9 Ways to Improve NPS Response Rates

Read More

Imagine you bought a washing machine from Amazon that was delivered this morning. And within an hour you received a survey in your inbox – ‘How likely are you to recommend the washing machine to your friends?’

Your washing machine still needs to be installed, and they expect you to recommend it to others!

You’ll simply ignore it, right?

So what should have been the right question to ask at this touchpoint?

A CSAT Survey on delivery experience – ‘On a scale of 1 to 5, how satisfied are you with your overall experience with our delivery service?’

Since Net Promoter Score is a loyalty metric it is not the right question here. But more often than not, businesses make this common mistake while sending an NPS survey.

The success of the NPS survey majorly depends on timing. Also, sending the right type of NPS survey at the right time matters a lot.

What does that mean?

Well, there are two types of NPS surveys – relationship NPS surveys and transactional NPS surveys. And each of them has a different approach when it comes to understanding and measuring overall customer satisfaction and loyalty.

Sounds a bit much? Fret not!

After working with many businesses across different industries, we have listed down the right time to send the right NPS survey using robust NPS software.

Let’s dive in!

Relationship NPS surveys are used to measure overall customer satisfaction and loyalty over a longer period. So, we recommend sending a rNPS survey every quarter to see the highest impact on customer retention.

As we now know relationship surveys can be sent either quarterly or after significant milestones in a customer journey, let’s discuss this based on each industry, and the survey frequency.

Before sending out rNPS surveys you need to figure out the right balance that aligns with your objective.

Decide how often you want to send NPS surveys. The frequency can vary depending on your industry, customer base, and the nature of your relationships. Common intervals include quarterly, semi-annually, or annually. Choose a schedule that aligns with your goals and resources.

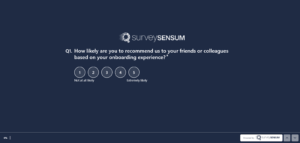

Now, choosing the right time to send the NPS survey can be tricky and you might not get it right every time. So, consider using a customer feedback platform like SurveySensum where CX consultants can help you with the right time to send your NPS surveys and also allow you to automate the survey-sending process.

Now, let’s understand when to send regular rNPS surveys for different industries.

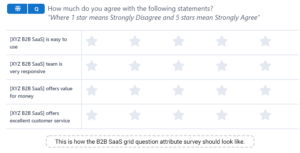

Survey frequency: Semi-annually or annually.

When to send: Send Relationship NPS surveys for your B2B SaaS products before subscription expiration or contract renewals.

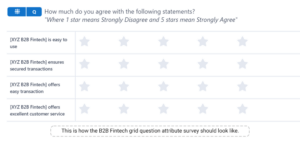

Survey frequency: Quarterly or semi-annually.

When to send: Conduct Relationship NPS surveys on a regular basis to monitor the ongoing satisfaction of clients.

Survey Frequency: After significant campaigns or projects.

When to send: Send Relationship NPS surveys after major marketing campaigns or projects to understand the impact of your efforts on client satisfaction.

Survey Frequency: Annually or after significant updates.

When to send: Given the sensitive nature of financial services, send Relationship NPS surveys annually to gauge long-term satisfaction.

Survey Frequency: Quarterly or semi-annually.

When to send: B2B service relationships often involve ongoing support. Regular Relationship NPS surveys help you understand how well your services are meeting clients’ needs and expectations.

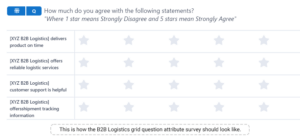

Survey Frequency: After significant shipments or orders.

When to send: Conduct Relationship NPS surveys after important shipments or orders to assess the quality of logistics and delivery services.

Survey Frequency: Annually, while consistently measuring customer satisfaction (CSAT) throughout the year.

Why: Insurance relationships tend to be long-term, and customer satisfaction is critical. By conducting Relationship NPS surveys annually, you can assess the overall loyalty and likelihood of your customers recommending your insurance services.

One of our clients, Allianz, a multinational financial services company, wanted to improve its NPS score. They started by sending NPS surveys across five important touchpoints – sales onboarding, issue resolution after-sales, renewal journey, claim, journey, and communication journey.

This helped them to gather feedback in real-time across the important touchpoints, take action, and resolve issues in time. As a result, their NPS score improved by 11 points.

But measuring NPS is not enough. Measuring CSAT consistently throughout the year allows you to address issues promptly and maintain a positive relationship.

