In recent years, the insurance industry has witnessed a remarkable transformation, and at the heart of this change is blockchain technology.

This innovative and secure digital ledger system has the potential to revolutionize claims processing, streamlining operations, enhancing transparency, and ultimately benefiting both insurance companies and policyholders.

In this article, we will delve into the world of blockchain technology and its profound impact on claims processing within the insurance sector.

Understanding Claims Processing

Claims processing is the pivotal moment when an insurance policyholder seeks reimbursement for a covered loss. Traditionally, this process involved multiple intermediaries, documentation reviews, and often lengthy delays. Insurance companies using blockchain can transform this process into a streamlined and transparent experience.

The Role of Transparency and Trust

Blockchain’s key feature is its ability to offer transparency and foster trust. Each claim-related transaction is recorded on the blockchain, visible to all relevant parties, including the policyholder, insurer, and regulators. This transparency reduces disputes and eliminates information asymmetry.

Blockchain Technology Unveiled

Blockchain is a distributed ledger that operates on a network of computers. Each block in the chain contains a set of transactions, and once recorded, they cannot be altered without consensus from the network participants. This technology ensures data integrity and security.

Benefits of Blockchain in Claims Processing

The adoption of blockchain in claims processing comes with a myriad of benefits. These include:

Enhanced Security Through Decentralization

Traditional data storage systems are vulnerable to breaches, but blockchain’s decentralized architecture makes it incredibly secure. Hackers would need to compromise every node in the network simultaneously to breach the system.

Smart Contracts: Automating Claims

Smart contracts are self-executing agreements with predefined conditions. In claims processing, these contracts can trigger automated payments once conditions are met, drastically reducing administrative overhead and processing times.

Accelerated Settlements and Reduced Fraud

Blockchain’s efficiency allows for quicker settlements, providing policyholders with timely assistance during critical moments. Additionally, the immutability of blockchain records mitigates fraudulent claims.

Real-World Implementations

The use of blockchain technology in the insurance industry has demonstrated its versatility. The real-world examples of its use highlight how various companies are using blockchain to make insurance processes better.

- AIA Group Limited: A leading insurance and financial services provider in Asia, AIA has explored blockchain to enhance claims processing efficiency. By using smart contracts, AIA aims to automate and expedite claims settlement, reducing administrative bottlenecks and improving customer experience.

- B3i Services AG: B3i, a collaborative initiative involving multiple insurance companies, focuses on utilizing blockchain to streamline reinsurance processes. Their platform aims to provide a more efficient and transparent way to manage and settle reinsurance contracts, benefiting both insurers and reinsurers.

- MetLife: MetLife has been exploring blockchain technology for various insurance processes, including claims processing. The company aims to enhance transparency and efficiency by using blockchain to automate claims verification and settlement, leading to faster payouts and improved customer satisfaction.

- AXA: AXA has been involved in blockchain initiatives to improve various aspects of insurance operations. In claims processing, they are exploring how blockchain can facilitate secure and transparent communication between insurers, policyholders, and third-party service providers, minimizing disputes and delays.

Challenges and Considerations

While the potential is vast, challenges such as scalability, interoperability, and regulatory compliance need to be addressed. Integrating blockchain with existing legacy systems can also be complex.

Regulatory and Compliance Implications

Blockchain’s borderless nature raises questions about jurisdiction and regulatory oversight. Striking a balance between innovation and compliance will be crucial for widespread adoption.

The Future Landscape of Insurance

As blockchain technology gains momentum, it’s expected to redefine insurance operations beyond claims processing. From underwriting to policy management, blockchain’s impact will be transformative.

Adoption Rates and Industry Collaboration

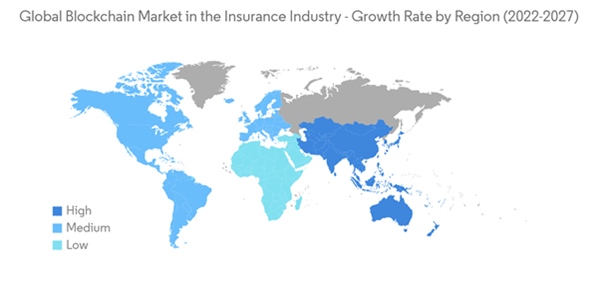

The adoption of blockchain technology within the insurance sector is not only gaining momentum but also poised for exponential growth. A key indicator of this trend is the projection that the Blockchain Market in the insurance industry is set to experience significant expansion.

With a Compound Annual Growth Rate (CAGR) of more than 63.4% forecasted between the years 2023 and 2028, the trajectory points toward substantial integration and advancement of blockchain technology within insurance processes.

This surge in growth signifies the industry’s recognition of the transformative potential that blockchain holds for claims processing, data security, and customer experience improvement.

Insurers are also collaborating to develop industry-wide blockchain standards. These collaborations ensure compatibility and interoperability among various stakeholders.

Conclusion

Blockchain technology is a game-changer for the insurance industry, particularly in claims processing. Its ability to enhance transparency, security, and efficiency holds the potential to create a more streamlined and trustworthy insurance experience.

As the industry continues to explore and adopt blockchain solutions, both insurers and policyholders stand to benefit from this transformative technology.

FAQs

Q: Is blockchain technology only applicable to claims processing?

No, blockchain has the potential to transform various aspects of the insurance industry, from claims processing to policy management and fraud prevention.

Q: Will blockchain eliminate the need for human involvement in claims processing?

While automation will increase, human oversight and decision-making will still play a vital role, especially in complex claim scenarios.

Q: How can insurers ensure data privacy on a blockchain?

Blockchain offers enhanced data privacy through encryption and permission-based access, allowing insurers to control who can view and modify data.

Q: What is the biggest hurdle in adopting blockchain for insurance?

One of the biggest challenges is integrating blockchain with existing legacy systems and ensuring seamless data flow between them.

Q: How can policyholders learn to navigate blockchain-based insurance processes?

Insurers should provide clear and user-friendly educational materials to help policyholders understand the new processes and benefits of blockchain technology.