In today’s world, where every online chatter can become a shout across the digital universe, understanding the current trend of online reviews is crucial for businesses aiming high.

With an overwhelming 68% of consumers letting reviews guide their choices, enterprises must know the pulse of the market to craft a stellar reputation. Birdeye’s vast network, encompassing over 150,000 businesses and a treasure trove of millions of reviews, offers a rich data set to discern these trends.

In this blog, we’ll delve into the latest online review trends, insights, and strategies to help you paint a detailed picture of consumer behavior and use it to your advantage.

Key findings

Let’s take a closer look at what our latest study uncovered about the current state of online reviews.

1. Overall industry trends

The landscape of online reviews witnessed notable growth and engagement in 2023, reflecting its increasing influence on consumer behavior. Here’s a quick glance at the key stats:

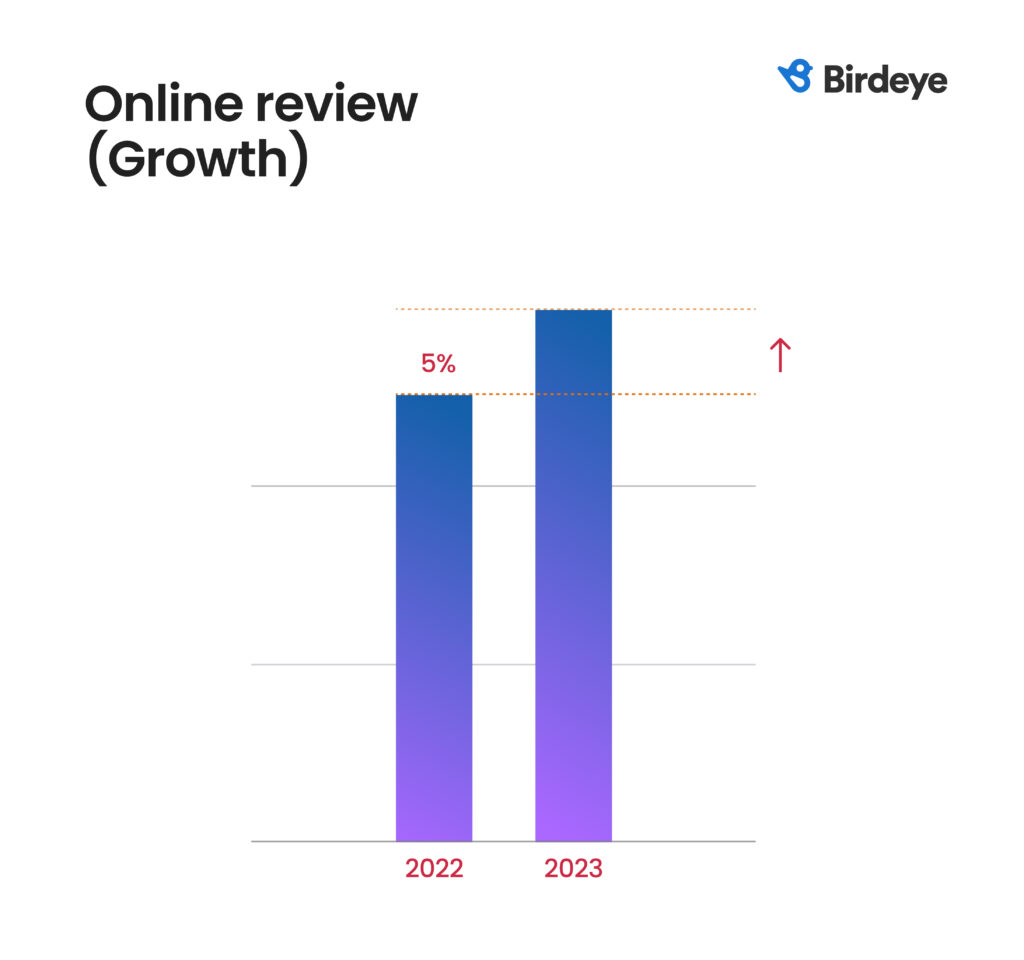

- Online reviews grew by 5% over the previous year.

