Customer lifetime value (CLV) is calculated in business marketing strategies to see the bigger picture. Many businesses focus on long-standing relationships and success, and not just on one-time sales.

For businesses looking to acquire and retain valuable customers, understanding the lifetime value of a customer is important. In simple terms, it is a metric that calculates how much a business can expect to earn from an average customer over their relationship span.

There’s much more to customer lifetime value, and we will be covering it in more detail in this insightful guide.

What is Customer Lifetime Value (CLV)

Customer lifetime value (CLV or CLTV) is the metric that represents the total money or income a business can expect from a customer during their association. It is a crucial metric of the customer experience program and lets you understand how valuable a customer is to your company.

Customer lifetime value calculation also helps businesses in identifying the most valuable customer segments. The longer a customer spends on purchases from a brand, the greater the lifetime customer value becomes.

To get a more in-depth understanding, consider CLV as a metric that guides you to how much you are willing to spend on a customer to maintain the relationship. In more simple terms, if a customer’s CLV is $1000, you won’t be investing more than this amount to keep the relationship as that won’t be profitable for your business.

Let’s now understand the importance of customer lifetime value in detail.

Importance of Customer Lifetime Value

Here’s the moment of truth. The probability of selling to a new customer is 5 to 20%, which rises to 60-70% in existing customers. That’s your first reason and an important one for measuring CLV. It simply implies that selling more and more to your existing (repeat) customers will generate more profits.

There’s a lot more to it than customer retention. Here are the advantages of CLV that show why it is important in the success of your business!

- If you are not measuring something, then you can’t improve that. Analyzing your CLV score and looking at the various components based on that can help you strategize better. You can change your tactics for sales, pricing, customer retention, and advertising to increase your profits.

- CLV is important for making future decisions as it improves forecasting. Based on the score, you can identify accurate expectations related to inventory, production, and other costs. Without this forecasting, you might end up overspending.

- Loyal customers come back again and again. With the help of CLV data, you can track the average number of sales for these customers to drive repeat sales by identifying and strategizing different key factors. To check what your loyal customers like about your business, you can conduct a simple survey.

- CLV helps you target your ideal customers. Knowing how much customers spend with your business over a specific duration of time lets you develop a good customer acquisition strategy. It is helpful in targeting customers who are likely to spend the most on your brand.

- Finally, CLV is all about the long run. So, it lets you have a closer look at your business by considering the time constraint. It helps you determine your existing acquisition and retention strategies. Ask yourself: are these strategies for getting quick wins or for steady, sustainable growth?

Now, let’s learn what do you need to calculate CLV and how to calculate the important metric.

What Do You Need to Calculate CLV?

As per the formula, you simply need some data and values. For that, you will have to conduct research and gather data from different sources.

Firstly, your team needs to understand the customers’ journey. It can be obtained from your CRM data on customer behavior. Several analytics tools help you in understanding customers’ experience with your website, products, and services.

However, keep in mind that you are collecting consumer data that doesn’t violate any privacy regulations. The data should deliver important insights while respecting individual privacy rights. Generally, the analytics and CRM tools have proper privacy compliance in place. So, you will be collecting and analyzing data for which the consumers have granted their consent.

All of this data will revolve around the number of transactions, average purchase value, average customer lifespan, monthly transactions, gross margin, retention rate, and so on. Next, we will see how to calculate CLV and what exact data you will need.

How to Calculate the Customer Lifetime Value?

There are four metrics that you need to calculate at first. These are Average Purchase Value, Average Purchase Frequency Rate, Customer Value, and Average Customer Lifespan. We will get to the four metrics and the customer lifetime value formula later in this section. First, let’s discuss the two different customer lifetime value models used the most by businesses.

1. Historical Customer Lifetime Value

The historical model is all about the past data to predict the lifetime customer value. It doesn’t consider the possibility of existing customers continuing with the business or not. In this, the average order value is considered to find the customers’ lifetime value. This model is useful only if the customers spend on your brand over a certain time duration.

But, no two customer segments are the same. That brings us to the drawbacks of this model. The customers that this model takes into account might go inactive any minute and that adds inconsistency to your results. Also, the current inactive customers that are not considered in this model might start purchasing again. So, accurate values are not guaranteed.

2. Predictive Customer Lifetime Value

The predictive model is more about forecasting the buying behavior of existing and new customers. This model is popular among businesses as the customer lifetime value it offers helps you identify your best-selling products or services, the most valuable customers, and the crucial factors that boost customer retention.

