What do the years 2001, 2007, 2014, and 2022 have in common? These years witnessed significant troughs in pharma financing, a drop in the capital markets, and an IPO window that remained firmly shut. In short, the biotech bubble had burst.

Cream will always rise to the top and there will always be a buyer for quality assets, whether therapeutics, platforms, or technology. Big pharma is still keen to access good technology, science, and assets, in many cases to plug a patent-expiry-shaped hole in their coffers. By buying in innovation pharma can acquire (at least partially) derisked revenue and increase chances of R&D success, as well as a refreshed portfolio.

Pfizer’s $11.6 billion spend on Biohaven, for example, has brought in a migraine franchise to the pharma major that had Comirnaty cash burning multiple holes in its pockets. That deal brings in a CGRP drug franchise, including the approved therapy Nurtec ODT, the only oral CGRP drug approved to prevent and treat migraines. a CGRP drug franchise, including the approved therapy Nurtec ODT, the only oral CGRP drug approved to prevent and treat migraines.

The continued quest for innovation will be a huge spur to dealmaking in the next five years, but the question remains: What does a good deal — for all parties — look like?

“Deals should be a win-win for both parties, but what a win is, is shifting,” said Robert Williamson, COO of Triumvira Immunologics, in Clarivate’s recent webinar, Deal making in uncertain times. According to Williamson, the definition of a win is evolving, especially for struggling biotech companies facing financial challenges in the aftermath of 2023. In the current funding climate, access to capital becomes a significant win. However, Williamson cautioned against prematurely relinquishing potential future growth by “selling the seed before it becomes a tree.”

For a time, the consensus thinking has been that if you sell your ‘crown jewels,’ you are never going to be successful. But is this still true? Biotechs should consider their strengths in innovation, discovery and early clinical development, said Takeda’s Sasha Huhalov, and look to pharma partners’ strengths when ready for broad clinical development and commercialization.

Plenty of biotech companies are happy to take a pharma deal presently to extend their financial runway into 2024, 2025, and 2026, said Williamson, “and if that means not retaining significant rights, so be it.”

Recognizing value

For a time, the biotech industry has been attempting to find the benefit in co-commercialization or co-development deals with pharma, but has this created any value? Arguably, that depends very much on therapeutic area, indication and go-to market strategy. Success has come from certain deals, such as Pharmasset, which decided it could go to market as a small public company with its Hepatitis C products. Had it not put together a commercial team and been seen as a credible threat to pharma, Gilead may not have laid down the $11bn it did to secure that corner of the market.

Matching the commercial and compliance capabilities of a $100m biotech to a $100bn pharma is impossible, and the sentiment around this idea is changing said Thaminda Ramnayake, Affini-T Therapeutics’ CBO.

Structuring a deal with performance obligations on it is an alternative, he said. And if this obligation is not needed, just let pharma and biotech do what they do best. This realization is more present within the industry now compared to a decade ago, he said, when the emphasis was on building a fully integrated biotech company.

Investment strategy

Industry commentators in the biopharma industry believe the upcoming years are expected to be a period of increased dealmaking activity. This presents significant opportunities for value creation, particularly due to the accumulation of cash by large companies and the lower prices of potential targets resulting from the recent market downturn.

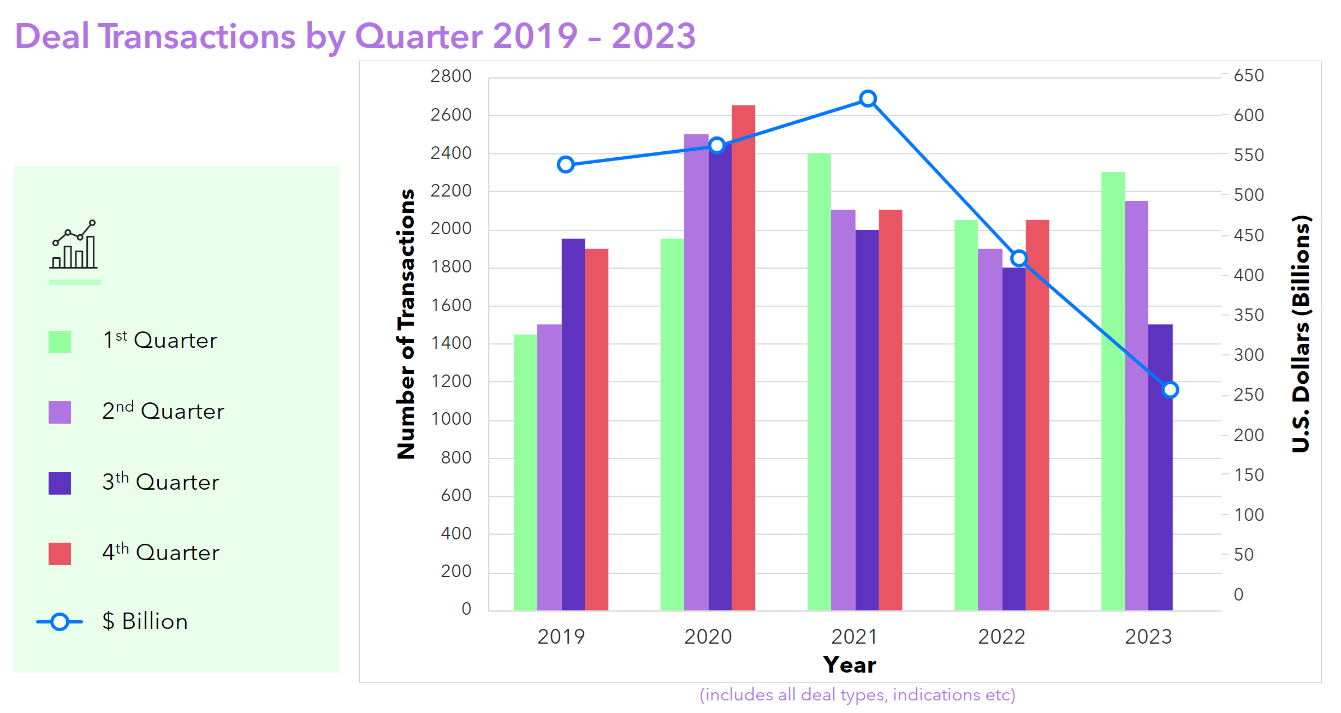

For the time being, the economic environment for biopharma dealmaking remains uncertain, with a promising increase in activity for the first half of 2023 tempered by a downturn in the third quarter.

Source: Clarivate Cortellis Deals Intelligence

If a company is considering entering a partnership or alliance, there are several key factors to take into account when making the right decision:

- Forecast asset value accurately

- Find the most suitable partner

- Identify the best stage at which to partner

- Prepare for a confident negotiation process

- Constantly monitor deal trends

- Pursue innovative technology

- Read the latest Clarivate thinking on making these steps a reality to ensure you create the best deal for your company and customers. on making these steps a reality to ensure you create the best deal for your company and customers.