Loyalty programs: should you issue your own points or miles?

Many people assume that operating a loyalty program necessarily implies issuing your own loyalty points or miles.

This actually is not true.

The optimal points to offer mostly depends on the frequency of engagement your brand has with target customers. Offering your own points could be less desirable than other options at your disposal.

Points and miles are a dominant and popular form of loyalty value. They’re a low-cost incentive compared to other forms of incentives such as discounts, cashback, affiliate marketing offers, or paying for search traffic from Google. Plus, many types of points are widely appreciated by customers, and are useful to the brand for scoring different customer actions while influencing behavior.

For some brands, issuing your own loyalty currency is certainly desirable. It allows you to set the points value, to see and control access to all the data, and to sell points to other brands for incremental revenue.

But issuing your own points or miles is not the only way to bring the benefits of points-based loyalty to your business. Many brands could actually earn greater loyalty by issuing a partner brand’s loyalty currency – or, simply allowing customers to ‘burn’ (i.e., spend) their favorite points as the method of payment with your business.

In this article, we’ll discuss how brands can optimize their use of points as a loyalty tactic, covering:

- the concept of liquidity: making points easy to earn and spend while ensuring you can still influence customer behaviors – and also making loyalty currencies easier for brands to collaborate to drive engagement

- the pros and cons of issuing your own loyalty currency, weighed against giving customers greater choice and freedom in how they benefit – which increasingly is recognized as a foundational component of an effective loyalty strategy

- how to issue loyalty points – including how to launch your own loyalty currency, if that’s the right approach for your business.

The major problem holding back loyalty programs is that most customers simply cannot spend enough money with a particular brand to ever earn enough points to get to interesting rewards. If customer frequency or total annual spend are relatively low for a particular business, it will be very challenging to get customers to join the program – because most people will anticipate they will never benefit.

The golden benchmark is about $25 USD per year in loyalty value. It has been our experience that customers estimate how much value they can earn from a loyalty program before deciding to join. If they think they can earn at least $25 per year, they are likely to join.

So, a brand issuing 1% in points would only really be able to engage customers spending $2,500 a year (or $1,250 if you issue 2%). But most types of retailer, other than grocery or fuel, can only expect 10-20% of total customers to commit to this level of spending.

Is your business above this threshold, or below? For most, it will be well below, which is why you should consider collaborating with partners so customers can earn your points more frequently. Alternatively, you can simply offer the loyalty points of a partner program, that your customers are already motivated to collect.

Points liquidity: the importance of making loyalty currencies easy to earn and spend

The easiest way to understand the concept of liquidity is to think about fiat currency (i.e., dollars, pesos, yen, etc.).

Fiat currency is highly liquid within countries that use that currency, because it can be used to buy and sell practically anything. But its absolute liquidity is limited because you often can’t use it in other countries.

Nobody with $100 in pesos leftover from a recent trip would travel back to Mexico just to spend them, but they might exchange them back into dollars. Some people with $20 in pesos wouldn’t even bother to exchange them back. Many people who travelled regularly (until overseas card payments became the norm) collected coins and banknotes from dozens of different countries, holding them for decades.

Today’s loyalty program members resemble yesterday’s foreign travellers: collecting small amounts of value in currencies they often can’t use. However, unlike fiat currencies, the points can expire, making them even less valuable over time.

There are also good reasons to restrict the liquidity of a loyalty currency.

A fully liquid loyalty currency could be spent anywhere – i.e., Walmart’s points could be spent at Target. Customers might like that, but it defeats Walmart’s objectives in offering points in the first place because they don’t want their loyalty value spent at a competitor.

But this is a question of balance, because greater liquidity makes the currency more useful, increasing its perceived value to customers, and enhancing the attractiveness of the loyalty proposition.

That is why Walmart might collaborate with fuel retailers, insurance companies, travel agencies, pharmacies, or construction hardware companies. Walmart may only compete on a very limited number of items with these other brands, but together, they might sell the goods that represent 40% to 60% of the products or services that an average family may need each month.

This means that brands with larger ecosystems of complementary partners can deliver greater freedom and choice to customers. Even where customer frequency is too low for that crucial $25 in points value per year, the liquidity of the loyalty currency means the brand can still influence desirable behaviors.

Greater customer frequency: a pathway to improved personalization

Today, most major loyalty programs are working towards improving customer frequency by enhancing points liquidity. This is happening chiefly through expanding their network of loyalty partnerships, or offering more low-value rewards, so that even infrequent customers can exchange a small amount of points for a general-use gift card.

