To keep pace with the changing landscape of sites of service for surgical procedures, medical device companies are under pressure to evolve their sales and marketing strategies to the expanding non-hospital market. According to Clarivate data, traditional inpatient procedures are increasingly shifting to outpatient settings. For example, major joint replacement surgeries in ambulatory surgery centers (ASCs) experienced a 30% growth from 2020 to 2022, with 60% of ASC directors and surgeons expecting this trend to continue.

“The medical device industry will need to adopt a data-driven approach, with access to comprehensive, up-to-date sources of information and nuanced analysis of complex real-world datasets. By connecting sophisticated data science and a device industry-focused context with real world data analytics, we can truly understand the complexities of how treatments are deployed and where opportunities are.”

Getting the right data and the right analysis at the right time forms the foundation for tailored strategies by providing companies insights into:

- How procedure volumes are shifting between sites of service

- ASC preferences and purchasing behaviors

- Growth in specific markets and competitive dynamics

Understand site of service shifts in procedure volumes

Drivers of the ongoing move toward non-hospital procedures include permanent operational changes resulting from the COVID-19 pandemic, as well as the Centers for Medicare and Medicaid Services (CMS) phasing out the Inpatient Only (IPO) list over the next three years and continuously adding procedures to the ASC Covered Procedures List (CPL). As a result, patients benefit from greater freedom of choice as well as reduced procedure costs.

