Innovative Team Collaboration: 3 Tools for Seamless Project Management

Read More

Samantha had long awaited the day she could upgrade her trusty old sedan to a shiny new car. After extensive research, she decided to visit Prestige Motors, a reputable dealership.

Samantha’s purchasing process went smoothly, and she drove home in her new car, thrilled with her decision. A few days later, she received an email from Prestige Motors, requesting her feedback on the dealership experience.

The survey began with standard questions about her overall experience, from the cleanliness of the showroom to the professionalism of the staff. But as she progressed through the survey, she noticed an open-ended question that asked,

→ “Is there anything you feel could be improved at Prestige Motors?”

Samantha paused for a moment, reflecting on her experience. She realized that there was one aspect that left room for improvement – the post-purchase follow-up.

So, she expressed her thoughts on the lack of post-purchase follow-ups by the dealership. And few days later, Samantha received an email from the dealership’s general manager. He expressed his gratitude for her feedback and apologized for the oversight.

But the dealership didn’t stop there. They not only improved their follow-up procedures but also extended their gratitude by sending Samantha a complimentary maintenance package and create invitation card for an exclusive customer appreciation event.

This shows that creating the automotive survey in the right way with the right questions allowed Sarah to voice her concerns and, in turn, led to improvements that benefited not only her but future customers as well.

But more often than not, auto dealerships create common mistakes like asking too many questions, not paying attention to mobile-friendliness, etc. These mistakes hinder them from gauging their automotive customer experience properly and miss out on all the amazing benefits of a dealership experience survey.

So, with this blog, we will embark on a journey to list out the 10 mistakes that brands should be careful about while creating their next dealership experience survey. But before that let’s start by understanding what exactly is a dealership experience survey.

What is a Dealership Experience Survey?

10 Things to Avoid While Launching a Dealership Experience Survey

A dealership experience survey is used by automotive dealerships to gather feedback from their customers regarding their experiences with their services and products.

The objective of this survey is to assess various aspects of the customer’s interaction with the dealership sales process which will enable the dealership to offer the best after-sales service. This will evidently boost their customer satisfaction.

Pro Tip: Use an effective automotive feedback tool, like SurveySensum, to create, keep track of, and analyze your car dealership satisfaction survey data. This tool will also enable you to resolve customer complaints in real time!

Now, that we know what is a dealership experience survey, let’s look at the 10 common mistakes that you need to avoid while launching your dealership experience survey.

“Did you have a good experience at our dealership? Please explain.”

Imagine receiving such a vague question in your email one day after your purchase. Now, the lacks a specific objective because it uses broad and subjective terms like ‘good experience’ without providing any criteria or context for you to evaluate your experience.

Now, do you think you will be able to provide constructive feedback to this question? No, right?

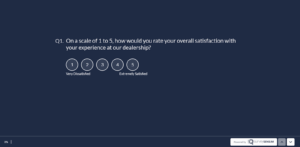

The right question here will be – “On a scale of 1 to 5, with 1 being ‘Very Dissatisfied’ and 5 being ‘Very Satisfied,’ how would you rate your overall experience at our dealership? Please provide comments to support your rating.”

Now, this question not only gathers quantitative data through the rating scale but also allows you to express your opinions and provide specific feedback – making it a more effective and actionable survey question.

This is why it’s crucial to establish a clear goal for your survey because, without a specific objective in mind, your survey will lack focus and fail to provide meaningful insights.

Here’s how you can ensure a clear objective for your survey:

Imagine you work at a dealership that sells both luxury cars and budget-friendly vehicles. You want to gather feedback from both segments. Now, each group will obviously have different preferences and expectations so the survey questions for them should also be different, right?

For luxury car buyers, the questions should focus on premium features, personalized service, and satisfaction with luxury features. And for budget-conscious shoppers, the questions revolve around affordability, value for money, and satisfaction with financing options.

Now, by segmenting your customers and tailoring the survey questions in this way, you can gather more meaningful feedback and use it to make improvements that will cater to the diverse preferences and expectations of your customer base.

So, in order to avoid the mistake of understanding your buyer’s persona and to effectively understand it, consider the following:

Do you know that, the ideal survey length is 5 minutes, and consumers are not willing to answer more than 5-7 survey questions?

So, while it is essential to gather comprehensive feedback, an excessively long survey can overwhelm and discourage respondents, resulting in lower completion rates and potentially less reliable data.

To avoid the pitfall of asking too many questions, consider the following tips:

Tip: Prioritizing key questions and keeping the survey concise not only respects your customers’ time but also ensures that you collect valuable insights that can drive improvements in your dealership’s services and customer satisfaction.

“What is the best and worst part of your dealership experience? And what would you suggest to improve it?”

Doesn’t this survey question sound a little off to you?

Yes, but why? In just one question, the customer is being asked about the best as well as the worst part of their dealership experience and also for any suggestion to improve the experience. Now, how will they respond?

This is an example of a confusing question.

Survey questions should be straightforward and easy for respondents to understand. When respondents encounter confusing or unclear questions, they become frustrated and abandon the survey. Ensuring clarity in your survey questions can improve completion rates and the overall quality of the data collected.