- The average Google star rating for Birdeye’s clients was 4.6.

- The longest reviews appeared on TrustRadius and ComplaintsBoard.

- 79% of reviews included comments, an increase from 73% in 2022.

- The average review length was 213 characters.

- There was an 18% decrease in reviews without ratings compared to 2022.

This uptick in online reviews comes after a challenging period in 2022 when the pandemic led to business slowdowns and a drop in online feedback. As things started to return to normal, the increase in review volume pointed to a recovery phase, with people getting more engaged than before.

2. The surge of Google reviews

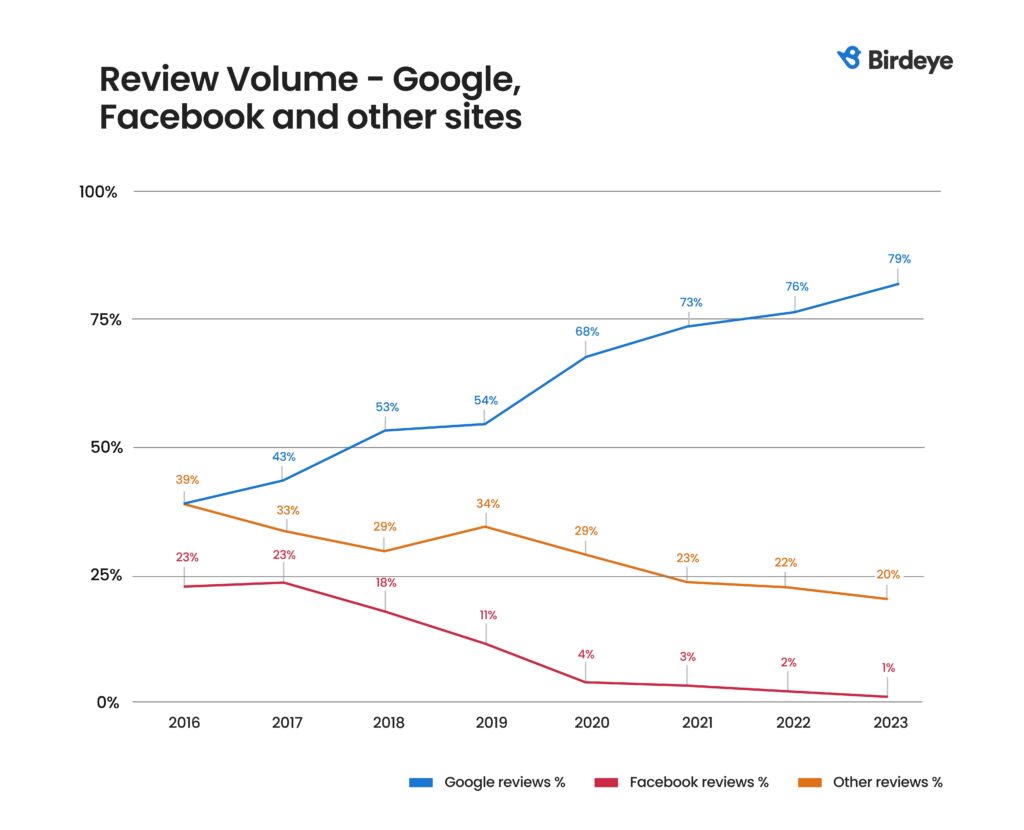

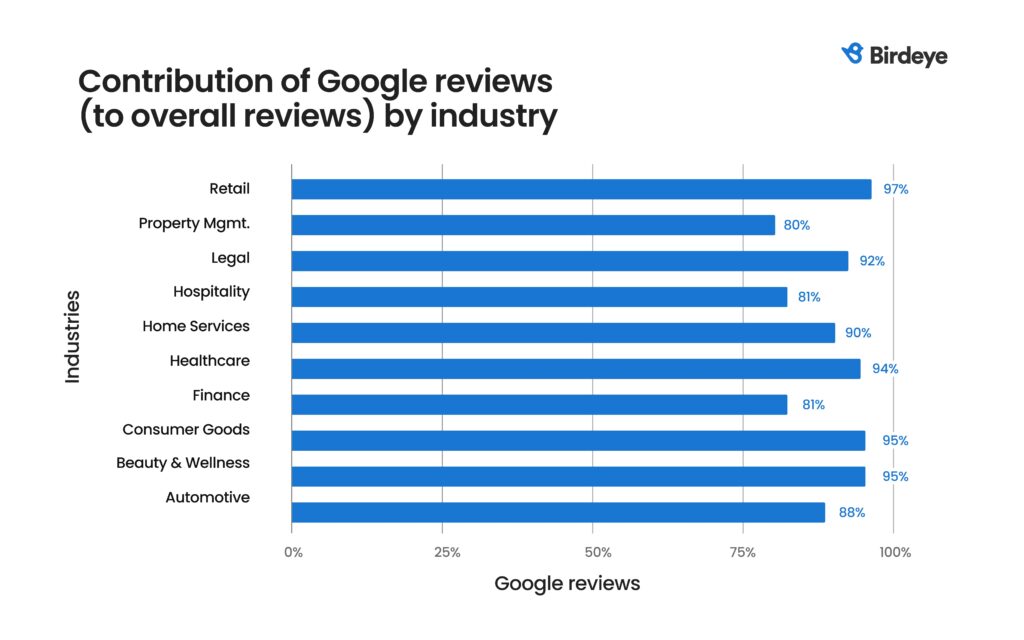

In 2023, the online review scene saw some interesting shifts, highlighting the ever-growing impact of Google reviews in the digital marketplace. Here are some key stats:

- Google reviews soared by 15%, capturing 79% of all online reviews.

- Each business location, on average, received 66 new Google reviews, underscoring Google’s significant sway in the review ecosystem.

- Google captured 97% of retail, 94% of healthcare, 92% of legal, and 90% of home services reviews.

- Facebook’s share of online reviews took a steep dive to 1% in 2023, down from 23% in 2016, marking a drastic reduction in its importance as a review platform.

These changes highlight Google’s expanding role in shaping online visibility for businesses, making the management of Google reviews more crucial than ever for a robust digital presence.

