant is 75% empty early in the week – but they have to be open anyway.

Similar partner offers can have a multiplier effect on the customer’s $500 in annual earnings, so the customer feels they are getting $1,500 to $2,500 per year in value by staying loyal to the bank’s program and partner network.

Similarly, when merchant partners start earning more revenue in this way, it would be hard for them to leave the bank’s loyalty ecosystem.

This is of particular interest to smaller local businesses with less advertising budget at their disposal. For the majority of merchants and consumers, the business they conduct is local – and certain local businesses, such as nice restaurants, are very popular with consumers. The bank can act as a gateway to commerce in the customer’s local community, even if the bank itself has offices spanning many cities, regions, or even countries.

In some parts of the world like the United States, health insurance costs have risen dramatically in the past two decades. Banks may have the ability to negotiate much more attractive rates on behalf of smaller retailers and self-employed individuals.

*

Few other types of businesses have this type of reach across all types of necessary stakeholders. Facilitating commerce should come naturally to most banks, using mostly existing technical and operational capabilities. What has been missing is a powerful, flexible, and intuitive loyalty rules engine that the merchants can use to define bonus points campaigns that really get the customer’s attention.

Banks that seem to be getting this right are DBS in Singapore, First National Bank in South Africa with their eBucks program, Amex to a large degree with Membership Rewards, the Avion program sponsored by Royal Bank of Canada, and Discovery Vitality – also in South Africa. Discovery Vitality is a particularly interesting example because they set up such a successful loyalty program for their insurance business that they ended up becoming a bank.

Indeed, some of these banks are successfully encouraging customers to use their credit cards over other payment methods; Amex has been doing this for decades.

There is no reason why your own bank cannot create an equally compelling ecosystem. You will get weekly (if not daily) engagement from customers, much richer customer insight from their purchases with partners, and gain a wide range of opportunities to earn incremental revenue.

That includes the ability to cross-sell and up-sell more of your services to consumers and merchant customers, to sell media and offer placements along the customer journeys, and to charge a modest fee for facilitating all this commerce.

This brings the dual benefits of new revenue streams, while also locking stakeholders into the network.

Importantly, all this incremental margin can be allocated to the LTV of the customers generating this incremental trade.

How greater points liquidity can supercharge bank loyalty programs

The whole reason customers use bank cards is that they make payments easy.

The opposite is true of banks’ loyalty programs, where there is widespread overdependency on impersonal CLOs with cumbersome earn mechanics.

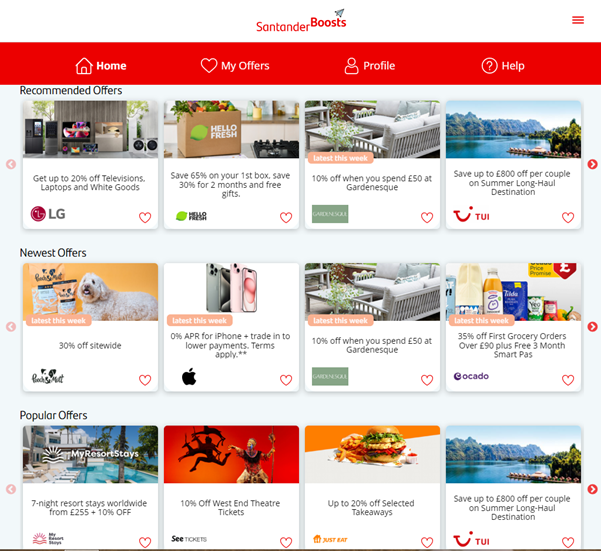

To give an example: a friend in the UK attempted to engage with the offers of his main bank, Santander. He had to click through 2 log-in screens and open a new browser window to launch the redemption catalog.

Inside, he found offers for gardening products – despite it being possible to tell from his registered address that he doesn’t have a garden.

There are also offers for pet brands; whereas he’s never had a pet or previously bought any pet products. Nor has he ever been on a resort holiday (he likes camping and skiing) or bought tickets for a West End musical.

In short, it looks like it’s been personalized for someone else – or not personalized at all.

It is absolutely not my intention to bash Santander here, because this absence of personalization and difficulty of redemption is standard across retail banking.