As the main aim of this model is to forecast what actions customers will take in the future, it is definitely better than historical CLV. However, this approach is all about prediction, and you should not expect 100% accurate results.

Now, let’s continue with the metrics we mentioned earlier.

3. Customer Lifetime Value Formulas

To get to the final formula, you first need to calculate four other values.

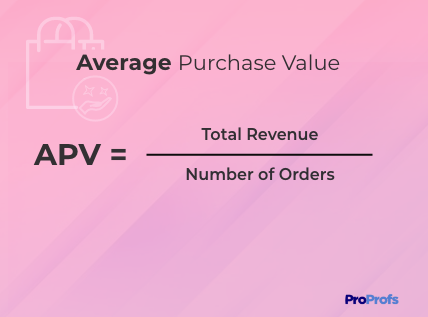

- Average Purchase Value

You can calculate this value by simply dividing your total revenue in a period by the number of successful orders placed in that period.

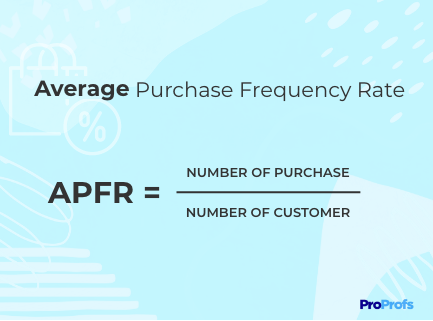

- Average Purchase Frequency Rate

To measure this rate, divide the number of successful orders by the number of unique customers who placed orders during that specific period.

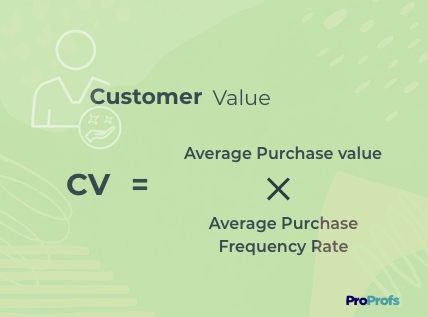

- Customer Value

To calculate the customer value, multiply the average purchase value by the average purchase frequency rate (both calculated in the above 2 steps).

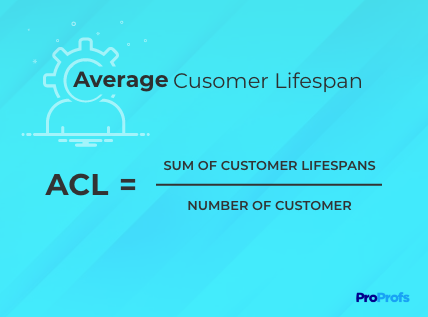

- Average Customer Lifespan

You need to find the average number of years a customer spends on your business. To calculate this, first, add the lifespans of all the customers (in years) and then divide the sum by the total number of customers considered.

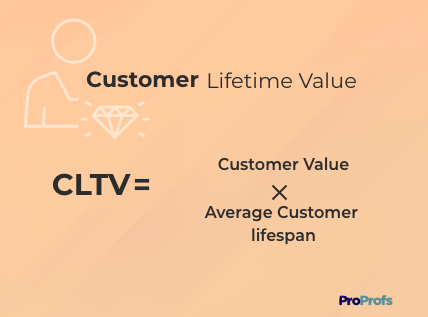

- Customer Lifetime Value (CLV)

To calculate the customer lifetime value, multiply the customer value with the average customer lifespan. This value will give you the income you can expect to generate from an average customer throughout their period of relationship with your company.

4. Customer Lifetime Value Example

Let’s calculate this value by taking an example. So, here’s the scenario.

A bakery generates $100000 in revenue in a year. The total number of orders placed in one year is 2000. The number of unique customers that placed orders in this one-year period is 600. The average lifespan of the customer is 5 years.

Let’s get to the customer lifetime value equation.

Step 1: Average Purchase Value = $100000 (total revenue)/2000 (number of orders) = $50

Step 2: Average Purchase Frequency Rate = 2000 (number or orders)/600 (number of customers) = 3.3

Step 3: Customer Value = $50 (average purchase value) * 3.3 (average purchase frequency rate) = $165

Step 4: Average Customer Lifespan = 5 years

Step 5: Customer Lifetime Value = $165 (customer value) * 5 (average customer lifespan) = $825

Here it is using our customer lifetime value calculator; we got the value i.e., $825. It means that an average customer spends $825 on the bakery store over their relationship with them.

5. Listen to Your Customers

Actively listening to your customers and gathering actionable feedback is great for growing your business. Using a customer satisfaction survey, you can understand what customers actually feel about your products and services. The valuable feedback is helpful in making improvements in the future to serve your customers better.

