The month of July could see seven FDA-approved adalimumab biosimilars launch in the United States, an unprecedented situation for a market that has been relatively slow to embrace biosimilars. By end of year, as many as ten adalimumab biosimilars could be on the U.S. market. The Biosimilars Forum has hailed 2022 as a watershed year that could create a more competitive U.S. biologics market and reduce prescription drug costs.

HUMIRA® is the world’s best-selling drug, indicated for rheumatoid arthritis, Crohn’s Disease, and ulcerative colitis, among other conditions. In 2022, it made its manufacturer, AbbVie, $21.2bn.

Amgen’s strategy

At the beginning of the year, Amgen launched AMJEVITA™, currently the only adalimumab biosimilar on the market in the U.S., after years of litigation which allowed AbbVie to forestall loss of exclusivity for HUMIRA®. When AMJETIVA™ finally launched at the end of January 2023, its unusual, tiered pricing strategy made headlines.

Amgen offers AMJEVITA™ at 55% below HUMIRA’s list price, $1,558 per 40 mg dose versus $3,461 per 40 mg dose of HUMIRA®, and at just a 5% discount, $3,288 per 40 mg dose. It is expected that the higher-cost version at a 5% discount will appeal to PBMs and MCOs that are seeking rebates to lower their net costs.

The larger discount will be available to insurers who choose not to utilize those discounts and rebates. This strategy is often chosen by the brand manufacturers who offer higher rebates at the net price level in exchange for better placement on formularies. According to 2022 primary market research from Clarivate, 62% of payers indicated that they cover Humira on ‘preferred brand’ status, while 16% of payers cover Humira on specialty tier.

This is a relatively new pricing strategy for biosimilars in the U.S., previously seen when Biocon and Viatris launched the interchangeable insulin biosimilar SEMGLEE, a biosimilar of Sanofi’s blockbuster long-acting insulin Lantus, in 2021 for a 65% discount over its equivalent. The firms rolled out both a branded and unbranded format.

Disparate Pricing Strategies

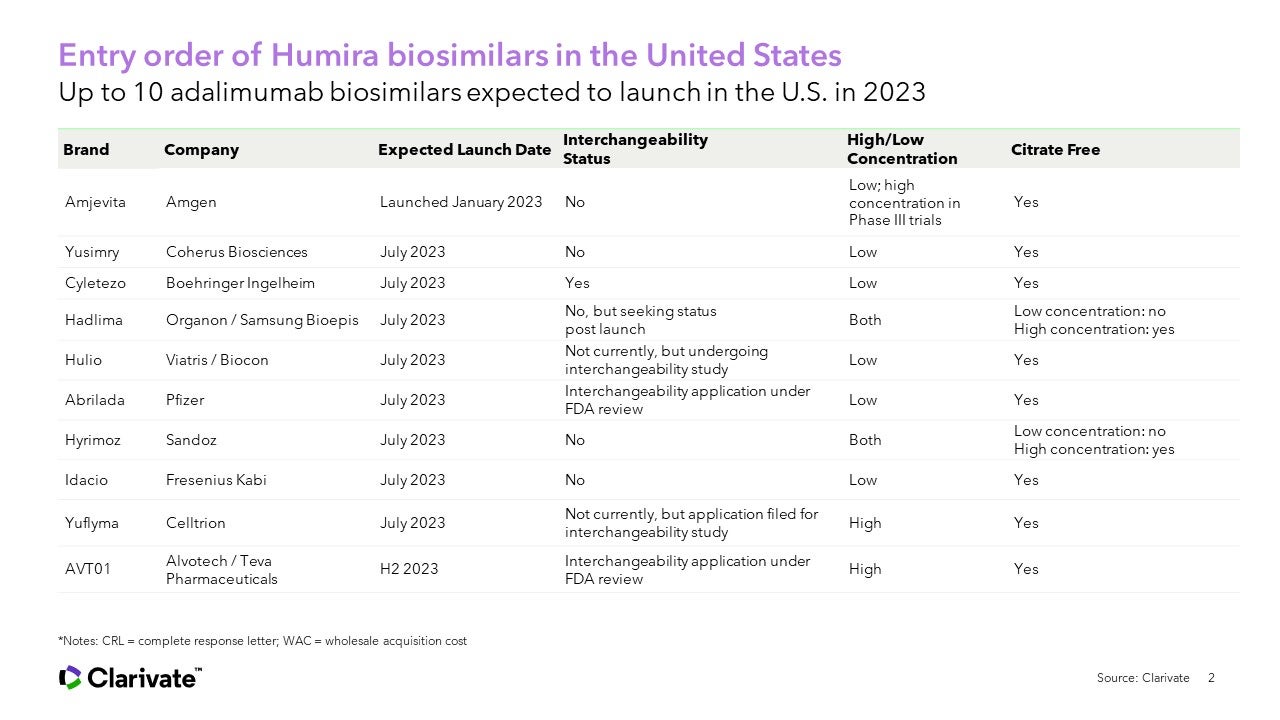

Still to come this year are biosimilars from Coherus Biosciences, Boehringer Ingelheim, Organon/Samsung Bioepis, Viatris/Biocon, Pfizer, Sandoz, Fresenius Kabi, Celltrion, and Alvotech/Teva depending on approval. With so many contenders, will we see more innovative pricing strategies?