But I do want our audience to realize that this approach is a hangover from a rapidly disappearing era of loyalty marketing – and it is not what the customer expects today.

Redemption catalogs as we have known them will soon be dead. On the goods side: redemption of points for merchandise is crashing. Very few people now want another toaster or lawn chair for their points.

People are still motivated by experiences – such as travel, a cooking class, or the chance to meet a celebrity. But as we explained in an article a couple of years ago, forcing customers into a separate ecommerce environment to claim these rewards is now unnecessary.

Banks have had decades of experience in payment processing. This means they could get a head start in allowing customers to earn their favorite currencies practically everywhere they shop, and ‘pay with points’ without friction.

Pay-with-points will be the primary differentiator for bank loyalty programs during the next 2-5 years. This differentiator won’t last much longer, because over time, every bank will enable this functionality and it will become commonplace.

So, combining a pay-with-points capability across a unique network of merchant partners is the key to earning significant customer engagement and loyalty, and making it difficult for customers to leave the loyalty ecosystem as competitors catch up.

Pay-with-points is already accelerating with the many banks that have enabled their customers to buy across a network of partners. Rather than a charge being applied to their credit card or bank account, the value spent is simply removed from their loyalty account.

This might sound challenging, but points are effectively a store of economic value. This means if the payment infrastructure offered by the bank, or existing among retailers, accepts more than one method of payment, points/miles can be spent just like regular money.

Mastercard and Visa began experimenting with such solutions 5-6 years ago, but technology limitations and experimental implementations produced awkward customer journeys, so none were adopted at scale.

This is changing, in part because modern payment terminals, running on open operating systems such as Android, are becoming much cheaper and more sophisticated. Many have already cracked the nut of being able to accept alternative forms of payment such as cryptocurrency, so ‘pay with points’ will be deployed at scale in the coming years.

A longer-term source of differentiation will come from banks helping business customers promote themselves to the bank’s consumer clients. This is a pot of gold, because the bank has all the information, and can cheaply acquire the necessary technology, to act as a marketplace enabler in this way.

By enabling such collaboration across the ecosystem, the bank can enable improved business for their merchants, and the ability to build very rich customer profiles based on the customer’s actual purchase behavior. That data and the resulting profiles would enable an entirely new level of predictive analytics and personalization, that creates new value for everyone.

‘Pay with points’ can supercharge these efforts because it can make engaging with such offers no more difficult than spending cash.

The bank can also take care of the reconciliation and settlement of points transactions that take place directly between ecosystem partners – effectively making it highly efficient for all stakeholders to use the bank’s loyalty currency.

Additional liquidity improvements in banks’ loyalty currencies

‘Pay with points’ is just one of the ways to make loyalty points easier for customers to use.

Exchange of bank loyalty points into airline or hotel group loyalty programs has been growing over the past decade from 20% to about 40% – so this is still highly relevant.

However, consumers are getting wiser, while travel loyalty programs continue to devalue their loyalty currencies. One day soon, most consumers will realize it is much better to use their bank points to redeem directly for a flight or hotel room, rather than exchange into the travel provider’s loyalty program and then redeem. Too much value is lost in the exchange because of greed by most involved parties. This will lead to banks offering travel products directly, from aggregators such as Hopper.com (and possibly Switchfly, Expedia, Arrivia, GetYourGuide, or Ctrip).

These experiences will look much less like a restrictive redemption catalogue; more like an accessible, modern ecommerce experience such as Booking.com. This will allow the bank to personalize offers and enable loyalty engagement with their choice of modern martech systems, much like any other sophisticated ecommerce brand.

Enabling ‘pay with points’ on an ecommerce platform is no more challenging than adding a new payment method at checkout – and such digital businesses are adept at adapting to what customers want.

The fastest growing category of redemption is into gift cards – such as Amazon, Walmart, or Nike. Gift cards will continue to be popular, but they are limited in their potency.

They are useful as a tactical measure to give the customer more choice and freedom – which customers appreciate.

But they don’t generate incremental value for the customer. Unlike distressed travel inventory, gift card redemptions do not enable the perceived step-up from the points value in the bank program, to the face-value of the gift card.

Influencing customers to do more interesting things with their points, that create a greater degree of perceived value, will help the bank to stand out and earn greater appreciation for its efforts.

