March 2019 | Report

2019 Energy & Utilities Industry Outlook

The challenge of keeping the lights on while completely revolutionizing how that happens is keeping even the nimblest executives on their toes

The professional consultants in our Energy & Utilities practice have identified six interdependent issues driving change in utilities in 2019 and beyond. Each of these issues is further explored throughout this paper.

- Addressing the infrastructure modernization imperative

- Meeting the challenge of complex distribution systems and the expanded integration of distributed energy resources (DERs)

- Securing rapidly evolving IT/OT systems, data, and operations

- Adapting to increased customer demands through improved processes and systems

- Managing the nexus of talent, productivity, and the digital future

- Embracing progressive technology to transform, scale, and grow

Introduction

For today’s electric utilities, the era of change has only just begun. The challenge of keeping the lights on while completely revolutionizing how that happens is keeping even the nimblest executives on their toes. Meanwhile, factors beyond their control— digital transformation, resilience mandates, an aging workforce, and the growing importance of distributed energy—are prompting a sweeping re-examination of their business model.

In our daily work alongside utilities, we have seen encouraging signs of progress. Many in the industry are rising to the digital challenge. Utilities are investing in enterprise data solutions to solve specific issues and to capitalize on opportunities. They are leveraging analytics to improve the customer experience and operational efficiency. Two-way data-communications capacities are proliferating, allowing utilities to gather and harness far more information. And they are getting smarter about who uses the data and why.

There is, of course, much more work to be done. Utility infrastructure modernization continues to be a major need, and a multi-year process. As technology advances and the regulatory and business constraints change, the requirement to protect their devices and operational technology systems evolves. We offer this 2019 outlook to help the industry prepare for what promises to be a dynamic year.

Chapter 1: Addressing the infrastructure modernization imperative

The challenge

Prompted by storms, fires, and outages, many regulators have put pressure on electric utilities to address reliability and resiliency concerns. Grid modernization efforts are shifting, replacing, and adding infrastructure to improve the grid so that it can be interactive and agile. In Q2 2018, over 40 U.S. states have commenced a grid-modernization initiative.

New technologies or “grid-edge resources” are being embraced, fueled by reduced battery storage costs that allow cheaper renewable energy to be stored for later use. This facilitates new demand- management opportunities.

Regulated local-distribution companies (LDCs) are being challenged to deliver greater customer value and choice and meet increasingly aggressive public-policy goals.

At the same time, LDCs’ core business is being threatened by several trends and initiatives—including customer self-generation, third-party energy providers, and community choice aggregation (CCA). Each of these reduces sales.

Taking action

The vision for the utility of the future (UoF), while still being defined, is beginning to coalesce around several necessary and key components. Although the vision varies across different regions and regulatory jurisdictions, the term now has some basic and agreed upon tenets. One thing is abundantly clear, digital technology enables many UoF, grid-modernization, and market-transformation initiatives. Specifically, investment in advanced distributed-system automation and smart- grid technologies alone make the grid more responsive and resilient. Grid-modernization investments lower operating costs by providing a cost take-out opportunity, and because these investments contribute to the asset base, they are entitled to cost recovery and a return on assets.