3. Review requests via email and SMS

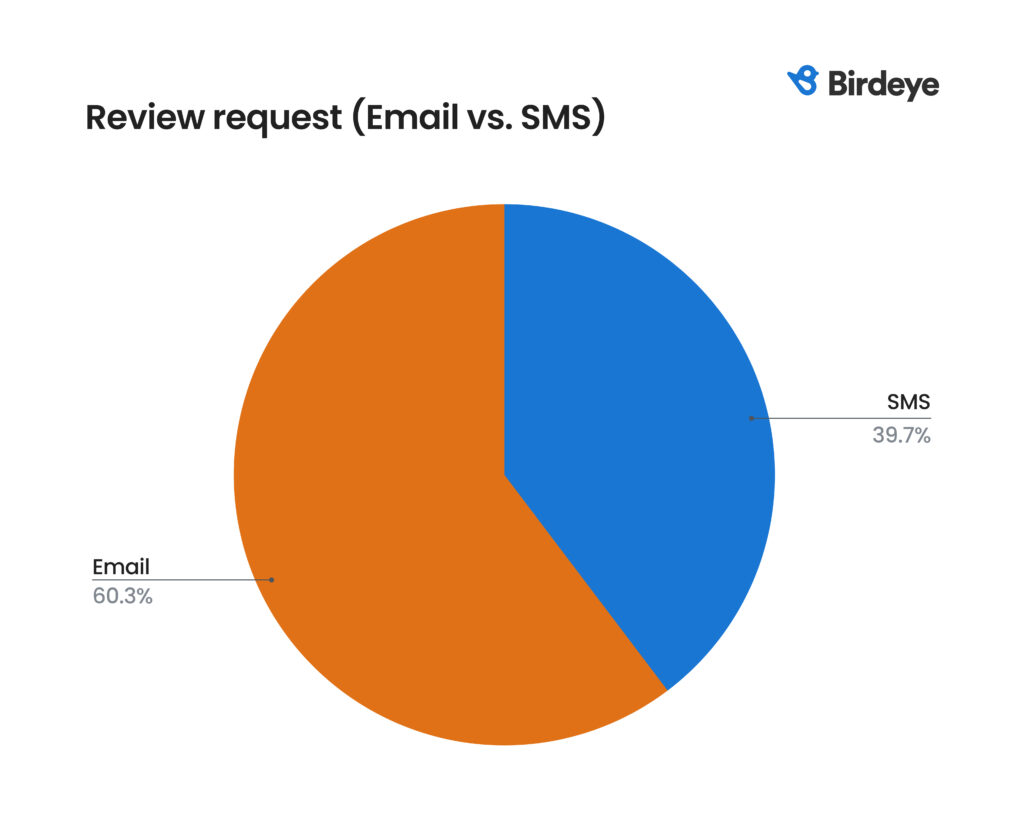

The strategies for soliciting reviews evolved in 2023, with digital channels leading the way in effectiveness and reach. Here are some important stats:

- 60% of review requests were sent via email.

- SMS requests had an 8% click-through rate.

- The retail industry saw the most significant growth in review requests, with SMS and email requests up by 58% and 162%, respectively.

