This article was written by Lawrence Tai, Product Manager at Nike.

Do you ever wonder how some companies do so well with the product they sell or the service they provide? How do they know if their customers are truly happy with their product and have a good experience?

For many, the answer is Net Promoter Score, or NPS for short. If you haven’t heard of it before, and you’re in the world of Product and Consumer Experience, then read on to learn what NPS is and how it’s calculated.

Already familiar with the basics? Skip ahead to find out how your product management team can use NPS to improve your business and consumer engagement experience.

So what is NPS?

Some say Net Promoter Score (NPS) is the “gold standard” customer experience metric, while others debate its merits, citing its simplistic formula. All in all, it is an indicator that provides an overall metric for monitoring improvements in a product, service, or organization.

It can be used in customer experience programs to measure the loyalty of customers to a company, or as a way to gauge how well customers are being served.

Developed in 2003 by Bain and Company, it is now used by millions of businesses worldwide to measure and monitor how they’re perceived by their customers.

The Net Promoter System does this by asking customers one single question:

How likely are you to recommend [Organization/Product/Brand/Service] to a friend or colleague?

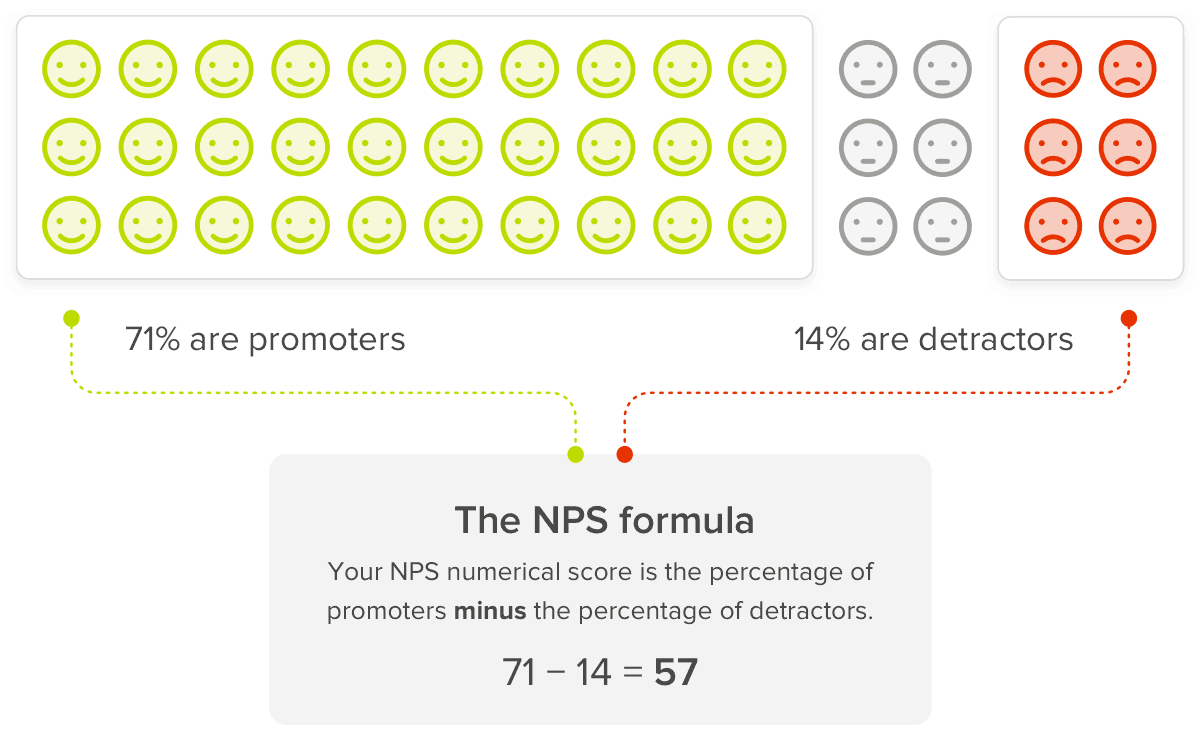

Customers are given a rating scale from 0-10, 0 being “not at all likely” and 10 being “extremely likely.” Based on their rating, customers are then classified in 3 categories: detractors, passives and promoters.

- Promoters rate your experience a 9 or 10 and are typically loyal and enthusiastic customers.

- Passives rate your experience a 7 or 8. They can be considered satisfied with your service, but something’s holding them back from being promoters.

- Detractors rate your experience a 0 to 6. These customers are unhappy, unlikely to buy from you again, and may even actively discourage others from using your products.

Once the pool of scores has been collected, companies will do a comprehensive diagnosis and analyze the calculated Net Promoter Score.

How to calculate NPS

To calculate the final score, subtract the percentage of Detractors from the percentage of Promoters:

% promoters – % detractors

or

[(# Promoters / # Respondents) – (# Detractors / # Respondents)] * 100

For example:

Let’s say that you collected a recent pool of scores and found that you had 20 promoters, 25 passives, and 55 detractors out of a total of 100 respondents. Your calculation would then be:

(20 promoters / 100 total) – (55 detractors / 100 total) =

20% (promoters) – 55% (detractors) = -35

Another example:

Say that you found you had 40 promoters, 4 passives, and 6 detractors out of a total of 50 respondents. Your calculation would then be:

(40 promoters / 50 total) – (6 detractors / 50 total) =

80% (promoters) – 12% (detractors) = 68

The basic construct of a Net Promoter Score is fairly easy to comprehend: If a company has more detractors than promoters the score will be negative. If there are more promoters than detractors, the score will be positive. The higher the Net Promoter Score, the better.

