Does trust matter more in any other industry? When it comes to the financial industry, there’s an acronym that highlights how seriously the digital world takes these institutions: YMYL (Your Money, Your Life). This phrase refers to financial and medical organizations, and they matter for every single person. With trust being paramount to consumers, you can imagine the importance of financial services reviews when it comes to the buyer’s journey.

Sure, there’s a significant impact via national brand awareness, but on the local level, a branch’s reputation matters.

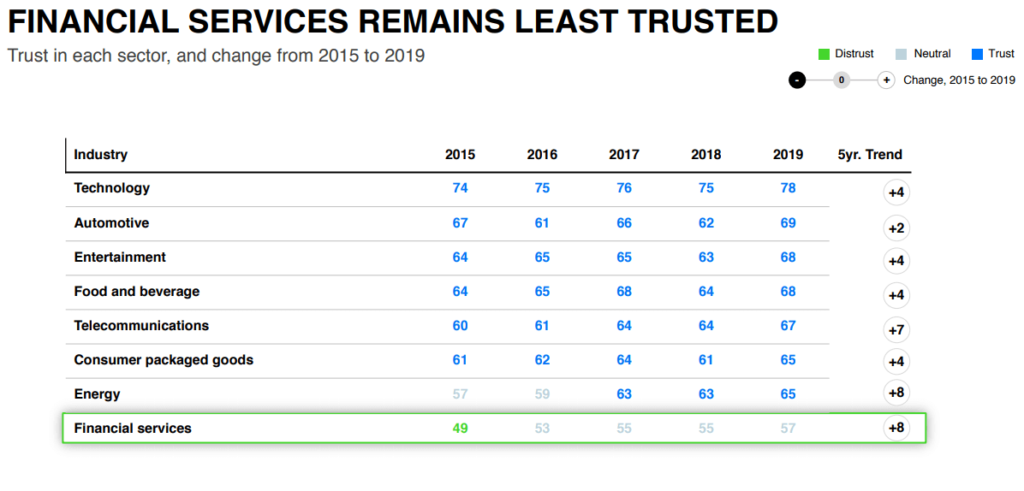

Historically, people have experienced a steady stream of scandals, breaches and failures. When it comes to money, consumers aren’t happy with their overall experience. In fact, when choosing a financial services company, Edelman found:

What does this mean for financial service organizations? More importantly, can online reviews provide these organizations with the boost they need to outperform their competitors?

Why reviews are important to the financial services industry

To understand what truly matters to consumers when it comes to their money, we can look to the data. Edelman found:

- The financial sector is untrusted in 15 of 26 markets

- 83% of consumers said a good user experience is important

- 79% of consumers pointed to having the latest technology

- A significant 15 pt trust gain was made with the informed public

- There's significant trust inequality in financial services

- Women are less trusting of innovations made in the financial sector

- 72% of consumers expect financial service organizations to make doing business with them easier

- 60% of consumers expect financial service organizations to lead on social issues that make the world a better place

- 81% of consumers state they must be able to trust the brand to do the right thing with their product and customer experience, and the brand's impact on society

This data impacts all of the financial services industry, including banking, lending, credit cards, insurance, asset management, mobile wallets, peer-to-peer transactions, cryptocurrency and robo-advisory.

This is why reviews matter.

Reviews are an effective and reliable way to combat consumer distrust. It’s also important because it provides consumers with the data they’re looking for, across a variety of dimensions.

Are reviews common?

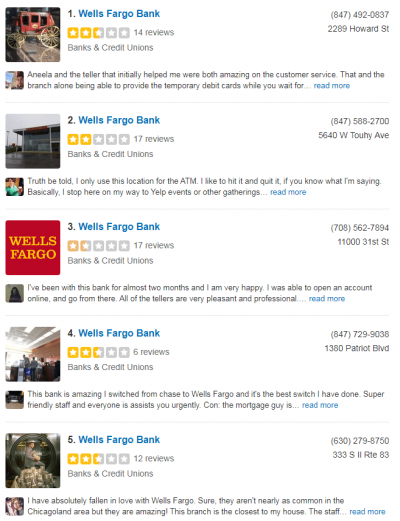

Do financial service organizations have balanced review portfolios? The unsatisfying answer here is, it depends. Some firms and professionals see the value of a strong online review portfolio while others do not. Some firms, like Wells Fargo, are still dealing with the fallout from a major scandal.

It’s hit or miss.

These financial organizations are all struggling with trust issues. A strong review portfolio is an easy way to win a steady supply of leads, clients and sales.

