Sago’s recent webinar, Back-to-School Tech & Trends: The Power of Influencers and Omnichannel Dynamics, delves into the fascinating world of back-to-school technology trends and the results from a recent survey of American and Canadian back-to-school shoppers. The objective of the joint omnibus study with element54 was to gain insights into the emerging use of technology and the role of influencers and social media in driving back-to-school decisions and omnichannel dynamics. The study covers various categories, including clothing, shoes, accessories, backpacks, lunch bags, school supplies, electronics, dormitory essentials, sports equipment, and health/personal care. Here are four of the eight key takeaways from the webinar.

To view all the insights and key take ways, watch the on-demand webinar!

Grabbing the Opportunity of a Sizeable Market

Key takeaway: The back-to-school market is sizeable in both the US and Canada, making it a great opportunity for occasion-based marketing.

49% of Americans and 40% of Canadians have at least one household member in school.

Students of all ages, including those 25+, contribute to the back-to-school market, with Canada having a higher proportion of older students.

Giving a Voice to Students

Key takeaway: Advertisers and marketers should target both parents and students in campaigns, as back-to-school purchasing decisions are often a joint effort.

Back-to-school shopping is a joint decision between parent and student for 46% of Americans and 53% of Canadians.

In Canada, both parents and students are more likely to be involved in the decision-making process.