- Healthcare was the top sector for sending review requests, followed by automotive and retail.

- The average open rate for email review requests was 20%, with a click-through rate of 7%.

4. Automated review responses

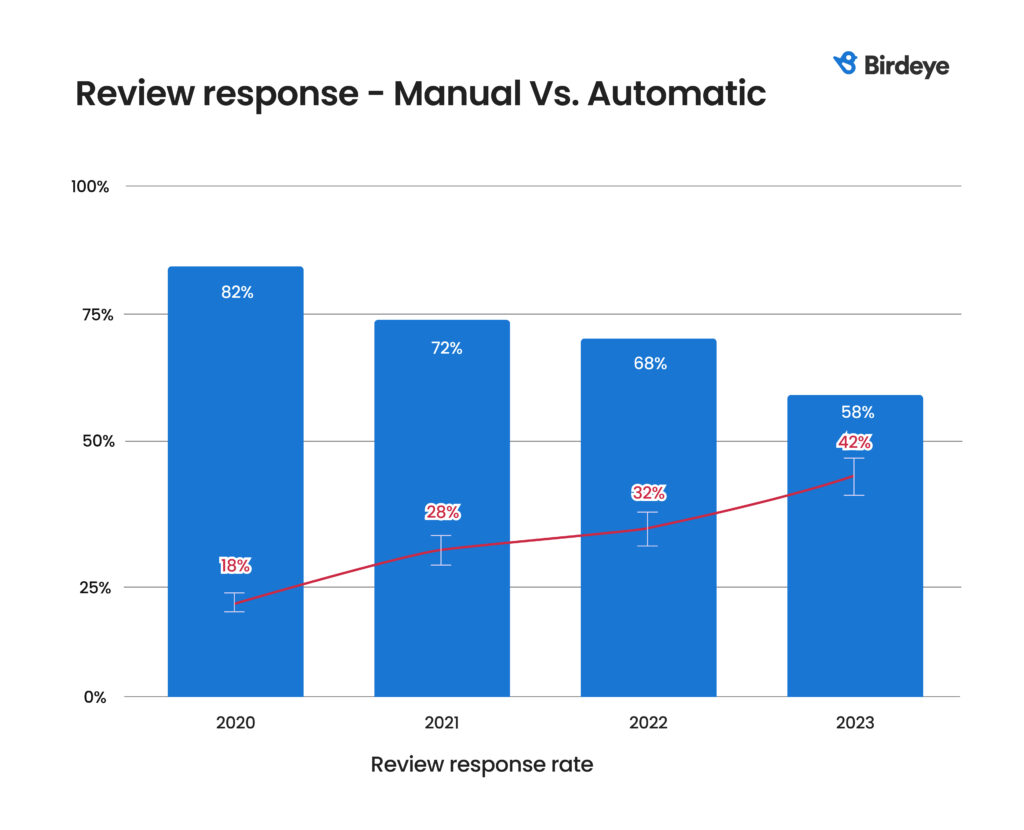

Businesses increasingly engaged with their reviews, indicating a trend towards more active online reputation management.