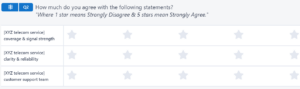

Survey Frequency: Annually, with consistent CSAT measurement.

Why: In the telecom industry, customers have ongoing relationships with their service providers. Sending Relationship NPS surveys annually helps you gauge the overall satisfaction and loyalty of customers.

Also, measure your CSAT score as it would help you to capture feedback related to various interactions and service experiences.

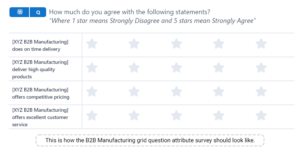

There are two aspects when it comes to sending an NPS survey in the automotive industry – the dealer and the brand itself.

Survey Frequency: After every service appointment as it focuses on the likelihood of recommending the dealership.

Why: After each service appointment, customers have a new experience to evaluate. Sending NPS surveys after every service appointment helps you understand their satisfaction levels with the service quality, customer support, and overall experience at the dealership.

Survey Frequency: Annually, as it helps you assess the likelihood of recommending the brand.

Why: As the customer’s relationship with an automotive brand tends to be more long-term, sending Relationship NPS surveys annually provides a holistic view of the overall loyalty and satisfaction with the brand.

This approach also aligns with the typical vehicle ownership cycle. You can understand customers’ sentiments regarding the brand, vehicle features, durability, and overall satisfaction.

Note: You can automate this whole process of sending NPS surveys with efficient feedback management tools like SurveySensum. Just set the time and date for your surveys in advance and the tool will automatically send your surveys to your uploaded customer list in time.

Understand When is the Right Time For Your Business to Send NPS Survey For Maximised Impact

Okay so now we have established what type of industries need to send rNPS surveys at regular intervals over a year. But what about the ones that don’t need regular follow-ups?

Let’s say a customer bought sunscreen from your beauty brand. The product might last for 2-3 months after regular usage. Do you think sending an rNPS survey annually or quarterly to this customer is going to help you measure their satisfaction and their likelihood of suggesting your product to others?

No.

Here it is important to send an rNPS survey after the customer has used the product for a significant amount of time. This approach will help you capture customer feedback when it matters most and understand their sentiments after key interactions and experiences.

Just make sure that the timing should be close enough to the milestone so that the experience is still fresh in the customer’s mind.

This approach is highly useful for retail. Let’s understand this.

As we learned from the above sunscreen example, sending an NPS survey in retail requires a different approach. Unlike the other industries we discussed above, NPS in retail is not measured annually or quarterly.

Then what should be the survey frequency of NPS surveys in retail?

Survey Frequency: After the customer has made 4-5 purchases from the brand.

Why: This allows retailers to gauge loyalty and satisfaction after customers have engaged with the brand multiple times.

Once a customer becomes a regular, you don’t need to send them rNPS surveys after every significant milestone. Instead, sending the survey once a year is sufficient to gauge their ongoing satisfaction and loyalty and improve your NPS in retail.

Okay, so we have covered when to send rNPS surveys for different industries. But is there a secret as to which days are optimal to send NPS surveys?

Create NPS Surveys With SurveySensum To Measure Customer Satisfaction In Retail

When it comes to sending NPS surveys the day of the week doesn’t matter as much as it might seem. Why?

Because as we have discussed above the customer-brand interaction is a better indicator of when to send NPS surveys rather than a day of the week.

Nonetheless, there are days in a week that yield more success than others. Here are some of those days:

Now that we’ve discussed the optimal day and time to send your NPS surveys, let’s delve into some important aspects of your NPS surveys.

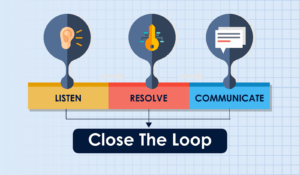

There is no point in going through the trouble of launching an NPS survey if you don’t take any action on it, right?

So, address issues promptly, capitalize on positive feedback, and close the feedback loop in time – maintaining customer satisfaction.

But how to do that?

When reaching out to promoters who provide positive feedback, express gratitude for their support, acknowledge their satisfaction, and show that you value their input and appreciate their loyalty.

But don’t just stop there. They have the potential to become brand advocates, so leverage them.

But how to create brand advocates?

Your promoters are already satisfied with your brand so put in extra effort and convert them into your brand advocates and they will promote your brand willingly. Offer exceptional personalized service to them, create meaningful loyalty programs for them with relevant benefits, and engage with them on social media.