What about searches?

Where do prospective clients search for financial services online? Prospective clients use a variety of mainstream, niche and specialty services. They use:

Here’s the problem with financial reviews. Clients look for two types of reviews.

1. Reviews of the organization

2. Reviews of the professionals

While it’s important for the organization to optimize their review portfolio, it’s also just as important for individual professionals to build their review profiles and reputation.

What about search?

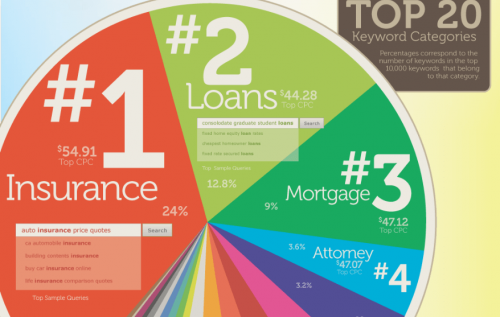

The search landscape is expensive and incredibly competitive. It’s not uncommon for financial related search queries to cost $40 to $60 per click! If your firm has deep pockets and you’re willing to fight it out in the search results, it may be worthwhile. If you’re an independent professional, not so much.

Reviews are an easier way to attract a large volume of prospective client attention.

Here’s the catch.

Great reviews are helpful. They give you the chance to attract and convert client attention. If you’re able to attract a steady stream of reviews to build a strong review portfolio, you can outperform your competitors (more on this later).

Reviews come with a significant downside.

Negative reviews are incredibly damaging to professionals and firms. Remember the trust issues I mentioned earlier? Those trust issues don’t really go away. If you have an amazing review portfolio, this means clients believe you to be the exception to the rule, the diamond in the rough.

Their overall perception of financial services remains unchanged.

Earn too many negative reviews and the horrible perceptions that permeate the industry come right back to your doorstep. How much is too many? Anything less than a five to one ratio, five positive reviews for every negative review, is a serious problem.

What does this mean?

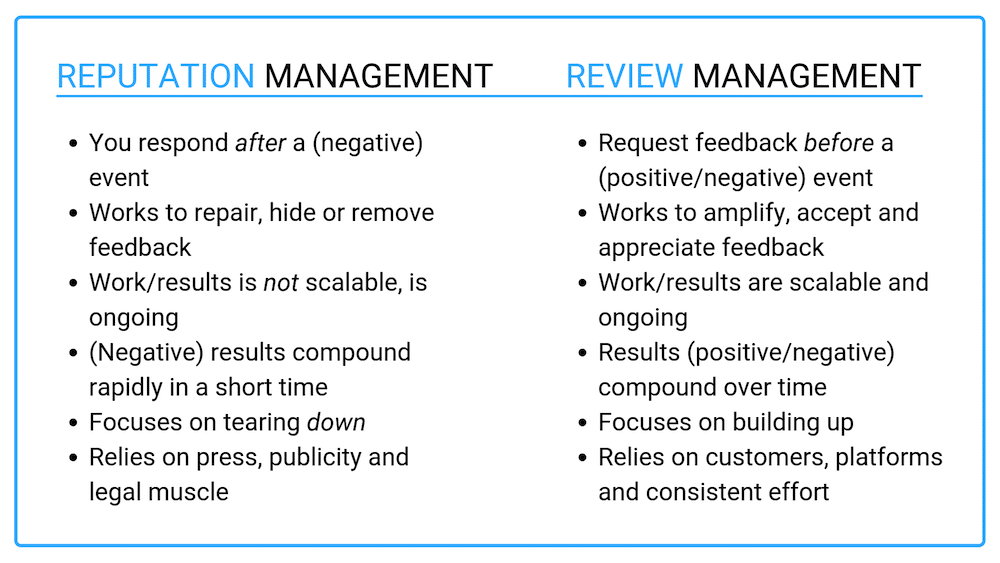

It means that an ongoing review management campaign, combined with occasional reputation management, is absolutely essential for continued success. You need both because they serve different purposes. Review management is proactive; reputation management is reactive.

Why do you need both?

Fake reviews. The Guardian shared a post showing that competitors, including financial services, are not above posting fake reviews. Competitors use these fake reviews to build themselves up and tear your organization down. A strong review management portfolio filled with legitimate reviews makes it harder for competitors to attack your business. A reputation and crisis management plan ensures that you have the tools and resources in place to deal with slander, libel or negative press.

But it all starts with good campaign management.

