Track The Generational And Behavioral Shifts In Europe’s Investors

It might have been just being stuck at home and bored or a “stuck-at-home” dividend from not traveling or commuting or shopping (as much) or even the specter of mortality, but the pandemic generally drove an uptick in retail investment transactions across Europe.

- In the UK, there was a surge of new self-directed investors who skewed young and BAME (Black, Asian, and minority ethnic).

- In France, too, new investors during the pandemic skewed 13 years younger than legacy investors and tended to invest smaller amounts.

- Italy also saw a rise in investment activity, similarly driven by smaller investors.

Across Europe, in other words, new investors have been piling in to the market — many of them driven by a sense of self-efficacy (“I can do research and invest myself”). And a vast swathe of new fintech companies are there to support them. Freetrade in the UK and BUX and Revolut across Europe are just three examples of booming fintechs serving these self-directed investors.

Despite the growth, Europeans still partake in retail investing less than their American and Asian peers. About half of UK adults are investors (often through pension funds), while only one in four French adults invest, and then in more conservative, government-backed, insurance-based products.

That’s roughly where the European investor likenesses end.

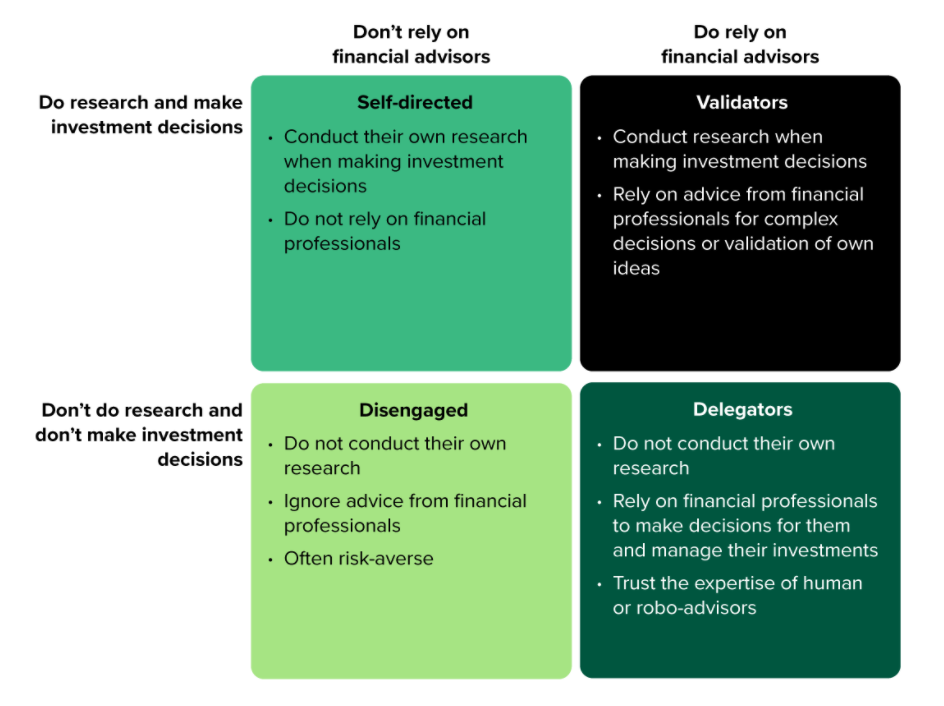

Our analysis of investors in the UK, France, and Italy revealed very different investor populations. Forrester’s investor segmentation brings a unique, behavioral lens to investors based on the degree that they do their own research and that they turn to advisors for help, creating four groups:

In each of these three major European markets, the composition of these segments was unique, and in each, the nature of each segment was different and revealing. For example, almost half of validators in the UK (the largest segment) are willing to have investment products with a big tech company.

For Forrester clients who wish to glean more of our insights into investor profiles, see our recent research on investor segmentations in the UK, in France, and in Italy.

(And for those outside Europe, we also published similar analyses for the US, Canada, China, Hong Kong, Singapore, and India).