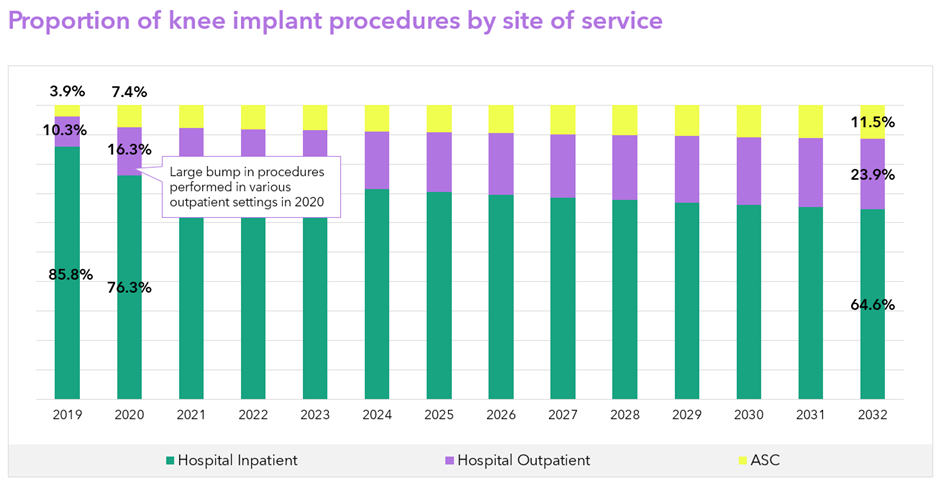

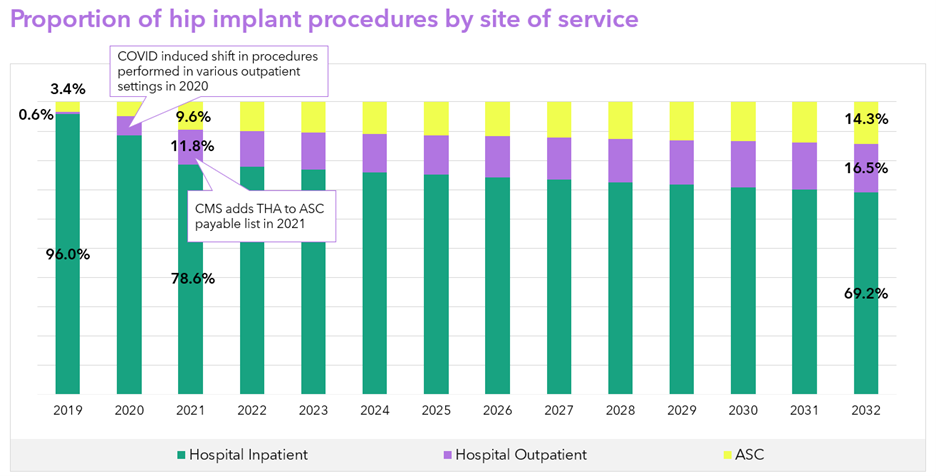

To illustrate the trends in procedural setting (in hospital versus out of the hospital), data from the Clarivate U.S. Procedure Finder and Medtech 360 reports show accelerated volumes of non-hospital total knee arthroplasties (TKAs) and total hip arthroplasties (THAs) resulting from both the COVID-19 pandemic and CMS changes to the IPO list and ASC CPL.

Source: Clarivate Medtech 360 reports

Source: Clarivate Medtech 360 reports

Volumes for sports medicine and spine-related procedures, such as rotator cuff repair, knee ligament reconstruction and cervical fusions, also rapidly increased in ASCs during the COVID-19 pandemic, according to U.S. Procedure Finder data. As other procedures are prioritized for removal from the CMS IPO list and addition to the ASC CPL, similar trends to those observed for TKAs and THAs can be expected.

When the procedure data are parsed at the affiliation and physician levels, medtech companies gain valuable information about the facilities and regions with the highest procedural growth and the greatest sales opportunities.

Determine ASC preferences and purchasing behavior

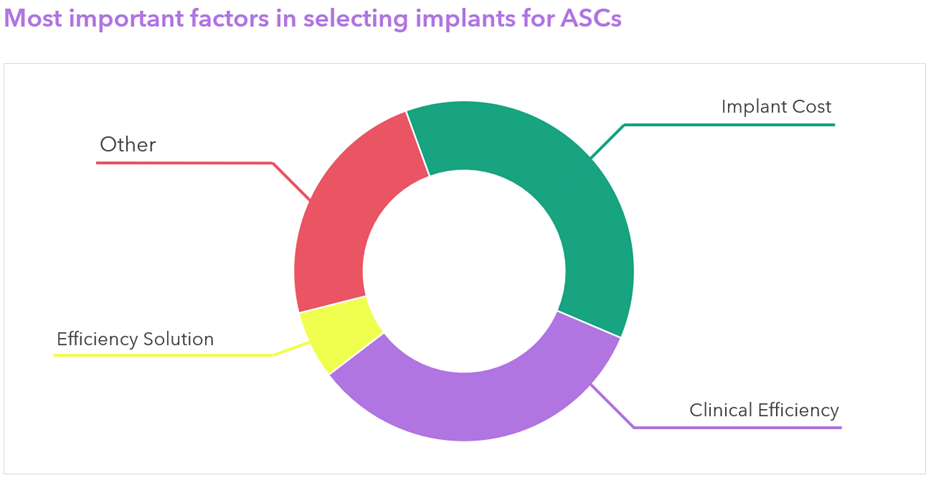

ASCs typically operate under different rules, expectations and budget structures than hospitals. Therefore, to tailor sales strategies to the competitive ASC market, medical device companies need to understand the specific factors driving purchasing and partnering decisions at ASCs. Survey data can be a powerful tool to characterize ASCs in terms of the:

- changes in ownership and structures to accommodate larger patient populations and drive revenue;

- common techniques performed;

- readiness to adopt robotic-assisted procedures or equipment;

- preference for brands and vendors and the reasons for those preferences; and

- attributes ASCs consider important when selecting a medical device partner, such as the product cost, clinical evidence regarding short- and long-term outcomes, modes of patient communication, availability of consultant services, type of training, contracting terms and reimbursement support.