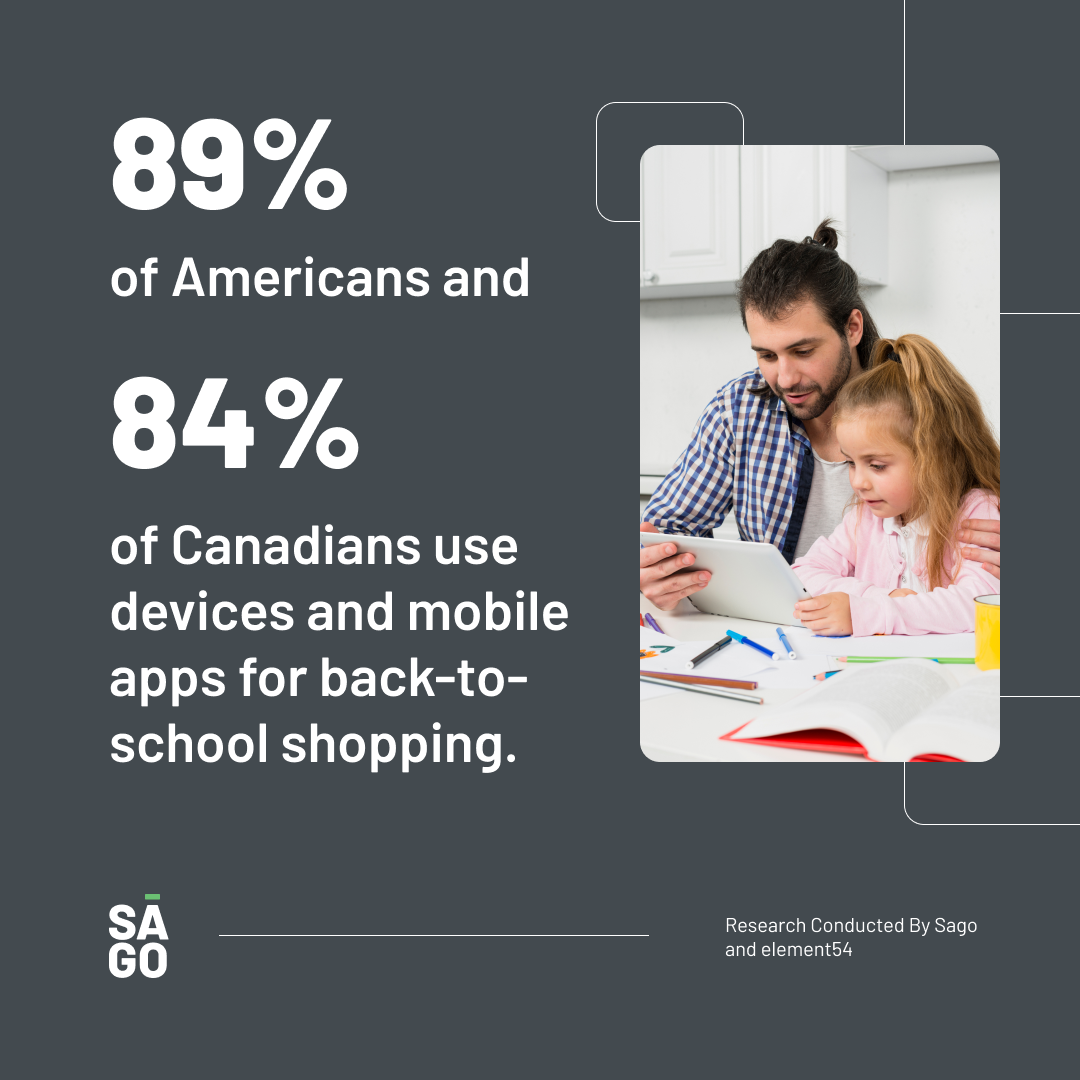

Harnessing the Power of Digital Marketing and Omnichannel Experience

Key takeaway: Digital marketing and a seamless omnichannel experience are crucial in capturing back-to-school shoppers, especially in the U.S.

Nearly all Americans (89%) and a significant majority of Canadians (84%) use devices and mobile apps for back-to-school shopping.

Omnichannel shopping is particularly high for apparel, with 79% of U.S. and 83% of Canadian shoppers purchasing in-store, 57% in the U.S. and 46% in Canada shopping online, and 33% in the U..S and 18% in Canada using mobile apps.

Recommendations from family and friends, in-store displays, Google search, websites, and ads across channels all play a role in influencing back-to-school purchases.

Americans are more likely than Canadians to seek information from multiple sources.

The Role of Pricing in Online Shopping

Key takeaway: Competitive prices are the primary driver for online shopping, according to respondents.

43% of Americans and 52% of Canadians consider competitive prices as the most important factor.

43% of Americans and 52% of Canadians consider competitive prices as the most important factor.

A wide product selection is of secondary importance, with 17% of Americans and 15% of Canadians rating it as most important.

Deals, promotions, fast and reliable delivery, and unique items not available in-store are tertiary factors.

Here are a few responses from survey participants around online shopping and the importance of finding the best deals:

“I prepare by searching for the products and equipment needed for the school online or in the store, then choosing the best prices.”

“I look for bargains or review prices of school equipment that maybe needed for the coming school.”

Unleashing the Potential of Back-to-School Marketing

The findings of this survey highlight the importance of leveraging digital marketing and omnichannel dynamics in back-to-school marketing strategies while also taking into account students in marketing campaigns. With a sizeable market, joint decision-making between parents and students, and the prevalence of digital platforms, marketers have a unique opportunity to engage with back-to-school shoppers. To explore the full range of insights and key takeaways, including the best times to advertise and how to harness the power of social media influencers, watch the on-demand webinar.

Methodology Summary:

The study was fielded July 7- 10, 2023 and consisted of 1,620 nationally representative American respondents and 1,931 nationally representative Canadian respondents. The American respondents were divided into three age groups: 18-34 (29%), 35-54 (33%), and 55+ (38%). Regarding gender, 48% were male and 52% were female. The respondents were distributed across different regions: West (24%), South (38%), Midwest (21%), and Northeast (17%). In the Canadian sample, 28% were aged 18-34, 35% were aged 35-54, and 37% were aged 55+. The gender distribution was 49% male and 51% female, and the regional breakdown was as follows: British Columbia (13%), Alberta (11%), Saskatchewan (3%), Manitoba (4%), Ontario (38%), Quebec (24%), and Atlantic Canada (7%).

4 Minutes

4 Minutes