The goal is to convert those detractors (unhappy, unimpressed customers) into promoters (brand evangelists) who will put the word out and allow for increased revenues and profits.

4 reasons your product NPS matters

Now, you’re probably thinking: “How does this one question and number alone provide me with all this collective data and analysis?”

It doesn’t. Considering just the question and number alone, it’s almost impossible to understand why customers feel the way they do.

So what most companies do is ask some follow-up questions after the initial NPS survey question:

- Reason for your score?

- How can we make your experience better?

The more data you can collect and analyze alongside your NPS, the more you’ll be able to understand what’s driving your customer experience, allowing you to prioritize your improvements to have the biggest impact on your customers.

Pay attention to:

- Who you are collecting your scores from

- When you are asking your NPS survey questions

- Where you are conducting the survey

- How you are capturing your NPS score

The medium over which the score is captured can bias results. For example, an NPS survey conducted within the product itself is likely to produce a higher score than an emailed survey.

Keeping all these contextual factors in mind, NPS as a whole can provide clues on customer retention, loyalty, brand value, and overall customer sentiment.

Let’s get into the 4 reasons why product NPS can be such an insightful metric for product management teams.

1. Objective feedback for customer sentiment analysis

There are many product feedback surveys that ask how likely a respondent is to use a product.

For example, Product/Market Fit surveys ask the question, “How would you feel if you could no longer use [product]?” to help you understand if your product meets the needs of the market.

However, the NPS question asks how likely the respondent is to recommend a product. There’s a big difference.

From a psychological standpoint, you’re not putting anything on the line when you’re speaking about your own likelihood of usage. If a stranger asked if you would use their product, you could say yes so that they stop pestering you, or so you don’t make them feel bad. The question of “usage” also doesn’t surface your sentiment towards the product – whether you like the product or not, you could say that you use it.

However, when asked whether you would recommend a product or not, you’re more likely to respond in an honest, straightforward manner that reveals your preferences. When you recommend something to your friends or family, you’re putting your reputation on the line. If you recommend something of true value, you gain their trust. If you recommend something of false value, you lose their trust.

By asking for a recommendation, you’ll get more objective and unbiased feedback. You’re capturing the true nature of the customers’ beliefs and sentiment towards your product.

2. Incorporating data into product development

Now, so far we know the primary focus of NPS is to track customer sentiment and product/service satisfaction. But, it’s also really useful to prioritize improvements and allocate resources once the data has been aggregated and dissected.

NPS points out to you that there is a problem – the qualitative feedback that NPS respondents offer can often tell you what the issues are. But, figuring out exactly what went wrong is one thing – finding the best way to solve it for customer happiness is another challenge altogether.

You want to be able to effectively use qualitative data that you gathered from NPS for product development. To do so you’ll have to segment out the data by your three categories: promoters, passives, and detractors.

Promoters will confirm what you’re doing right. They are your validators. Sometimes they might go the extra mile and tell you what they would like to see improved. Treat their feedback as scripture because they are your best customers, your target audience, and the whole reason you’re sitting in your chair, gainfully employed.

Passives and detractors can get a little tricky. Since they didn’t indicate they would recommend your product, it means that there’s something that’s not sitting right with them. Perhaps they’re not your ideal customers, as it could be an instance of “wrong place, wrong product.”

They might or might not leave a reason for their rating even after you follow up, so you might never know their “whys.”

However, on the flip side, it’s not always a bad thing, it all depends how you look at it. The fact that they took their time to leave their rating means that they want to like your product. Stay present and aware of everyone’s actions as it could dictate how likely your product will experience growth.

3. Surface decision making factors

After gathering NPS data points and understanding them on a holistic level, you’ll begin to see where and how you need to make changes to improve your business. Remember, NPS is just an indicator that provides an overall metric to track and monitor improvements in a product, service or organization. If the data is aggregated correctly and dissected properly, it will reveal to you exactly what improvements you need to make and where to make them.

NPS can drive key decision factors on areas of growth depending on how the data has been collected, such as:

- Sales & Marketing

- Customer Retention

- Customer Engagement

- Product Development

- Product Release

- Repurchases

- Referrals

Depending on the product, service, or organization, NPS can be applied across the board, over a spectrum of focus areas. From the buying experience, to the product go-live process, to employee onboarding – all of these areas have the potential to create detractors and promoters alike.

To this end, understanding which pages or features in the product increase customer satisfaction and guiding users to those features is one of the most reliable ways to improve NPS over time.

4. Create customer alignment

Referencing back to customer sentiment, when you ask the question, “How likely are you to recommend [Organization/Product/Brand/Service] to a friend or colleague?” you’re not only gauging how they feel about your product/brand/service, but also what they want or even need. Creating this alignment between Product and Consumer is extremely important. After all, without consumers, there would be no product.

After you’ve collected the responses from your NPS survey, at least from the 3 main questions that were discussed earlier, I would recommend implementing an actionable closed-loop feedback lifecycle to track and validate your alignment based on the data you’ve aggregated.

- Analyze your responses

- Engage & Interact: Talk, listen, and learn from your customers

- Fix the issue

- Share Development

- Experience New Product/Service/Brand

- Collect Feedback

Rinse and repeat.

About Lawrence Tai

Lawrence Tai is a Product Manager at Nike and Mentor at Product Gym. Lawrence has over 8 years of product management experience and started his career as a business analyst. Lawrence has a Bachelor of Science in Information Technology and Systems from the University of Maryland Baltimore County.