The reason for this trend is that when customers are motivated to collect your loyalty currency in the first place, they will engage and share data that helps improve personalization.

With low frequency, customers may never join, and you may never gain permission to market to them, because they don’t expect to ever reach interesting rewards. However, if you offer the points/miles that your customers are already collecting – i.e., a partner’s points – the customer will be much more motivated to engage, and you will collect a lot more data.

This is moving up the agenda because, with cookie-based advertising now heavily restricted, loyalty participation is now a brand’s most effective method of collecting first-party or zero-party data. This means that loyalty programs are now a more important channel for customer acquisition and retention than ever before.

Customer frequency is partly determined by the nature of your business.

A low-frequency business would be an airline (for most people), or brands selling occasional purchases such as refrigerators, cars, laptops, shoes, gala dresses, etc.

There are always exceptions, such as a frequent flyer who travels a lot for business, or a TV star who needs a lot of clothing. But if 90% of your customers don’t buy your items very often, they’ll struggle to reach $25 in points per year.

This is a problem, because if only your top 20% or customers are frequent enough to benefit, you’re only capturing adequate data on a small percentage of customers. Of course, the mid-to-long-tail of customers include people who simply don’t need to spend a lot in your category. But it also includes people who are allocating share of wallet to competitors – and who may reallocate more of their spend to you, with the right incentives.

A high-frequency business, on the other hand, such as grocery stores, banks, and payment card issuers etc, do have sufficient customer frequency, with many customers returning every week.

These brands, however, aren’t that exciting to most customers. Some low-income customers may be highly motivated to earn a few dollars a month off their grocery bill, but the most valuable customers usually need an aspirational redemption such as a holiday to make the effort of the loyalty program worthwhile. This appeal is usually amplified when the travel brand offers redemptions on distressed inventory – allowing for redemptions with a perceived value of 3-4 times their direct cost.

As a result, brands have recently been focused on introducing greater liquidity into their loyalty currencies. In the 1990s, it became possible to exchange many supermarket reward points into Air Miles. This enhancement in liquidity effectively made both the supermarket points, and Air Miles, more useful to customers of both brands.

Many loyalty program members will now be accustomed to similar liquidity enhancements, such as exchanging your American Express Membership Rewards Points into Avios or Bonvoy. Another good example is the Avion Rewards program, from Canada’s RBC (a bank) which any customer can join, even if they don’t bank with RBC, to earn and burn with a wide range of brands.

Remember, your loyalty goal is not to issue the maximum number of points, but for the maximum number of customers to see joining your program as worthwhile.

Deciding whether to be a currency owner

A longstanding problem in loyalty, which is actually worsening in recent years, is an excess of loyalty currencies in the market.

Today, brands in many industries, from ecommerce or direct-to-consumer brands, to CPGs, to publishers and more, are now investing more heavily in loyalty. Clearly, all these businesses need a loyalty strategy, and most brands can incorporate loyalty points into this strategy.

But the truth is that consumers simply don’t need or want a different loyalty currency for every brand they shop. In fact, we believe that over the course of this decade, the number of brands operating a loyalty program that issues others’ points/miles will grow dramatically, while the number of loyalty currencies available will decline dramatically.

This is in the best interests of both consumers and brands. Consumers will be able to consolidate more loyalty value in fewer currencies, and brands in categories with lower emotional appeal will attract many more customers who want the points/miles of an aspirational brand, such as an airline or hotel group.

So, you should consider carefully whether you want to be a ‘currency owner’ (in the way that the UK’s Sainsbury’s grocery chain owns the Nectar loyalty currency). The alternative is simply issuing another brand’s currency (in the way that eBay and Esso gas stations also issue Nectar points).

There can be significant benefits to being a currency owner. But for many brands, issuing the points/miles that your customers are already motivated to collect greatly reduces friction (and probably indirect cost), while increasing your ability to capture insightful data that helps improve personalization.

The costs and risk of being a currency owner

Loyalty programs are regulated entities in most jurisdictions, which means there are legal and financial considerations to being a currency owner.

A currency owner must account for issued points as a cost of sale, and, if they follow solid fiduciary guidelines, set aside a pool of money in a separate bank account to cover liabilities when the points are redeemed. That value then appears as liability on your balance sheet, which remains until the customer redeems the currency against a purchase (or the points expire).

By contrast, when you issue another brand’s loyalty currency, you can treat the cost of the partner’s points as an immediate expense – a direct ‘cost of sale’, with no lasting impact on your balance sheet.

Points liabilities are often a point of tension between the CFO and the CMO.

