Fraud in financial transactions is a major problem for organizations all over the world, especially banks. This article is focused on the challenges and most recent techniques to reduce payment fraud.

We live in the age of a fascinating technological revolution. Never before imagined concepts become a reality at an impressive pace! Unfortunately, criminals are evolving too, and they take advantage of the same technological advancements, plus become more creative along the way. In this article, I would like to talk about the solutions for Fraud Detection with AI and ML – Artificial Intelligence and Machine Learning.

While fraud, as a form of crime, robbing people of their assets existed for centuries, in 2020 it could be a real disaster for financial institutions, like banks or businesses in the E-Commerce industry. Security is a super-important issue right now!

Just think about it – organizations around the world already lose up to 5% of their revenue due to fraudulent transactions. Considering the scale at which some of them operate, this a colossal sum of money. According to PwC at least half of companies had been a target of fraudulent attacks in some form. If this Nilson Report is to be believed, in 2020 global fraud damages will exceed the USD billion mark!

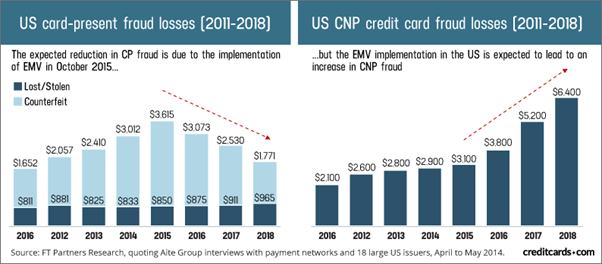

There are different kinds of financial frauds, false insurance claims, for example. But if we want to point the most important one, we must look no further than credit card fraud. Just look at the rise of this type of fraud in recent years:

Let’s figure out how it can happen and what are the best practices for its detection and prevention.

How does credit card fraud happen?

It is pretty simple, and it could be divided into two categories – the owner’s negligence or security breach. The first case is all of those things, which banks tell you not to do. Don’t reveal your credit card number, CVV, or password to other people – it’s called personal information for a reason! Losing your credit card may lead to it being stolen and duplicated, which is ultimately your fault too.

The other way, of course, it’s when your accounts or emails being hacked, criminals make counterfeit credit cards or even financial institutions employees steal your information. Luckily, there are ways to detect all those scenarios and there is even a credit card fraud prevention solution for businesses in various industries, but let’s take one step at a time. Now we know how does credit card fraud happens, we will find out how to deal with it.

What is credit card fraud detection?

It is basically a set of activities aimed to save the money and assets being stolen by criminals. There are a lot of traditional methods, which worked perfectly fine for some time. However now, it is a kind of area where constant improvement is crucial for survival. That’s why it is important to talk about what Machine Learning, a subdivision of Artificial Intelligence, can do here.

You need a team of Data Science experts and main information on credit card transactions in your organization, such as Amount, Date, User Location, Usual Behavioral Patterns of your clients, etc. Experts, obtaining that, will be able to develop a model that will be able to prevent and reveal any fraudulent activity among your transactions. This model will be fine-tuned in the process, and there are few ways to make it work, we will talk about it later. Now, let’s move on to the most common scenarios, which ML-powered Fraud Detection could handle easily.

The most common techniques of credit card frauds

Clone transactions

This one is fairly simple to understand. Imagine when each member of your family receives the same bill for the service that was used only by you. If you pay for it – it is a legitimate transaction. If your brother receives the same invoice for the same service – it can be considered as a clone transaction. Unfortunately, this happens a lot in business reality. Those clone transactions could be just a human mistake, without any criminal intentions. Traditional methods are good at spotting clone transactions but weak at distinguishing mistakes from criminal intentions. Machine Learning algorithms are fairly better in making a decision on that.

Identity theft

Your personal information like the date of your birth, social security number, or even a secret question with the middle name of your grandmother could be stolen. This is called identity theft and could provide criminals with access to your money. Fraud detection systems, both traditional and ML-powered, should focus on analyzing customer behavior and deviation from usual patterns to prevent this. Imagine spending $100 once in a few days on groceries in a particular store. If somehow your credit card will be charged with a $2000 payment in the different shop in the city, an unusual place for you, additional verification would be required – that’s how prevention works here.

False application fraud

This usually comes along with identity theft and credit card theft. False application fraud is when criminals try to obtain a new credit account or even a brand-new credit card for another person using your identity and bank account. Just like in the previous case it could be dealt with using anomaly detection, determining unusual patterns for your behavior, and alerting banks for sending more verifications or blocking your account for a while.

Credit card forgery

Also known as credit card skimming, meaning the creation of an illegal copy of your card. Criminals use machines called “skimmers” for this and after obtaining data from the original card they can use it or resell it. Classification techniques can be used here for determining the legitimacy of a card, both physical and electronic, based on geolocation and behavioral patterns.

Account takeover

One email message can be used to steal your personal password and account number, and in a matter of minutes take over your bank account. On your part, of course, you can refuse to click suspicious links or send anyone your personal information if it is not required and secure. However, everything can happen, fraudulent emails could look exactly like originals. So to fight this crime, Artificial Intelligence can offer neural networks and pattern recognition techniques to detect fraudulent activity and prevent any damages.

What are the benefits of credit card fraud detection with Machine Learning?

“The only limit to AI is human imagination.”

― Chris Duffey

Comparing to traditional methods, Artificial Intelligence and Machine Learning are offering the possibility to detect credit card fraud automatically, streaming of updates in real-time, faster verification techniques, determining hidden correlations in data and events. In most cases, conventional credit card fraud detection techniques could only detect obvious fraudulent activities and much weaker in prevention. If it is possible at the moment, your business should consider using the best and the most advanced Machine Learning techniques to provide the highest level of security in 2020.

All ML algorithms for credit card fraud detection could be divided into Supervised and Unsupervised. Each category has a particular implementation in certain use cases. Here are the most common methods split by categories:

| Supervised | Unsupervised |

| K-Nearest Neighbors | PCA (Principal Component Analysis) |

| XGBoost (Extreme Gradient Boosting) | LOF (Local Outlier Factor) |

| Light GBM (Gradient Boosting Machine) | One-class SVM (Support Vector Machine) |

| Random Forest | Isolation Forest (IF) |

The most important things to look for while choosing the fraud prevention and detection solution

Taking a step towards introducing a fraud detection solution to your organization, here are the six main features you should look for in a solution.

Predictive Analytics

Yes, predictive analytics can’t tell you with a 100% certainty what will actually happen, but with a big amount of data and trained models, it can get close enough.

Experience

The most powerful technology is meaningless without proper analysts managing a credit card fraud detection solution. While Machine Learning algorithms can do most of the job, they still need to be trained and adjusted for better results.

Outlier models

Fraud detection solution should not be limited to just historical data, but also have the capability to adjust for non-linear data. This is where outlier models come into play, which is even more important for emerging markets with no existing predictions.

Custom rule management

This feature simply accommodates the unique policies of your organization without making it uncomfortable or inconvenient for the clients.

Global profiling

It is aimed to keep up with the latest fraud trends around the globe and adjusting your fraud detection solutions to the new schemes with new approaches and tools.

Mobile cards control

Sharing access to security measures with your clients is a good idea and an essential feature in a fraud detection solution. If your client is able to set a certain restriction on areas of spending, geolocation, or the amount of spending, it will provide an even higher level of security.

Conclusion

If you want to learn more about Credit Card Fraud Detection Solutions, how they fit your business, and get a consultation – feel free to contact SPD Group. This company has proven expertise in Artificial Intelligence and Machine Learning development for businesses of any size and will definitely help your organization.