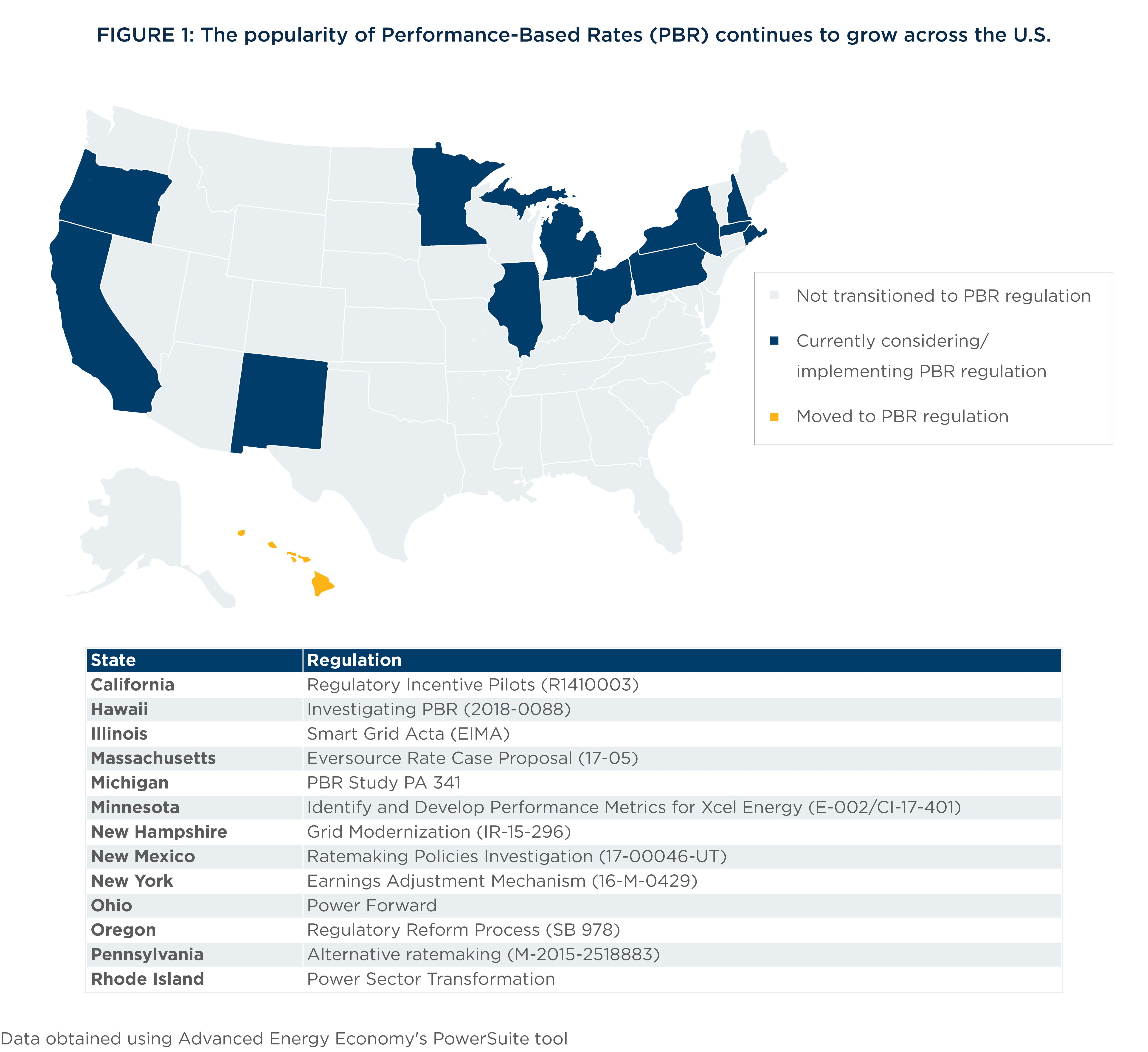

The traditional cost-of-service (COS) model is being challenged. The rise of performance-based rates (PBR) transforms the traditional model—where profit arises from returns on capital investments (like power plants) or on the volume of electricity sold—into one where profit is driven by meeting goals for an affordable, reliable, and clean power system. Utility Dive reports that 49% of utilities currently operate in a COS environment; 32% operate in a hybrid COS-PBR environment; just 4% operate in a predominantly PBR environment. Figure 1 describes the 13 U.S. states that are currently considering some variation of PBR regulation.

Different regulatory paradigms for cost recovery may include PBR, cost-of-service, subscription, and hybrids, depending on cost element. Utility professionals must plan for the hybrid of performance-based regulation and cost-of-service regulation as the preferred rate-making mechanism in next decade. Utility executives must begin to take a fresh look at their performance management approach to synchronize long-term regulatory and business strategies while integrating appropriate performance metrics and key performance indicators.

