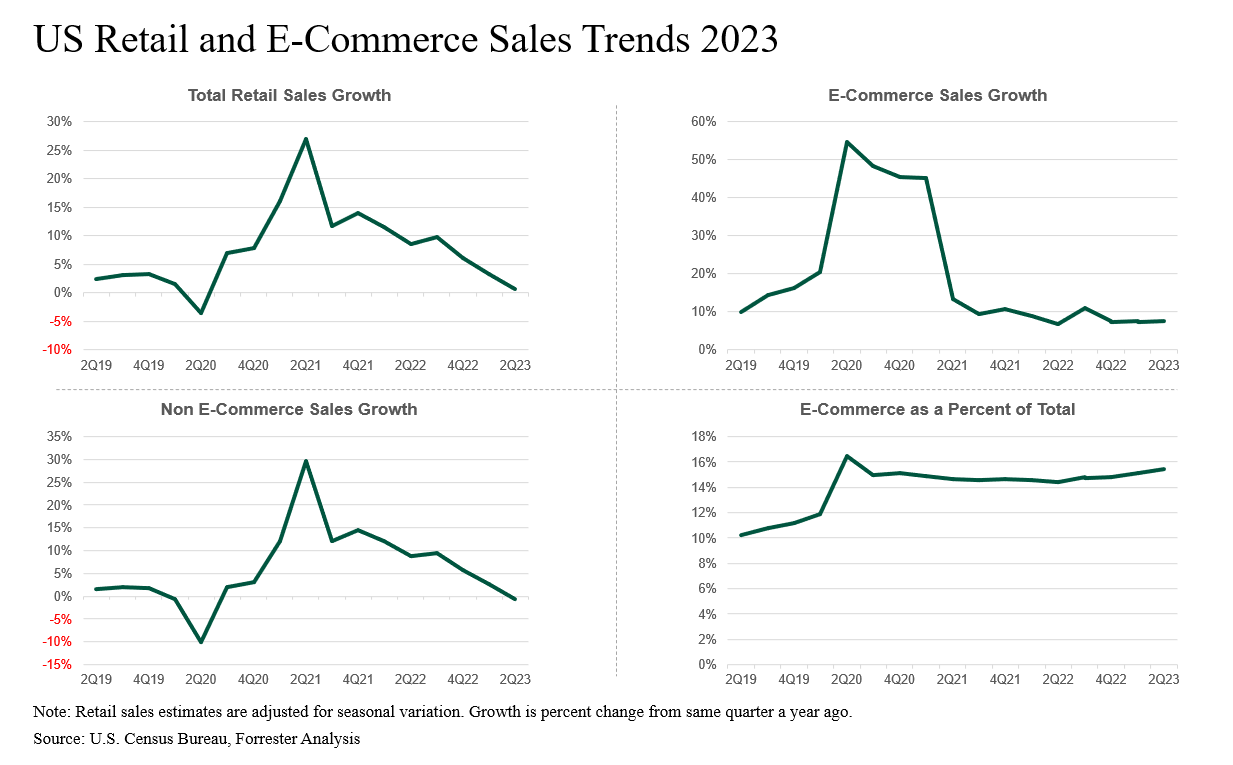

US Retail And E-Commerce Sales Trends, 2023

Retail sales growth in the United States is currently gradually decelerating, which can be attributed to three key factors:

- The substantial savings that households accumulated during the 2020–2021 lockdowns and government stimulus have been steadily diminishing. According to estimates from the San Francisco Federal Reserve, US consumers’ excess savings have decreased from approximately $2.1 trillion in August 2021 to around $500 billion.

- US consumers were heavily impacted by historically high levels of inflation in 2022, resulting in an additional trillion dollars being spent on goods and services due to increased prices.

- US consumers are showing reduced interest in high-ticket items due to rising interest rates, which have reached their highest levels in decades.

To analyze the recent trends in US retail and e-commerce sales, we conducted an analysis of the quarterly retail e-commerce sales data provided by the US Census Bureau. The retail sales data that we have analyzed was adjusted for seasonal variations, with growth measured as a percentage change from the same quarter in the previous year. Here are the notable trends that we have identified:

- Overall retail sales growth has continued to slow down. After experiencing double-digit growth for five consecutive quarters (Q1 2021 through Q1 2022), total retail sales growth has declined for the past three quarters (as shown in the figure below). In Q2 2023, total retail sales growth dropped to less than 1% year over year. We last saw such low growth levels, aside from Q2 2020, in 2009.

- E-commerce sales growth has been losing momentum. Following significant double-digit growth from Q2 2020 to Q1 2021, the pace of e-commerce sales growth has slowed considerably. E-commerce sales growth remained in the single digits for six out of the last eight quarters, including the last three quarters. This growth looks very weak considering that, apart from Q1 2019, US e-commerce sales consistently posted double-digit growth for 46 consecutive quarters from Q4 2009 to Q2 2021.

- E-commerce sales penetration has started to increase again. After consistently remaining within the 14% to 15% range from Q1 2021 to Q4 2022, the share of e-commerce sales as a percentage of total sales has surpassed 15% in the past two quarters. In Q2 2023, e-commerce penetration reached its second-highest level in history, second only to Q2 2020.

- Sales from physical stores also continue to decelerate. Offline retail sales growth has been in decline for the past three quarters and actually posted negative growth in Q2 2023. Offline retail sales never achieved double-digit growth between 2000 and 2020. It experienced double-digit growth for five quarters, however, from Q1 2021 to Q1 2022, as consumers returned to physical stores when pandemic-related restrictions were eased, but this growth was temporary.

If you would like to learn more about growth forecasts for US retail and e-commerce sales, please refer to our newly published US Online Retail Forecast, 2023 To 2028. It provides insights into US total retail sales, online retail sales, and offline retail sales for 30 product categories for the next five years, with the historical data going back to 1998. Be sure to download the Excel spreadsheet for the full details.

Want to talk to us about this research? Please schedule an inquiry or guidance session with me!