US Holiday Retail Sales Will Reach $969 Billion In 2023

US retail sales will continue their growth trajectory during the 2023 holiday season. That’s in spite of challenges such as diminishing pandemic-related excess savings, rising interest rates, and the resumption of student loan payments.

Forrester defines holiday retail sales as encompassing durable and nondurable goods that consumers buy during November and December. These retail sales exclude automotive and gasoline sales and spending on services, such as food and beverage services at restaurants.

So how do we see this holiday season shaping up?

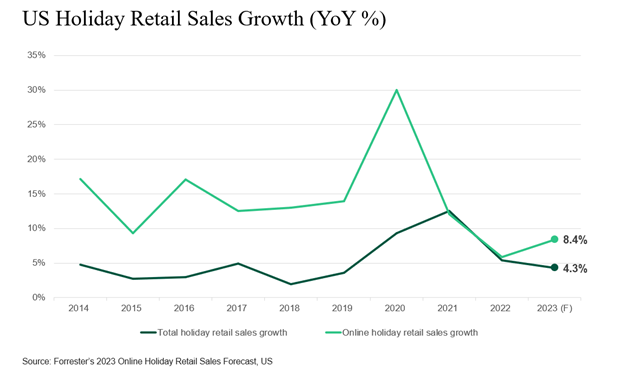

- This year, we are forecasting that total end-of-year holiday retail sales in the US will reach $969 billion, reflecting a 4.3% year-over-year (YoY) increase. This annual growth rate is slightly lower than last year, but it surpasses the average that we observed in pre-pandemic years from 2014 to 2019.

- Of that total, we expect US online holiday retail sales to reach $232 billion, growing at 8.4% YoY (see figure below). This marks the second consecutive year that online holiday retail sales will see single-digit growth, a departure from earlier years when double-digit growth was the norm.

Following are several macroeconomic trends that we believe will have a positive impact on US holiday retail sales growth during the 2023 holiday season:

- Sustained positive real GDP growth. Despite extensive discussions over the past 12–18 months regarding the possibility of a US recession, the US economy has displayed remarkable resilience, maintaining a positive trajectory. The International Monetary Fund revised its real GDP growth forecast for 2023 upwards, from 1.0% YoY in its World Economic Outlook, October 2022 edition, to 2.1% YoY in its October 2023 release.

- A robust US labor market. US unemployment rates have consistently remained below 4% since February 2022, per the US Bureau of Labor Statistics (BLS). The BLS indicates that there’s been job growth across several sectors, with significant gains in leisure and hospitality, professional and business services, and healthcare. Seasonal hiring trends have varied, with some retailers and logistics providers announcing plans to hire more or the same number of seasonal workers compared to 2022, while others have more conservative hiring plans for the 2023 holiday season.

- Moderation in US inflation. Per the BLS, US headline inflation reached its peak in June 2022 at 9.1%. Due to the Federal Reserve’s actions in raising interest rates, headline inflation has since dropped, to 3.0% in June 2023. Core inflation, which excludes food and energy, has also shown a consistent decline over the past 12 months, falling from 6.6% in September 2022 to 4.1% in September 2023.

- Positive consumer spending volume growth. During the first eight months of 2023, US Bureau of Economic Analysis data shows that US consumer spending on goods (excluding auto/gas) grew by 4.3% YoY, down from 7.7% YoY growth in 2022. A more detailed analysis of nominal vs. real spending indicates that the volume growth is starting to pick up again as we enter the holiday season. Real growth for US consumer spending on goods (excluding auto/gas) was only 0.5% during H1 of 2023, but it increased to 2.1% during July and August of 2023.

Our recently published 2023 Online Holiday Retail Sales Forecast, US report provides our forecast for total retail sales, online retail sales, and offline retail sales specifically for the 2023 holiday season, with historical data going back to 2010.

If you are a Forrester client and want to learn more, please schedule an inquiry with me!