There are a lot of ways a business can reap rewards from brand tracking, but certain brand tracking errors can leave you with insights that are meaningless to your business and its strategic objectives. To make sure you get the most out of your brand tracking, avoid these mistakes.

1. Using standardised questions only

While a standardised questionnaire might keep the cost of your brand health tracking down, you could be unintentionally hamstringing your business by using a set of survey questions that don’t align with your business, its strategic goals or your industry at large. For example, a B2B business will have a very different set of questions to a B2C business. Likewise, a media company will not share the same questions as an automotive company—the competitive landscape each business operates in and how each business measures success is vastly different—and their brand tracking survey questions should reflect that.

Moreover, each business will have tried to develop a brand identity, which should reflect their mission and values. So, when it comes to validating your brand association and imagery, you need questions that are specific to your brand identity, mission, and values if you want to gain any meaningful insights.

For this reason, we always recommend enlisting the help of a brand tracking professional who can help you tailor your questions to both your business and industry. This will ensure you’ll receive the most relevant and useful information to work with.

Learn more: How to track, measure and improve your brand health

2. Using irrelevant KPIs

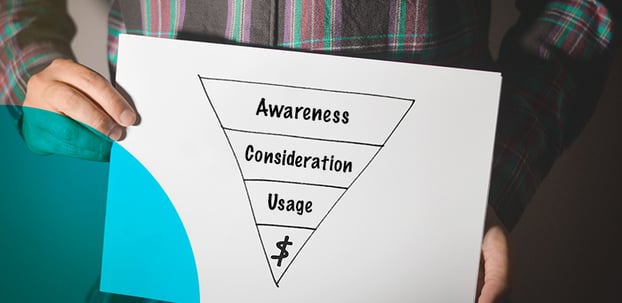

Just as standardised survey questions don’t provide valuable insights for your business, the same goes for using standardised KPIs. Fundamentally, brand tracking is about measuring the moments that matter along the customer journey as customers transition from awareness through to purchase and then loyalty. However, not all brands share the same customer journey. Meaning the traditional moments that matter (aka your KPIs)—usually represented as a funnel of awareness, consideration and usage—will likely need to be adapted to better align with your customer journey.

For example, a software company may opt to include a “trial” stage between their consideration and usage stages in their funnel/customer journey to better understand how effective this step is moving people towards purchasing their product.

By comparing your brand with others and assessing how many consumers you’re losing as they move through the purchase journey (e.g. from consideration into usage), you can pinpoint priority areas that need to be addressed. Moreover, with the right set up, you can also put a monetary value on what this would equate to.

Failing to have KPIs that reflect your customer journey means you’ll struggle to get a clear picture of how your brand is performing, which can negatively impact your decision making. In a worst-case scenario, they could lead you to form the wrong strategy. You could end up spending a lot of time, energy, money, and resources to improve an irrelevant KPI, only to see no result at the end of it.

3. Only looking at top level data

While most businesses that employ brand tracking use a tailored version of the brand funnel—awareness, consideration and purchase—as their key KPIs, they can leave a lot of vital information untapped if these top-level KPIs are not explored thoroughly. It is one thing to know what your awareness to consideration percentage is compared to your competition, but it is another to know why.

Failing to drill into your data to explore ‘the why’ behind your results means you cannot understand what elements of your brand are driving growth. Without this level of detail, you might end up with a strategy something like this:

“Our goal is to increase awareness to consideration by 3 per cent by the end of the year, which has the potential to increase our market share by 1 per cent.”

Sounds great on the surface but there is a distinct lack of detail to on how your brand will achieve this. This is where the likes of brand association and brand attributes come into play. By delving into these two elements of your brand, you can uncover what drives people to purchase products or services in your market—and how you and your competition perform on these drivers. This information is critical in being able to form the ‘how’ part of your strategy and will help inform and prioritise what to do next.

4. Not having a large enough sample size

Another mistake we sometimes encounter is when a brand does not have a large enough sample size. Not only do you risk giving your small number of respondents survey fatigue if you’re running brand tracking on a frequent basis, but your results are not robust enough to be able to drill down into any granular detail, such as by persona or demographic segments (age, location, etc). At best, you’re left with a broad overview of your market, with none of the juicy detail that can really empower and guide your brand. At worst, your sample size may not even be enough to accurately portray your market, which could skew your results and lead you down the wrong track.

5. Not running regular surveys

Brand tracking should not be a once-off exercise. It is most effective as an ongoing programme of work that allows you to assess your brand’s performance over time. Brands can opt to run brand tracking as often as every month or as little as once a year. How often is usually determined by how much marketing activity you have in the market.

While undertaking brand tracking on a yearly basis is reasonable for most businesses, there is one caveat to be aware of: starting a brand tracking programme when a big campaign is already in market.

You need to establish baseline metrics first. Once you’ve established these, you can take post-campaign tracking to understand how the campaign has performed i.e., how your brand metrics have shifted. Without a baseline measure, there is no way to know exactly how much impact your marketing is having. For this reason, we recommend surveying both before and after you have a major campaign in the market.

6. Not using brand tracking to inform future strategy

If you’ve gone to the effort of conducting brand tracking, either yourself or via an agency, make sure its findings are circulated and incorporated into your business decisions. Too often we see brand tracking treated as a tick-box exercise and the insights—and opportunities they represent—left untapped and quickly forgotten. The best way to avoid this is to ensure you have tailored questions and relevant KPIs, that you explore ‘the why’, have a strong sample size, have established your baseline metrics, and are running your brand tracking on an ongoing basis to both measure and monitor your performance and continue to improve your brand health over time.

A healthy brand is a profitable brand. Learn the ins and outs of brand health with our complete guide to tracking, measuring and improving the performance of your brand.