This is where gamification can be useful – because the perceived value of a gamified experience can potentially distract from a lower degree of monetary value.

We don’t mean adding digital games to your website or apps; rather, establishing game mechanics such as challenges or goals, that help the customer along a desired path to worthwhile objectives and rewards.

Gamification can also be used as part of a sustainability and social responsibility initiative, where the gamified experience helps educate customers, demonstrate the steps the bank is taking towards ESG objectives, and position the bank as a force in helping the environment.

Of course, these experiences should be incorporated into the loyalty program, in a way that ensures the smooth flow of data and ongoing campaigning at scale.

The history of marketing innovation has often been of new experiences running alongside brands’ primary channels with little integration; this was true of early ecommerce stores, early mobile apps and as mentioned, present-day redemption catalogues.

This nearly always created inconsistent customer experiences and made things difficult for the marketing team. Fortunately, this is no longer necessary thanks to advances in marketing technology.

A modern martech stack provides the foundation for competitive bank loyalty programs

For a long time, the most advanced ecommerce technology was owned and operated by massive retailers such Amazon. Now, however, even brands which operate outside of conventional ecommerce are introducing highly advanced tools accelerating and optimizing trade and customer engagement.

A good example was Air France-KLM’s adoption in 2023 of Contentstack – a digital experience platform (DXP). The DXP is a sophisticated software category which incorporates an ecommerce platform with a wide range of marketing modules, while prioritizing a high level of data extensibility; they are commonly used by major retailers. Banks, too, should be modernizing their martech in similar ways.

This is a wide-reaching topic and one that really goes beyond the scope of Currency Alliance’s remit, so we’re not going to delve too far into it here.

The crucial thing to understand is that the bank needs the tools to introduce, incentivize and measure loyalty engagement at practically every step of the customer journey.

Part of this effort is in the bank’s website and app – which should be able to surface offers from partners and the bank itself. In these environments, the customer selects whether to pay with points or regular money for as many transactions as possible.

Banks also should establish the dataflows so that customer engagement in the bank’s ecosystem, or with the bank’s loyalty card or loyalty currency, are part of a feedback loop that updates the customer profile in the CDP.

Banks should also be able to take advantage of personalization tools, campaigning systems and pricing engines that allow customer engagement, offers and redemption value to be tailored to the context of the transaction.

If the bank is promoting a new savings account, a high-income individual should probably be able see a higher interest rate when they’re shopping the available products – because the commerce system has detected the customer profile and personalized the content.

This kind of personalization should take place automatically, across all of the bank’s products and services, influenced by the predicted LTV of each customer in order to maximise ROI.

An ambitious bank should consider creating a ‘super app’ in which the customer can also shop transportation partners and retail partners – because these are also high-frequency categories that the customer needs practically every day.

Evolution across these opportunities will play out over years at most banks, but you don’t need cutting-edge martech across the entire stack to approach the present competitive standard in customer loyalty. You just need to start somewhere and evolve the proposition as necessary.

At the end of the day, people understand points-based loyalty programs and they want to earn points towards aspirational rewards.

Brands need to do more to create a step-up in perceived value of those points in order to deliver value while lowering cost.

And, banks need to deliver a customer experience that enables the entire ecosystem to operate smoothly, so everyone saves precious time while driving increased customer engagement.

This means common technologies to enable collaboration among all stakeholders. It means setting up and operating the loyalty ecosystem at the lowest cost possible, so the majority of value can flow to customers – rather than be absorbed by vendors and other indirect operating costs.

The technology to do this already exists, and it’s not that hard to get started. Currency Alliance has already built and deployed the necessary technology and operating processes, so that even brands with legacy tech can build out loyalty program partner networks at scale, and at low cost.

The technology can be deployed as a thin layer of cloud-based functionality in front of legacy systems to breathe new life into marketing capabilities.

Our tools are already being used by First Abu Dhabi Bank to extend the bank’s partner ecosystem amongst travel brands (read case study). Another bank is using our tools to enable partner redemptions across a wide network of their partners’ products and services.

The promise for bank-sponsored loyalty ecosystems is tremendous, and we shall see over the coming decade which banks actually have the vision and the ability to execute.

For more information on how such an ecosystem could be assembled, get in touch with Currency Alliance here.