On the other hand, with detractors, contact them promptly after receiving negative feedback. Apologize for their dissatisfaction and assure them that their concerns will be addressed. Now, investigate the issue and find a resolution that aligns with the customer’s needs and expectations.

Keep the customer informed about the steps being taken to rectify the situation.

Lastly, when dealing with passives, engage with them to understand their concerns and identify areas for improvement. Proactively address their feedback and show how you’re making changes based on their input. Tailor your responses based on the specific feedback given. Demonstrate that you’re genuinely interested in their experience and opinions.

Why? It allows you to continuously monitor the impact of your actions over time.

This process shouldn’t be a one-time activity; rather, it should be a recurring practice. By tracking your NPS over various time periods, you gain insights into the trends and fluctuations in customer satisfaction. You can pinpoint when changes were implemented and how they influenced NPS.

This historical perspective is invaluable because it helps you understand the long-term effects of your efforts.

In essence, analyzing historical NPS enables you to connect the dots between your actions and their impact on customer satisfaction, providing a roadmap for continuous improvement and informed decision-making

Imagine: As the manager of a telecom customer support team, you implemented a training program to boost response times and issue resolution. After a few months, you decide to analyze your NPS to see if these changes have positively influenced customer satisfaction.

Initially, you measured an NPS of 20. However, after implementing the program, you monitor NPS for several months and observe a steady increase to a score of 40. This reflects the positive impact of your improvements. Your regular analysis allowed you to see this positive trend.

Upon analysis, you discovered that the improvement is because customers are mentioning shorter wait times and quicker issue resolution. This confirms the effectiveness of your actions, like the training program.

Though your rising NPS is promising, you understand the importance of industry benchmarking. Your research reveals the telecom industry’s average NPS is 45, indicating you’re slightly below the norm despite improvements.

This benchmarking against industry standards gives you a broader perspective and suggests that there may be additional opportunities for improvement to compete more effectively with your competitors.

Note: Industry NPS benchmarking can differ based on geographical regions due to cultural differences and local expectations. Analyzing how you fare in your targeted geography provides a localized perspective.

So, through regular analysis of your NPS and benchmarking against industry standards, you not only identified the positive impact of your actions on customer satisfaction but also gained insights into where you stand relative to your competitors.

Now, we have discussed this in length regarding the right intervals for rNPS surveys but what but the tNPS surveys? Let’s find out.

As you know Net Promoter Score is a loyalty metric. It focuses on building and gauging relationships over time, making it less suitable for gathering feedback after just a single transaction or interaction. That is why we recommend sending CSAT surveys instead of tNPS surveys.

And here’s how you can use a CSAT survey, instead of tNPS.

Use clear and concise questions in your CSAT survey. For instance – ‘How satisfied were you with your recent support interaction?’

Offer a rating scale with the question, typically from ‘Very Unsatisfied’ to ‘Very Satisfied’, allowing customers to provide their sentiment.

You can also include follow-up questions to gather insights into specific aspects of the interaction that contributed to the customer’s satisfaction or dissatisfaction.

Before you end this blog, let’s quickly understand the common mistakes that need to be avoided when sending NPS surveys.

Here are four common survey mistakes that you can avoid.

1. Not Sending Surveys Consistently: Inconsistent survey timing can lead to skewed data analysis and hinder your ability to accurately track trends over time. Sending surveys regularly allows you to capture shifts in customer sentiment, identify patterns, and make informed decisions based on reliable data.

2. Ignoring Survey Fatigue and Its Effect on Response Rates: To mitigate this, carefully manage the frequency of survey requests. Avoid bombarding customers with surveys, especially if they’ve recently responded to one.

3. Not Taking Action on the Feedback: Collecting feedback is only valuable if you act on it. Neglecting to address customer concerns, suggestions, and issues communicated through surveys can result in dissatisfaction and erosion of trust.

4. Not Measuring the Impact of the Actions: After implementing changes based on customer feedback, it’s essential to measure the impact of these actions. Failure to do so leaves you in the dark about the effectiveness of your efforts.

Surveys are only effective when they are sent in the right way at the right time. Not understanding the importance of sending NPS surveys at the right touchpoint of the customer journey will result in the gathering of unreliable and inaccurate customer feedback.

So, before sending out your NPS surveys make sure that you properly understand what type of NPS survey needs to be sent at which touchpoint and that it properly aligns with your goals and objectives.

In order to do that use customer feedback software like SurveySensum. It enables timely NPS survey creation and distribution while also facilitating feedback analysis, sentiment tracking, and real-time detractor resolution and feedback closure.