“This pricing strategy is likely to become more common to satisfy the needs of the payers and the pharmacy benefit managers,” said Hamzah Aideed, Senior Manager of Healthcare Research and Data Analytics, Biosimilars at Clarivate, in a recent webinar discussing the impact of HUMIRA® biosimilars on the US market. Two-tier pricing makes sense as a strategy for biosimilars companies to get more market penetration in the U.S., he explained, but not for the European market, where the lowest price point will gain the greatest share.

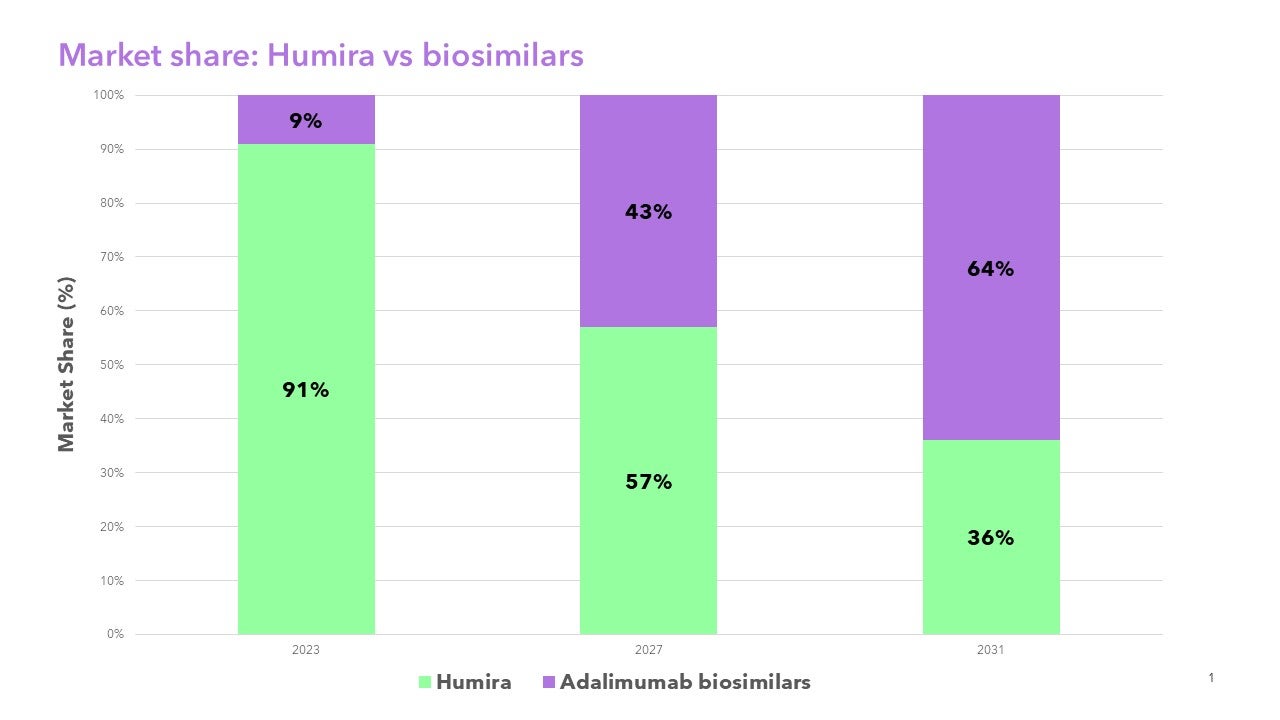

Clarivate research indicates biosimilar competition will drive down prices and relative market share of HUMIRA® in the U.S. from 91% in 2023 to 36% by 2031. Clarivate biosimilars insights include 10-year forecasting covering over 40 reference brands across the G7 countries, annual surveys of over 500 U.S. and European physicians across six specialties, and global pipeline analysis curated by experts to provide insights into the evolving landscape.

Conversely, Coherus Biosciences has partnered with Mark Cuban’s Cost Plus Drug company, enabling individuals to purchase YUSIMRY™ directly at a discount of 85% ($569 plus dispensing and shipping fees), an unprecedented discount in the U.S. This strategy is reacting to the cost challenges patients face and is an “affordable solution for patients who are uninsured, underinsured, or recently separated from Medicaid coverage,” said Coherus chief business officer Chris Slavinsky in a statement. Whether the company plans to market the drug itself at a smaller discount is yet to be seen.

The current U.S. ecosystem looks set for a divergence in pricing strategies as manufacturers target certain sets of payers, such as PBMs, in the commercial setting, but also pricing within the Medicare setting. It is still unclear how some of the mechanisms within the Inflation Reduction Act will benefit biosimilars in the long run. The Act contains a provision that boosts reimbursement to physicians to encourage adoption of biosimilars by paying them an add-on fee of 8% of the average sales price (ASP) of the reference drug in addition to the cost of the biosimilar, a two-percentage point increase from the current 6% add-on, allowing biosimilars to have lower list prices to benefit patients’ out-of-pocket costs.

However, structures such as the increased reimbursement rate at 2% may cause a further bifurcation of the market, with companies going after a certain type of payer or patient.

Clarivate research indicates that rheumatologists and gastroenterologists trust a biosimilar from large multinational companies, such as Amgen, that has maintained a good reputation with prescribing physicians in the biologics and biosimilars market. To compete, smaller players will have to come up with creative or disruptive pricing strategies such as formulation differences or alternative designations to challenge large and trusted players that also benefit from first mover advantage.

The Clarivate biosimilars team can help you to understand biosimilar regulations, pricing and reimbursement policies and the strategies in place to encourage biosimilar use, enabling you to seize the opportunity in this rewarding market. More information on can be found here.