If you run your business from a WordPress site, making an easy-to-follow survey doesn’t have to require all kinds of formatting and knowledge of HTML coding. WordPress lets you get to it with ease. Thanks to great design, it’s super easy to come up with a website survey form that is completely responsive and mobile-friendly. And because it’s so easy, you can focus more on making it look good and getting the feedback you need.

You can also send out NPS surveys to know the likelihood of your customers recommending your brand to friends or colleagues on a rating scale of 0-10. Based on the average score, you can check the percentage of happy customers to make necessary changes to your business strategies.

How to Boost Your Customer Lifetime Value (CLV)

Using the data gathered by your team and with the help of the above-mentioned formulas and simple calculations, you will easily know the average customer lifetime value. But how to improve it to get more profit? Here are some proven strategies to boost your CLV.

1. Prioritize & Improve Customer Support

Source: Salesforce

Businesses often leave their customers’ hands once the purchase is completed. But, you should take care of your customers’ needs before and after the purchase. By providing a delightful customer experience, you increase your loyal customer base, and people feel comfortable using your products and services.

The best way to do so is to have a proper customer service system in place. Use customer helpdesk software to manage interactions with customers and to provide support efficiently. The better your service will be, the more will be the probability of customers doing business with you in the future.

2. Optimize Onboarding

Customer onboarding is the very first interaction people have with your brand after becoming your customers. A smooth and warm welcome encourages them to come back for more. This simply means a higher lifetime value. You need to impress them with the right content, help material, promotional coupons for further purchases, and more.

According to the products and services you offer, optimize your onboarding process. Make it straightforward and quick. Try to use some tutorial videos or have a process to guide customers that motivates them to return to your products again.

3. Increase Average Order Value

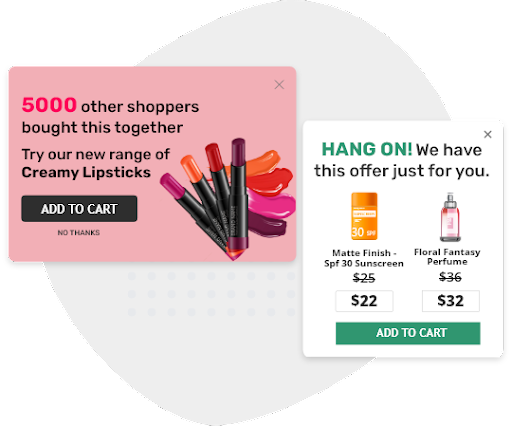

Increasing average order value doesn’t mean increasing your products’ price by a few dollars. You have to be smart when customers are placing orders. We are talking about up-sell and cross-sell. When the customer has decided to buy something, try to sell more or something of more value to improve your average order value.

With the help of targeted up-sell and cross-sell popups, you can easily promote and display relevant products to boost sales. If you’re a SaaS-based company, you can encourage the customers to purchase a quarterly or annual subscription.

4. Over-deliver & Surprise Customers

Customers love surprises, and overdelivering on your brand promise can prove to be effective for building customer loyalty and increasing CLV. Many brands use this tactic by delivering more than what they promised. It can be a small present or a sweet welcome note with a discount coupon along with the product.

Some businesses send gifts to their loyal and valuable customers on birthdays or special occasions to bring them back to the brand more often. What’s more? These customers are likely to talk about your surprise and brand on social media and to their friends and colleagues.

5. Listen to Your Customers

Actively listening to your customers and gathering actionable feedback is great for growing your business. Using a customer satisfaction survey, you can understand what customers actually feel about your products and services. The valuable feedback is helpful in making improvements in the future to serve your customers better.

You can also send out NPS surveys to know the likelihood of your customers recommending your brand to friends or colleagues on a rating scale of 0-10. Based on the average score, you can check the percentage of happy customers to make necessary changes to your business strategies.

Track, Measure, Improve, and Grow!

Customer lifetime value is a really useful metric and lets you know how loyal customers are to your business. From the formulas above, it is clear that calculating customer lifetime value is super easy. It is time for you to track the customers’ data and use it to measure CLV today.

Based on the results, improve your CLV using the tips and tactics mentioned above. Make sure to use the right analytics software and sheets to get customers’ data. Also, first-party data is the most accurate. Using customer feedback surveys, learn about your customers and improve your business to take your growth curve to new heights.

Do you want a free Survey Software?

We have the #1 Online Survey Maker Software to get actionable user insights.