Source: Clarivate Marketrack™

Track growth in specific markets as well as competitive dynamics

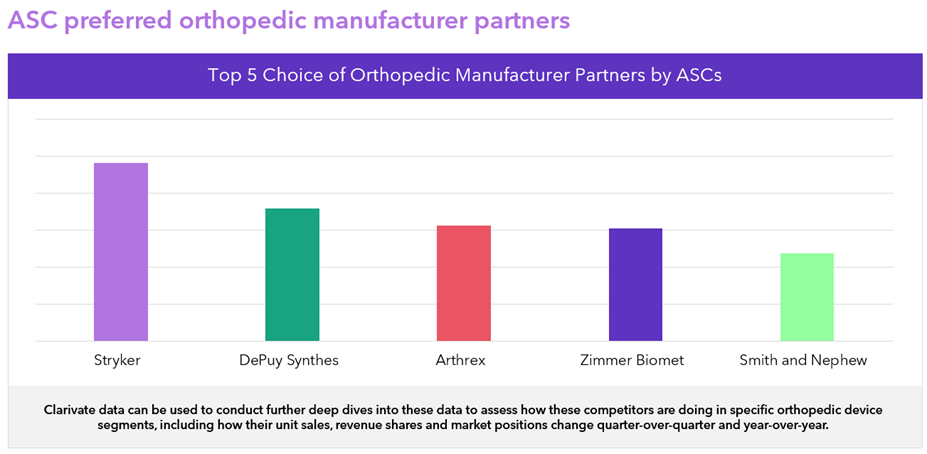

Point-in-time data fail to capture the dynamic growth of the ASC market. To track competitors and the space overall, medical device companies rely on regularly updated data to identify key trends in brand shares over time, product launches, which companies and devices are experiencing the greatest uptake and the factors driving success or failure.

Source: Clarivate Marketrack™

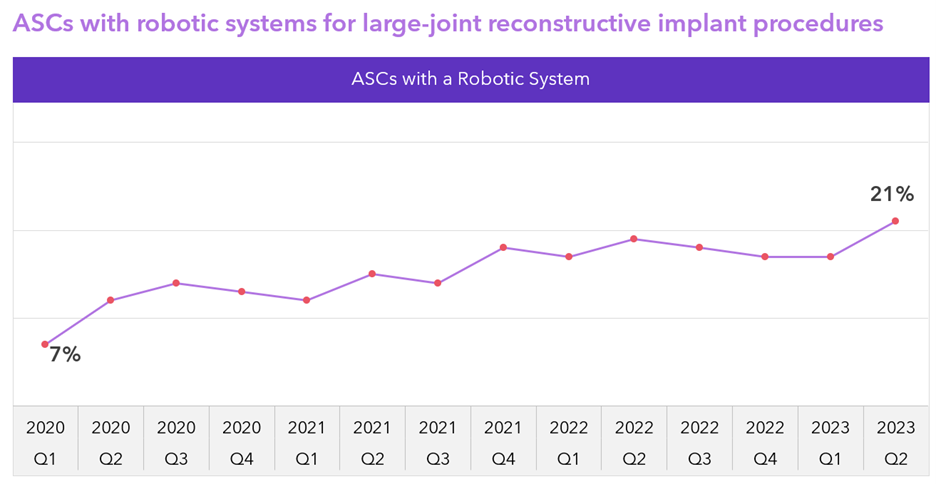

For example, to stay abreast of changes in the adoption of robotic systems and robotic-assisted surgeries in ASCs, Clarivate surveys provide data to track quarter-over-quarter and year-over-year changes in this space.

Source: Clarivate Marketrack™

To achieve the promise of their innovations for improved health and patient outcomes, medical device companies require access to the right information and analyses to identify opportunities for entry into the rapidly growing ASC market. In addition to the commercial considerations discussed here, success in the non-hospital setting depends on appropriate medical affairs and provider engagement strategies.

Learn more about how Clarivate helps medical device companies develop and refine their sales strategies for the ASC market through the Clarivate medtech intelligence offerings, including products such as Procedure Finder, Marketrack and Medtech 360.

This post was written by April Chan-Tsui, Director, Product Operations, Content; Valentina Lim, Manager, Healthcare Research & Data Analytics; and Rahul Paul, Senior Healthcare Research & Data Analyst.