Additional reading

Chapter 2: Meeting the challenge of complex distribution systems and the expanded integration of DERs

The challenge

Utilities continue to grapple with the need to adapt the traditional utility-to-customer energy distribution systems to modern developments. These developments range from increased customer expectations, decentralized energy production, a growing electric vehicle fleet, the advent of energy storage, and opportunities posed by data analytics. Regardless of the changes, utilities need to ensure that generation and load remain in constant balance, without compromising power quality, reliability, and safety.

The imperative to modernize the grid, convert it into a robust multi-directional system, and enhance situational awareness to recover from outages is gaining momentum. A more adaptive grid is required to accommodate new trends such as electric vehicle (EV) use, which is currently proliferated at 5 million EV’s worldwide and growing by more than 50% annually. This is posing challenges and opportunities for utilities.

Additionally, states and regulators are increasingly pushing for the adoption of DERs such as demand response, solar photovoltaics, energy storage, and EV charging stations. These flexible energy resources, often at the grid edge, are gaining importance in meeting customer energy needs. In 2017, five classes of behind- the-meter DERs contributed 46.4 gigawatts of supply to the 769 gigawatt summer peak load; that contribution is projected to more than double to 104 gigawatts by 2023.

Taking action

Utilities that are facing these challenges should explore adopting Advanced Distribution Management Systems (ADMS). ADMS solutions integrate critical utility systems that were previously separate, including the Outage Management System (OMS), Distribution Management System (DMS), and the Supervisory Control and Data Acquisition (SCADA) system, supported by advanced application modules like DERMS (see Figure 2).

An ADMS elevates the OMS with better data acquisition and automation to deliver several key benefits including faster power restoration, more efficient dispatching of crews during outages, and improved customer communications. Further, an ADMS expands the DMS roles to improve power flow management, optimize voltage, and automate circuit reconfiguration. Overall, ADMS platforms enable utilities to improve key performance metrics (e.g., SAIDI, SAIFI, CAIDI). Investing in an ADMS should be considered by utilities that need to replace an OMS or that are facing significant upgrades. An ADMS can help utilities manage the complexity from DERs by improving forecasting, control, and visibility on the network, and by harnessing analytics.

An ADMS is not a one-size-fits-all solution. Utilities can purchase modules like OMS, SCADA, or DMS one- by-one. DER Management System (DERMS) modules can empower utilities to harness DERs to support grid objectives by opening a pathway to track and control DERs, aligning DER behavior to balance power flow, and reduce peaks rather than the reverse.

To guide selection and procurement of an ADMS, it is vital to assess current and future-state requirements and develop a high-level business case to prioritize investments. A modular ADMS deployment can get very costly and require a significant implementation effort.

But a disciplined, well-conceived roadmap can keep deployment manageable.

Additional reading

Chapter 3: Securing rapidly evolving IT/OT systems, data, and operations

The challenge

Utility executives cite the cybersecurity of their devices and operational technology systems as their top overall concern, according to our recent survey. The risks are constantly escalating as utility operations become more connected and hackers grow more sophisticated. This elevated anxiety is not surprising, given attacks like the one that breached Schneider Electric’s Triconex Safety Instrumented System and halted operations at a critical infrastructure facility, or the attack on the Ukrainian power grid that resulted in a 20% power loss in 2015.

Taking action

For most organizations, cybersecurity is not a technical issue; it demands a cultural change. Rather than attempting to find the tactical gaps highlighted through penetration testing, utilities need to address the root cause of these gaps. This can be accomplished by implementing strategic initiatives that drive a culture of security throughout the organization.

Leading cybersecurity programs, like the best digital transformation journeys, involve everyone in the organization working together to address the threats.

Rather than deploying a few engineers to shore up weaknesses that have developed over years, cybersecurity should be embedded in the organization. Top-quality defenses are grounded in business process improvements.

Cybersecurity isn’t only about protect and detect, but more importantly how to respond and recover swiftly and completely when an incident occurs. The key is a detailed and practiced incident response plan that will separate your operational network from the outside world and isolate and eradicate the problem, all while allowing critical system operations to continue to deliver core utility service to its customers. Cybersecurity is not just a technology issue, it’s about protecting the business.

Additional reading

Chapter 4: Adapting to increased customer demands through improved processes and systems

The challenge

As customer expectations shift and the utility industry grows increasingly complex, the systems underpinning operations have come under intense stress. Many utilities run outdated customer information systems (CIS) that lack robust customer- relationship-management functionality. Moreover, these traditional billing systems have evolved over time into unrecognizable platforms that far surpass their intended purpose.

Such legacy systems are typically incapable of supporting now-critical customer and regulatory options, such as new rate structures and channels of communication. The systems lack robust customer-relationship functionality and are not easily integrated with modern digital operating platforms. This renders success harder to achieve.

Yet replacing a utility CIS is risky, expensive, and time consuming. The CIS is critical to core operations as these systems underpin a vast number of business processes and are generally integrated with nearly all other core utility applications. So how can it be removed without throwing the utility into turmoil?

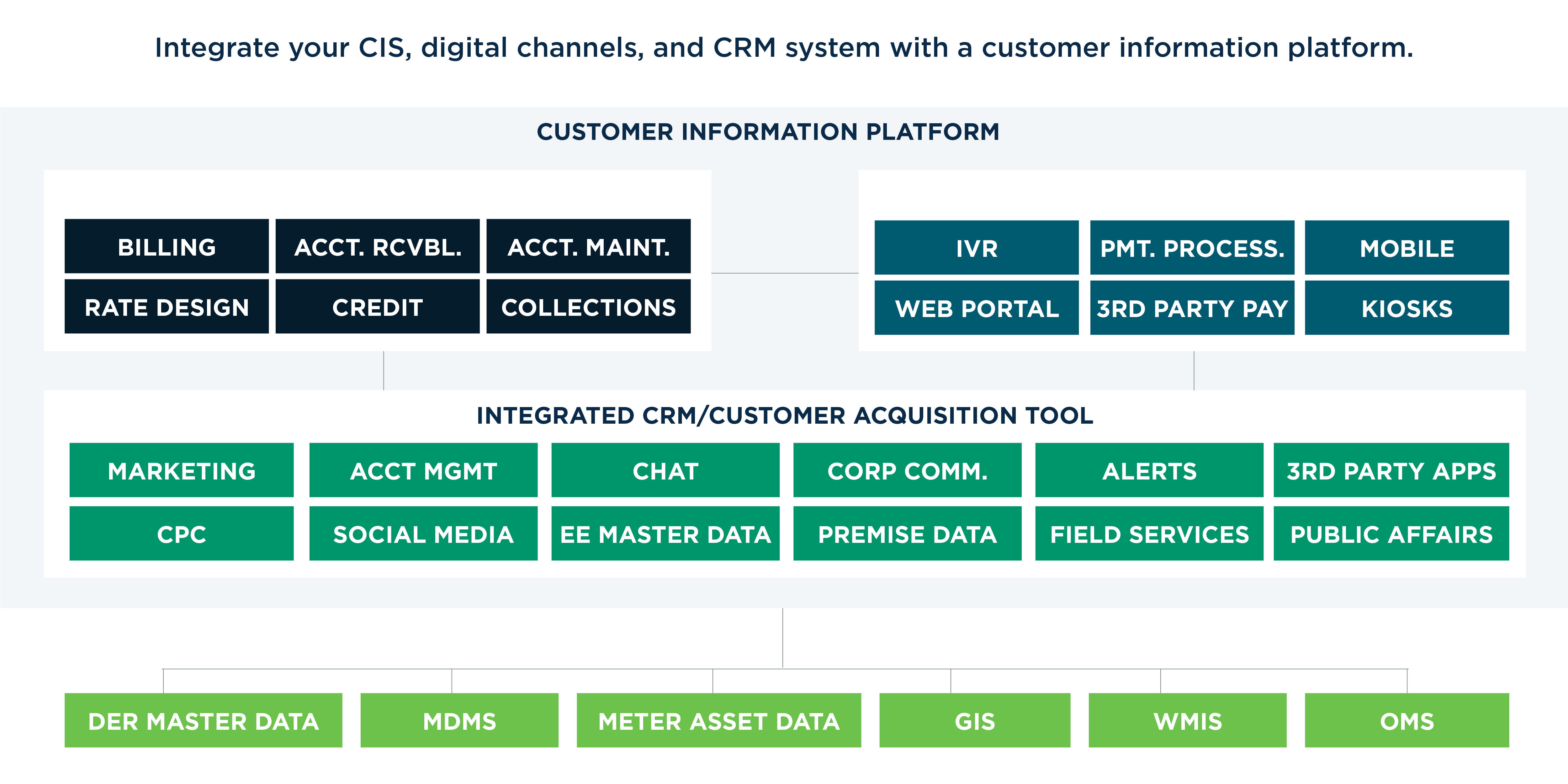

Taking action

Utilities can modernize customer engagement more quickly and with less risk by deploying a front-end customer-relationship-management (CRM) system that integrates with the CIS and other information systems. This is often referred to as a customer information platform (CIP), this solution offers a comprehensive view of customer activity, including marketing, communications, and field services—information that is essential for profitable growth, resource decisions, and an improved customer experience. These platforms are very flexible and can readily integrate with other utility applications that use customer data, such as work orders, outage information, DERs, efficiency and load-management programs, customer communication preferences, and the like.

Utilities can modernize customer engagement more quickly and with less risk by deploying a front-end CRM system that integrates with the CIS and other information systems.

”

A CIP can be extremely valuable in helping engage customers in a manner the market expects. It can also ease the transition from a legacy CIS by allowing the utility to implement the system and make major process changes progressively, breaking the transformation into smaller iterations. Many progressive utilities have already embarked on this journey, deploying CIPs to manage high value accounts, notably commercial and industrial customers.

The CIP approach also accelerates time to value, enabling rapid sharing of customer data across internal operations and data repositories, rather than forcing the utility to wait for completion of a years-long CIS replacement. In turn, the utility can focus on staff training for applications that are critical to its future. For all its benefits, the CIP architecture must be carefully constructed to ensure compatibility with CISs of the future, newer versions of which can increasingly manage sophisticated customer interactions.

Additional reading

Chapter 5: Managing the nexus of talent, productivity, and the digital future

The challenge

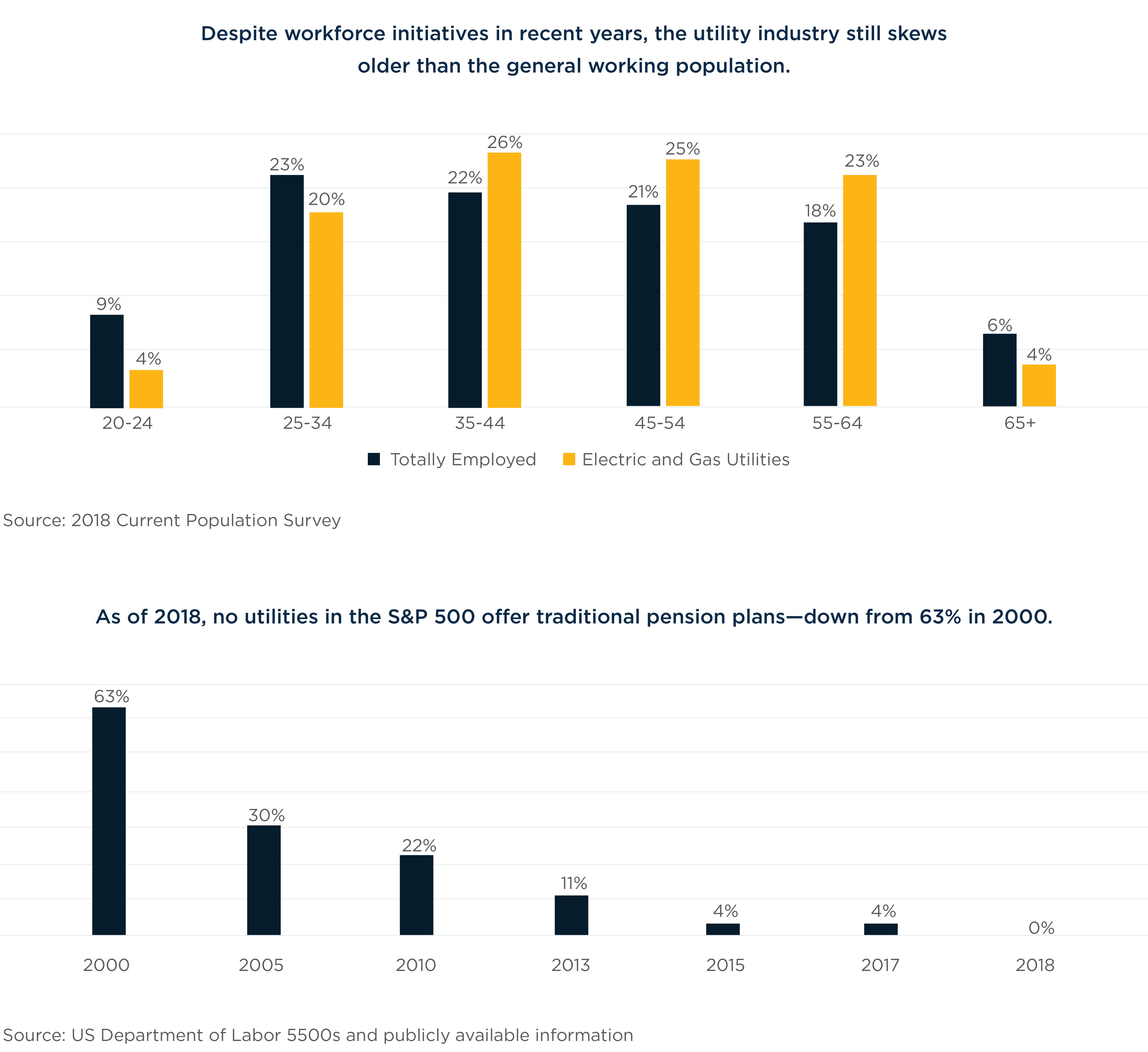

Despite workforce initiatives in recent years, the utility industry still skews older than the general working population with those aged 35-64 overrepresented in electric and gas utilities compared to the economy generally (see Figure 4). Utilities are facing the need—or the opportunity—to replenish the workforce, and in some cases to phase out or rethink functions that are costly, inefficient, or can be automated. In the past, the solution to many utility challenges was to deploy additional resources and capital to address these challenges, rather than changing how workers operate.

At the same time, utility workers are retiring at a historic rate and it is becoming more difficult to replace them. Utilities used to attract workers based on generous retirement packages but many of those benefits have been trimmed or eliminated (see Figure 5). Over the past 10 years, unemployment has decreased dramatically with the implication that utilities have had to compete harder to secure and retain top talent. Many utilities need to do far more to prepare themselves to operate with the same or fewer resources.

Taking action

In order to compete and deliver shareholder value, efficiency is critical. That includes looking at IT, back office, field services, and other engineering areas to collaborate cross functionally to identify ways to reduce waste and improve customer service, in much the same way as many other companies have been doing Lean and Six Sigma initiatives for several years. It includes reducing waste in processes, improving cost structures, and finding ways to extend asset life.

It means minimizing variability across service delivery, and adopting a far more disciplined, quality-conscious approach, ultimately to boost customer satisfaction and profits. And it means doing all this while the top line is plateauing or even slumping.

Utilities should seize the need to replenish their workforce and view it as an opportunity to change how they operate. Recruiting engineers who can implement modern technology solutions and workers who are more comfortable with technology can help expedite the digital transformation needed to compete. Moreover, communication skills and the ability to learn are increasingly crucial. As utilities modernize, they need employees with broad understanding of their organizations’ many silos.

The right talent—a faster, better, and more cost-effective team—is a vital precondition for productivity. Talent is also essential to capitalizing on the emerging digital business model. This is perhaps most relevant to a future where the utility’s business increasingly resembles a trading platform managed by blockchain, rather than a producer and distributor of electrons.

Additional reading

Chapter 6: Embracing progressive transactive technology to transform, scale, and grow

The challenge

As utilities adapt to the distributed energy future, they are increasingly doing business with a growing diversity of counterparts and engaging in a variety of transactions taking place at the grid edge.

The counterparts include customers, the wholesale market, regulators, DER aggregators, and small-scale energy providers. The transactions include demand response market signals, procurement of equipment and materials, and incentives for customers to adapt their EV charging schedule.

Existing IT infrastructure that relayed signals and meter reads back to a central system may not work as well in an increasingly dynamic distributed-grid architecture, where conditions will vary by time of day and location. Utilities need a distributed computing architecture to track and settle modern transactions, ranging from electricity sales to remote EV charging and renewable energy credits.

For new transactional scenarios—such as tracking renewable credits or managing complex supply chains— utilities are considering more trustworthy and immutable data structures.

Taking Action

To find ways to deliver additional value, reduce costs, and explore new energy-service channels, utilities are exploring the possibilities presented by blockchain. While the news in 2018 provided ample hype and disappointment in the cryptocurrency markets, it’s important to understand that utilities may deploy a technology like blockchain in a model that protects customer data and is secure for use in public markets. The potential benefits of a private blockchain include decentralization and immutability of transactions, which are key to delivering efficiency and security. Because blockchain offers a new way for transactions to be tracked and executed, it enables new ways to align customers behavior to the grid and supports new interactions.

Blockchain has been shown to deliver cost savings in supply chain optimization, such as in materials traceability. Because utilities manage a vast inventory of capital equipment and supplies from numerous suppliers, blockchain can streamline the process and help improve decision making by creating and maintaining a holistic view into a complex supply chain ecosystem.

Blockchain-enabled smart contracts can also verify and facilitate transactions occurring at the grid edge. With smart contracts, agreement terms are established in advance and encoded in the blockchain, which then settles a qualifying transaction when the terms have been met. For example, a smart contract would settle a transaction automatically when it detects that an energy- storage system is discharged for demand response, or when carbon credits have been delivered. Decentralized peer-to-peer energy transactions are one of many possible applications of smart contracts, which also may find use in wholesale energy trading and supply chain/ chain-of-custody applications. Utilities that embrace the spirit of experimentation and test this new technology in demonstration programs will position themselves to compete in the future.

Because blockchain offers a new way for transactions to be tracked and executed, it enables new ways to align customers behavior to the grid, supports new interactions.

”

Conclusion

The challenges faced by today’s utilities would have been unimaginable a generation ago. Executives and engineers contend with a level of complexity and a pace of change that demand agility and forethought. They are grappling with a nexus of environmentalism, active regulation, and distributed energy production. They face sobering questions, such as where to place the right bets to invest in technology that shifts the traditional distribution utility paradigm (such as DER integration and transactive energy platforms) while continuing to modernize and maintain an aging distribution infrastructure.

As more advanced and emerging technology comes online, the grid must evolve to handle changing load conditions with increased level of sophistication. With all this change, a key question will be: who should bear the cost of maintaining central infrastructure as customers switch to distributed generation? Most still rely on a traditional utility to supply a portion of their daily energy demand, and nearly all require their utility to serve as a provider of last resort. As such, very little critical infrastructure can be retired.

Amid these challenges, successful utilities now think of themselves as trailblazers. They are embracing digital transformation and reshaping their businesses in the mold of tech companies—using data as a key business asset and serving as intermediaries for many-to-many transactions. This means taking a new, more strategic approach to cybersecurity. It means rethinking talent and capitalizing on data as a business asset. It means crafting a better customer experience while modernizing infrastructure so that it is more resilient. It means embracing DERs and transactive solutions for managing it. With regulators, it means proactively opening a constructive, data-driven dialogue on reliable reasonably priced clean energy, rather than waiting for regulation to unilaterally change the rules of the game.

Above all, utilities must welcome the fact that the future of the industry is digital. They must become champions of innovation. As usual with rapid change, those who proactively seize the challenges will have the best chance to reap the benefits.