Do you have what it takes to maintain your review management campaign? Check out our Ultimate Review Management Checklist Guide.

Why financial service reviews are a competitive advantage

Clients don’t have your expertise.

Most of them aren’t able to properly evaluate your performance. Sure, they’re able to make a clear distinction after a period of time, but by then it’s too late. Trust is the primary concern before, during and after the relationship.

Why do reviews provide such a strong competitive advantage?

It’s primarily due to a conflict of interest. The financial services industry runs on conflicts of interest. Let’s think about this for a second.

- Why you need to optimize your TripAdvisor listings

- How to approach listing optimization

- What you'll need to optimize in your TripAdvisor listing

- How to optimize your TripAdvisor listings

This is why reviews are such a strong competitive advantage.

Reviews show clients whether you’re willing to go against your own self-interest. They show prospective clients that you’re willing to act in their best interest first before you’ve collected a dime from them. It’s an exceedingly rare quality that most clients are drawn to.

How financial service providers should request reviews

A face-to-face request is 34 times more effective than any other request method. This doesn’t mean other methods like phone, email or text are ineffective. It simply means it’s the most effective method.

That shouldn’t be a surprise.

Here are a few review request templates you can use to layer your requests, boosting response rates even further.

Face-to-face review request template

[Client name], last year we were able to achieve [result] for you.

I’m pretty happy about the results we’ve been able to achieve together, and I’m really thankful you stuck by me/us. Would you be willing to share your story?

Sure it helps us, but it also helps other clients who are just like you.

Appreciate you either way!

[Signature]

Review request email template

Subject: You’re not a great client…

You’re one of our very best clients, [client name].

This year we’ve achieved [result], and I’m really proud of that. I wanted to thank you for sticking with us and ask if you’d be willing to share your story with others.

Yes, it absolutely helps us, but it also helps other clients.

That’s essential, especially when you’re dealing with a few bad apples in our industry.

Would you be willing to help? [Review Funnel Link]

[Signature]

Review request text template

Hi [client name], [Your Name] here with [company]. This year we’ve helped you achieve [result]. I thought I’d reach out and ask a simple question. Are you happy? Would you let us know? [Review Funnel Link]

You’ll want to make sure you don’t run afoul of the Graham Leach Bliley Act, (GLBA). Reach out to your compliance officer, resident expert or government site to identify the restrictions that apply to your specific industry or locale.

Designate the right employee to manage your review management campaigns. It’s important that no one gains access to personal, nonpublic information without the proper authority and credentials.

If you plan on using sensitive data, be sure to select an employee (or the professional) who knows how to maintain compliance. Under no circumstances should sensitive client data be shared inappropriately. This is yet another reason to make a face-to-face request. If clients share inappropriate data in their review, the onus is on you to catch and sanitize offending portions from their review.

Using reviews in your financial services marketing

Avoid sharing reviews with nonpublic data.

You can share aggregate data (e.g., 800+ 5-star reviews on Yelp) or common sentiments (e.g., 9 out of 10 clients say they’ve made more with us than their previous wealth advisors). It’s also a good idea to use reviews, provided that you tread carefully.

Use remarketing and retargeting to promote your reviews or as part of a larger campaign to increase brand perception and trust.

1. Use display and PPC ads + review samples as part of a larger branding campaign to draw in prospective clients.

2. Share your best reviews at the end of your lead magnets, digital downloads and helpful resources.

3. Use remarketing and retargeting to keep prospects warm.

4. Use social proof + a review acquisition campaign via your autoresponder campaigns and remarketing to capture more reviews from satisfied clients.

You can use your review portfolio, via third party sites, to warm up cold leads (i.e., prospects who’ve downloaded a lead magnet or subscribed to your email list). Next, use reviews with objections to convert warm prospects who’ve visited specific pages on your site to hot prospects. Finally, you can direct these hot prospects to a conversion page (e.g., get a quote, contact sales, etc.).

Financial service providers need reviews to restore trust

When it comes to trust, financial services are ranked dead last. Consumers have the least amount of trust in the financial sector. This isn’t due to mistakes you’ve made, but it’s still an issue that affects your business.

Online reviews change that.

Your review portfolio is an effective and reliable way to combat client distrust. It’s also important because it provides prospective clients with the data they’re looking for. As we’ve seen, a strong review portfolio is a competitive advantage.

Your clients are searching for two types of reviews: Reviews of your organization and reviews of your professional track record. A strong review portfolio gives them both. Build your portfolio now, and you’ll have the tools you need to boost your financial rewards.