- 63% of reviews received a response, a 10% increase from the previous year.

- Automated responses accounted for 42% of all replies.

- Home services and legal industries showed a higher preference for automatic responses at 79% and 71%, respectively.

Why are online review statistics important for your business?

Understanding online review statistics is essential for businesses because these metrics are like a pulse check on customer satisfaction and the overall reputation of your business. The volume, quality, and frequency of online reviews can significantly influence potential customers, as reviews are often the first thing a potential customer encounters when learning about what you have to offer.

How businesses respond to reviews, whether positive or negative, also speaks volumes. A prompt and thoughtful reply to reviews or feedback can demonstrate your commitment to customer service, turning even a dissatisfied reviewer into a loyal supporter over time.

In a world where everyone is quick to share their two cents online, keeping an eye on these review stats can help you adjust your strategies to improve, win over more customers, and grow bigger.

Know the pulse of the market

Watch a demo to see how Birdeye can help you better manage your online reviews.

Key industry trends observed

1. Automation to drive reviews

As online discovery becomes crucial for consumers, businesses are turning to automation to boost their reputation efficiently.

Birdeye stands out in this shift, with 92% of its review requests in 2023 being automated. This highlights how essential automated processes have become for a streamlined feedback loop.

Responding to reviews is also evolving, with a growing trend towards automation:

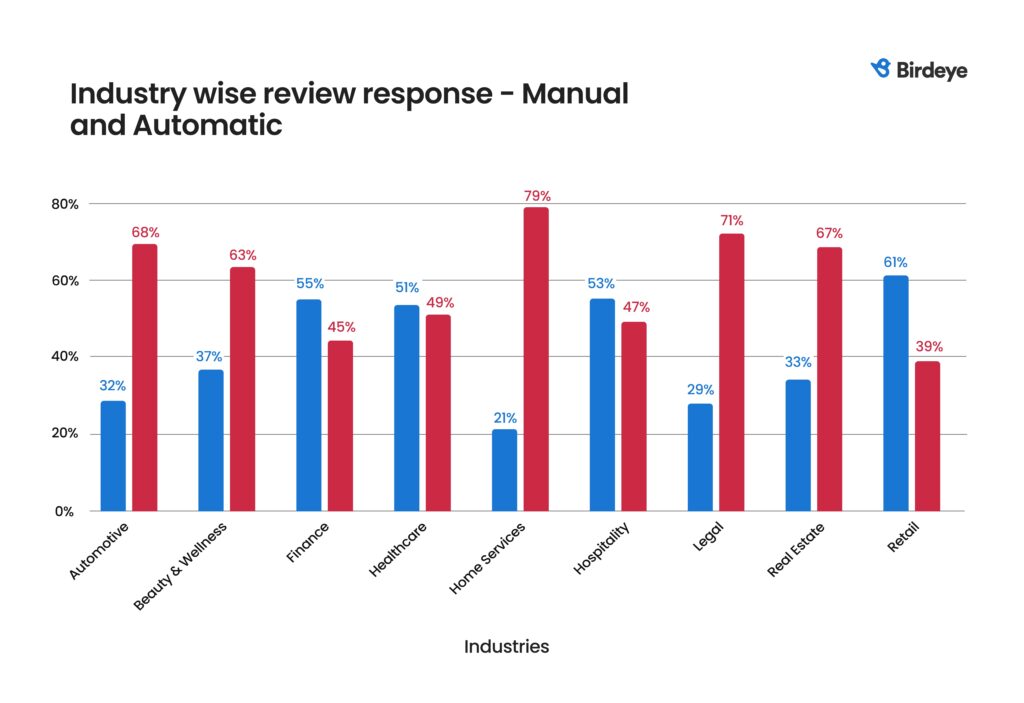

- Manual responses dropped to 58% in 2023, a 10% decrease from 2022.

- Automated responses rose to 42% in 2023, thanks to AI advancements.

However, industry-specific adoption rates for automated responses show varying preferences:

- High automation: Home Services (79%), Legal (71%), Automotive (68%), Property Management (67%).

- Manual preference: Retail (61%), Hospitality (53%), Healthcare (51%), Finance (55%).

This trend towards automation in collecting and responding to reviews indicates a shift in customer engagement strategies, emphasizing efficiency while balancing the need for personalization.

Birdeye can be a game-changer for enterprises aiming to refine their automation strategies. With its sophisticated AI-driven review platform, Birdeye equips businesses with the necessary resources to automate review processes, extract valuable insights, and foster stronger customer relationships.

2. Email is preferred over SMS for sending review requests, but…

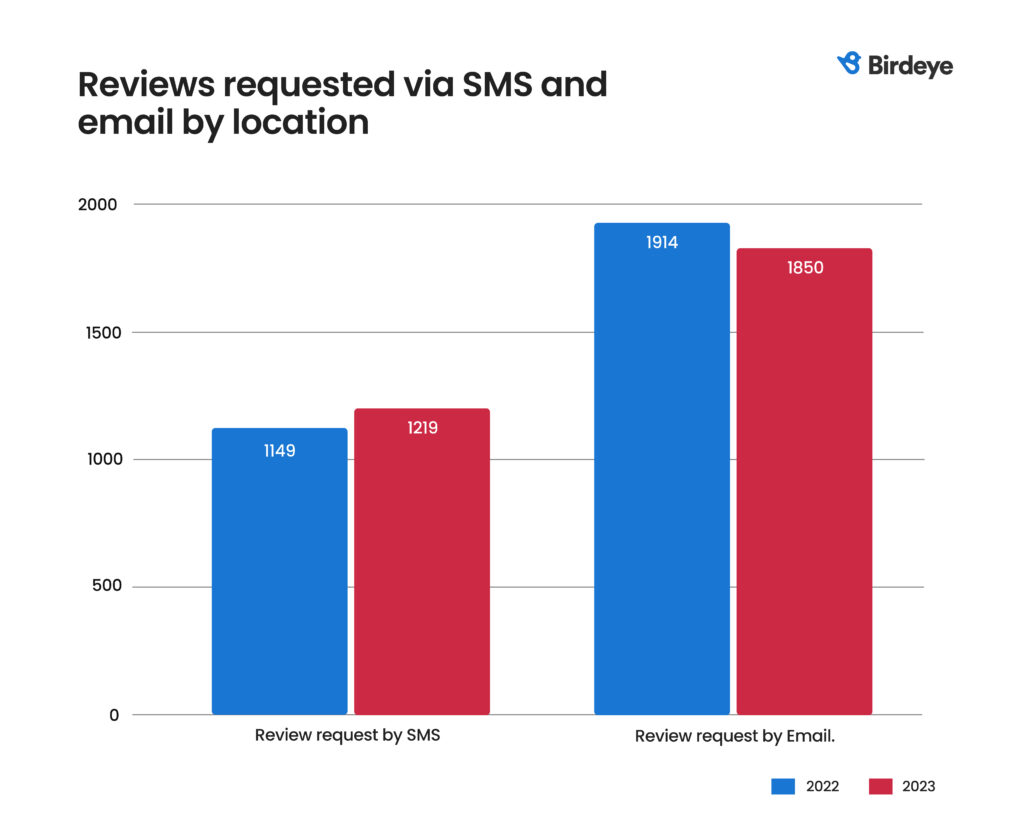

Despite email’s reigning popularity for review requests, emerging trends suggest a shift. With Gen Z’s growing presence in the workforce and an overall spike in mobile use, SMS is gaining ground. Here’s what our study revealed:

- Email dominance: 60% of review requests are still being emailed.

- SMS on the rise: There was a 6% increase in SMS usage for review requests in 2023, while email saw a 3% decline from the previous year.

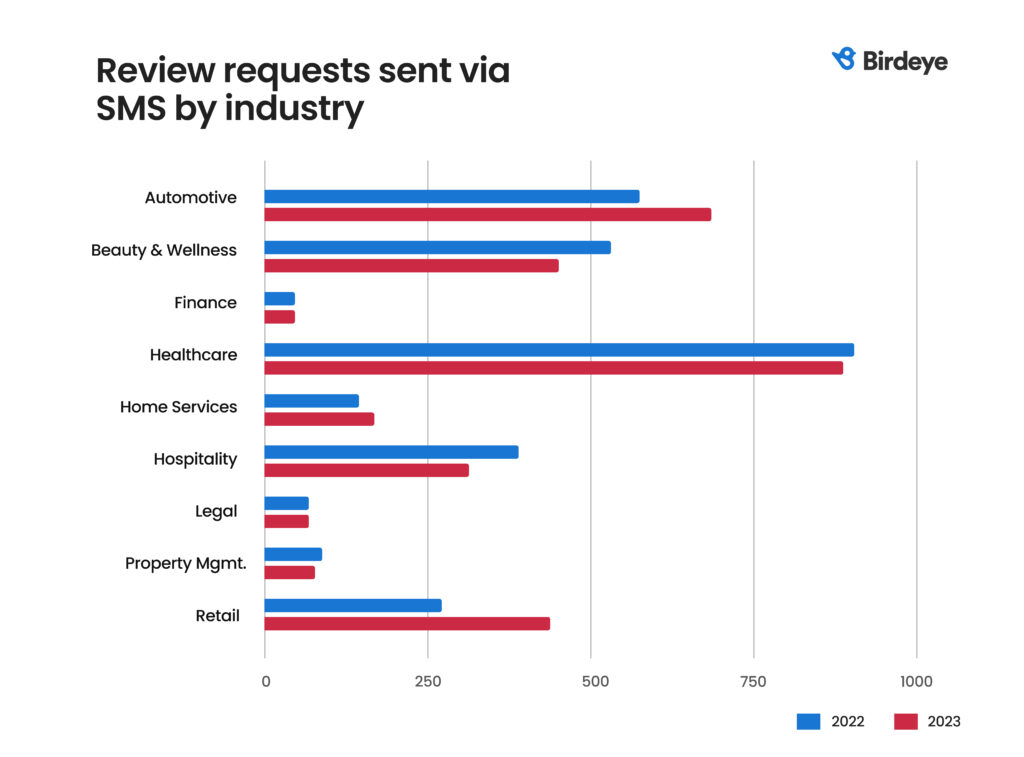

Here’s a closer look at industry-specific behaviors in 2023:

- Healthcare leads: Consistent with the previous year, the healthcare sector remains at the forefront of sending review requests.

- Retail and automotive surge: Both sectors have notably ramped up their SMS game, with retail experiencing a 58% jump and automotive a 14% rise in SMS usage for review requests, signaling a shift that might reshape how businesses engage with customers for feedback.