To avoid this mistake in your dealership experience survey, consider the following points:

By avoiding confusing or ambiguous language, you can collect reliable data that will help your dealership make informed decisions and improvements based on customer feedback.

Neglecting to test your survey can lead to unexpected issues, such as confusing questions, formatting errors, or technical glitches that can frustrate respondents and compromise the quality of the data collected.

To effectively pilot test your survey before launching it, consider the following steps:

By addressing any issues or concerns identified during pilot testing, you can create a survey that maximizes response rates, collects high-quality data, and provides valuable insights into the dealership experience.

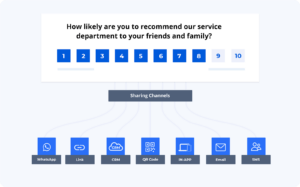

Let’s say you prepared a well-designed dealership experience survey to gauge the satisfaction level of your new customers but forgot to pay attention to timing and delivery channels. You sent the survey on a Saturday evening, which is not the ideal time, and via WhatsApp, on the number in which the customer doesn’t have WhatsApp.

This shows that failing to send surveys at the optimal moment or through the preferred channels of your customers can result in lower response rates and less valuable feedback.

To ensure that you send surveys at the right time and through the right channel, consider the following strategies:

By tailoring your survey-sending approach to customer preferences and capturing feedback when it matters most and through the right channels, you can gather insights that drive improvements in the dealership experience.

Share Omnichannel Surveys With SurveySensum – Request a Demo

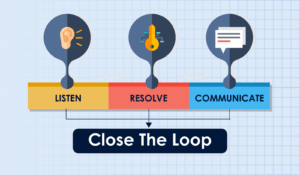

Collecting feedback from customers is just the first step in improving your dealership experience survey process – the critical step is following up with your customer.

Failing to follow up with customers after they’ve provided their feedback can result in missed opportunities to build stronger relationships, address concerns, and demonstrate your commitment to improvement.

So, follow up with customers to thank them for their time and feedback. This demonstrates your appreciation for their input. Also, not all feedback will be positive, some customers may raise valid concerns or issues. Following up allows you to address these concerns promptly and work towards resolutions – resulting in a positive experience.

Based on Statista’s report titled “Smartphone Mobile Network Subscriptions Worldwide,” in 2022, the global smartphone user count reached 6.6 billion, with projections indicating a growth to over 7.8 billion users by 2028.

These statistics underscore the continuous rise in mobile device users each year, underscoring the importance of optimizing your retail surveys for mobile users. Failing to address this critical aspect can lead to subpar user experiences and, consequently, a decline in response rates.

Image file name: Example of a mobile-friendly survey

Image alt text: This image shows an example of a mobile-friendly dealership experience survey where the survey is fit to the mobile screen.

To ensure that your dealership experience survey is optimized for mobile users:

As mobile device usage continues to grow, it’s essential to prioritize the mobile user experience to collect meaningful feedback and maintain a positive relationship with your customers.

Create Mobile-Friendly Dealership Experience Survey – Sign Up Now!

The primary purpose of any survey, including a dealership experience survey, is to gather insights that can drive improvements. Neglecting to act on the feedback received means missing out on valuable opportunities to enhance your dealership’s operations.

To truly benefit from the insights you’ve gained, it’s crucial to close the feedback loop by taking action on the feedback received and communicating these actions to your customers. It sends a clear message to your customers that their opinions and concerns are taken seriously and that you are actively working to address them.

To effectively close the feedback loop and make the most of your survey results:

Closing the feedback loop not only leads to enhanced customer satisfaction but also strengthens employee engagement and customer loyalty.

Effectively Close the Feedback Loop With SurveySensum – Request a Demo

To fully leverage the feedback from your dealership experience survey and drive positive change, it’s essential to share key insights with your sales and marketing teams.

Sharing survey insights aligns the goals and objectives of the sales and marketing teams with the overall customer experience. When these teams understand customer sentiments and preferences, they can tailor their strategies to meet customer expectations more effectively.

To effectively share survey insights with the sales and marketing teams:

1. What type of visit is this?

2. On a scale of 1-5, how is your overall service experience? (1-5 point scale)

3. Please rate the easiness of setting a service appointment with our dealership. (1-5 point scale)

4. Please rate the easiness of the service registration process. (1-5 point scale)

5. Please rate your experience with dealing with our Service Advisor. (1-5 point scale)

6. Please rate your experience with our service center facilities. (1-5 point scale)

7. Please rate your experience with waiting time. (1-5 point scale)

8. Was the vehicle delivered on or before the promised time? [binary scale]

9. What was the reason given by the Service Advisor for the delay? (Pick one)

10. On a scale of 0-10, how likely are you to recommend our dealership to a friend or colleague? (0-10 point scale)

There you go, 10 key questions that you can ask in your next dealership experience survey and harness its full potential.

Dealership experience surveys gather feedback and understand customer thoughts, but there are some common mistakes that dealerships make while creating these surveys. Here’s a summary of the discussed mistakes: