Five Notable Fintech Attributes And Companies

[This post was coauthored by Christy Lano.]

Forrester’s latest report on the state of fintech shows that funding for fintech companies not only rebounded (from a decidedly down year in 2021) but has skyrocketed to new, historic heights. To dive deeper into this research, we’re looking at specific fintech companies and — more importantly — what their products, value propositions, business models, digital services, or brand positioning can tell us about trends in fintech and financial services.

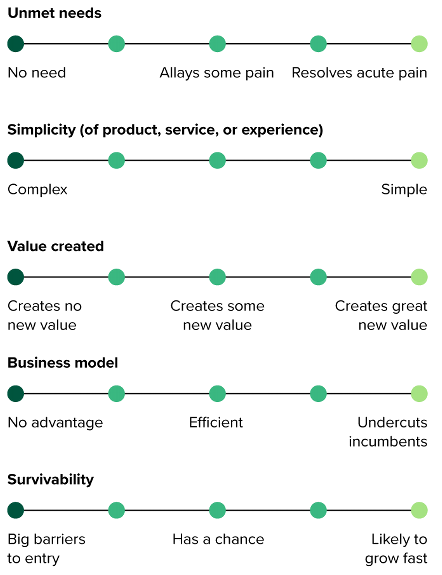

Five fintechs illustrate the attributes that make some so successful — and so disruptive (see the figure later in this post). Here are the fintech companies that show some of the key trends at play:

- Unmet need: SilverBills. Necessity spurs innovation, and a range of emerging fintech companies focus on shared finance. SilverBills is one of only a few fintechs that helps adults manage their elderly parents’ finances by addressing stressors such as bills, check-writing, and deadlines with notifications and other services — all to benefit both the elderly payer and their caregiver(s).

- Simplicity: Tide. Many fintechs find success by honing in on a specific area of financial services and simplifying the product, service, or experience for customers. Tide, for example, was one of the first neobanks to focus on small businesses: It gives businesses the ability to open and set up a bank account in minutes. Once onboarded, the customer can view categorized income and spending, track invoices, upload receipts, and easily sync with accounting software.

- Value creation: Ando. Emerging fintechs can differentiate by zeroing in on niche markets that are underserved and creating value for a specific audience. Ando’s value proposition is all about sustainable banking, attracting customers who prioritize environmental concerns. Ando focuses on investments in sustainable transportation, regenerative agriculture, and clean energy.

- Business model: Swan. By finding more effective and efficient ways to operate, fintechs avoid legacy costs that incumbent firms have. Some fintechs are generating new revenue streams by helping incumbents embed their financial products on other platforms — or helping them build new products. Swan enables companies to embed financial products — including options such as “buy now, pay later” or international bank account numbers — in their own products or platforms. The idea is to help firms eliminate the friction customers face in bouncing between apps to pay for something — and explore new revenue streams and ecosystem opportunities.

- Survivability: Nubank. Fintechs face barriers to entry in amassing the (often massive) customer base of most incumbents. Nubank, a digital-only bank in Brazil, now serves 40 million customers. It built this customer base online, avoiding the costs of a branch network. Customers at Nubank can open an account in 20 minutes, get same-day credit card approval, and receive the card in eight days. It takes incumbent banks in their market much longer to provide these services.

If you are a Forrester client, we encourage you to read The State Of Fintech, 2022 to learn about other successful fintechs (and what’s driving their growth). This report also lays out how incumbents can plan and act on the opportunities in the fintech space, along with our predictions for the future of fintech.

Five Attributes Of Successful Fintech Companies