3. Quality over quantity

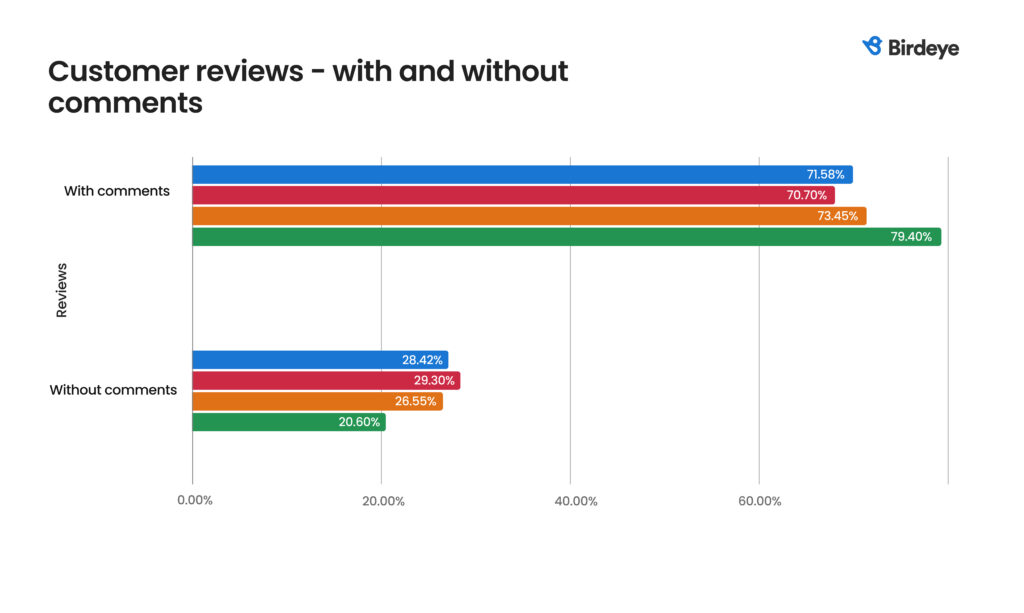

A key takeaway from the study is the shift towards prioritizing the quality of reviews. With an increase in reviews including comments and a steady average review length, businesses are encouraged to focus on garnering substantive feedback. Here’s a snapshot of the trends:

- Reviews with comments saw a yearly increase of 5.95% in 2023.

- Reviews without comments experienced a corresponding decline of 5.95%.

- From 2014 to 2018, there was a noticeable decrease in the length of reviews.

- After 2018, the average review length has found a steady range between 213 and 249 characters.

4. Impact of niche review platforms

While Google reviews have a commanding presence across different industries, consumers also turn to niche review websites to choose businesses across various sectors, especially in hospitality, finance, and property management. Let’s take a look at some industry-specific insights:

- Automotive: Google (88%) remains the top choice, but BBB, DealerRater, and other sites like Carwise and Cars.com are also crucial as 86% of car buyers research online before visiting a dealership.

- Healthcare: Google leads with 94%, yet niche review sites like Healthgrades and Zocdoc are key as they provide detailed information about healthcare providers.

- Home services: Google is the primary review platform, hosting 90% of the reviews. Although other sites like ConsumerAffairs, Angi, and HomeAdvisor account for only 10%, they help homeowners make their choices by offering specialized ratings and accreditations.

- Hospitality: Google tops the chat with an 81% share of reviews, while other niche sites like OpenTable and Booking.com make their presence felt with 5% and 3% of review shares, respectively.

- Legal: Google hosts 92% of legal reviews, with niche sites like Lawyers.com, Avvo, and Martindale providing more detailed professional information.

- Property management: Google reviews dominate with an 80% share, yet specialized platforms like apartments.com and apartmentratings.com, holding 20% of review shares, are essential for their detailed apartment listings.

- Retail: With Google (97%) and Facebook (2%) hosting most of the reviews, very few reviews appear on platforms other than these.

Regardless of industry, businesses are largely influenced by their Google reviews. Retail, consumer goods and services, and beauty and wellness sectors show an especially pronounced preference for Google’s platform for online customer feedback.

Survey methodology

This report draws on insights from over 150,000 Birdeye customers across various industries. The analysis was conducted at the industry level to ensure the confidentiality of proprietary information, offering a comprehensive look at trends across different sectors.

Originally published

![[Feature image] Are you on these 40+ powerful eCommerce review sites blog](https://birdeye.com/blog/wp-content/uploads/Feature-image-Are-you-on-these-40-powerful-eCommerce-review-sites_-375x195.jpg)