The liability can be commercially useful in two ways:

- the customer stores up their points value for an aspirational redemption, such as a vacation – incentivizing them to shop more with your brand

- the customer exchanges their currency into another brand at a price that you set – normally, lower than the cost of the liability on your balance sheet.

CFOs don’t mind this liability as long as there is not a massive volume of redemptions in a fairly short period of time because that liability costs very little cash. CMOs, by contrast, realize that unspent points, and especially expiring points, represent frustrated customers.

So while the CMO works to make currency more liquid, often, CFOs force the loyalty team to find ways to limit redemptions. This upsets customers, and is likely to make your brand the ‘bad guy’ in the press and on social media if the restrictions ultimately devalue the points/miles.

Effectively, the loyalty currency is another consumer product, so you have all the usual cost and effort associated with building and maintaining a brand, customer service, licencing technology, etc. That’s the same with any loyalty program, but direct costs are likely to be lower if you’re not the currency owner.

Weighing up the benefits of issuing a partner’s loyalty points

For some brands, the preference to issue their own loyalty points is an emotional one. They question why they would spend money issuing another brand’s points – or perhaps they aspire to be the next AAdvantage, Hilton Honors or Chase Rewards.

It’s important to put this emotional preference to one side, and consider the practical issues.

On the business side, you’re looking for an affordable means of customer retention and acquisition.

On the customer side, you’re looking to create the greatest possible perceived value.

Issuing your own points might eventually come at a lower direct cost – but if they’re not your customer’s favorite points, the perceived value may be low, and the hoped-for ROI may never materialize.

Consider the example of a retailer (i.e., fashion), that has margins of 40%. Whether the retailer issues its own points, or a partner’s, the cost of points issuance might be $1 per $100 spent.

If it’s the retailer’s own currency, this ‘cost’ is a liability – which is cleared when the currency is redeemed. That means when that $1 is redeemed, the retailer achieves a $0.40 net margin on points issuance because the goods for which the points were redeemed also have a 40% margin.

Issuing the partner currency incurs a direct cost – so your net cost is the $1.00 paid to the partner for taking on the liability in their program.

This makes it appear advantageous to issue your own currency, but it’s important to remember that the points issuance is a marketing cost – so ROI comes down to whether you’ve had the desired impact on customer behavior.

Most high-margin retailers have fairly low customer frequency, so if you issue your own loyalty currency, perhaps only 20-30% of customers will ever earn enough value to redeem. That could mean for every $100 in points issued, only $20-30 are ever actually redeemed – producing a negative net margin.

On the other hand, 60-70% of customers may be motivated to redeem in the currency of a partnered airline or hotel. So while the cost of points issuance is higher, the retailer gains a far more powerful tool for influencing customer behaviour – for no greater investment than 1% on the cost of sale.

So the net-net is that you may be able to save 40% by forcing customers to redeem within your own program, but you may miss out on far greater engagement opportunities over a longer time horizon.

That includes the ability to increase your brand appeal with the currency owner’s member base. In fact, partnering with a large airline or hotel group could open your marketing to another hundred million members of that partner’s loyalty program.

Or even better, extend your reach further by offering 5-10 different loyalty currencies and allow the customer to choose which one is most meaningful to them.

*

For low-margin, high-frequency retailers such as grocery, participation is typically a lot higher than 20% – so issuing your own points may be quite efficient. Indeed, that’s why most supermarkets are currency owners. But most retailers don’t have this advantage of high customer frequency, so issuing a partner’s points is likely to be necessary to get the majority of customers engaged.

There are certain benefits to being a currency owner. We are not going any further into that in this article, because I believe every brand that can have a dominant loyalty program already has one. That means, if you have read this far, you are almost certainly in the category of brands that needs to think seriously about offering someone else’s loyalty currency.

This is a frank discussion that you need to have internally. There is no shame whatsoever in recognizing that being a currency owner isn’t right for your business, since you can still run a highly effective loyalty program. Indeed, many leading hospitality brands and rental car companies operate a hybrid solution where their most frequent customers are motivated to earn the brand’s own points, while less frequent customers have the choice of other popular points/miles.

The important thing is that customers are motivated to engage with your brand.

In fact, where data security legislation has been introduced (such as in California or the European Union), you don’t even have permission to collect or analyze data unless customers opt in. So, offer what your customers want, and you will be rewarded with greater share of wallet.

These benefits have been proven over and over again by clients of Currency Alliance – who collaborate with complementary brands to issue a curated list of points that customers care about as an incentive for customer acquisition and retention.

For most brands, collaboration with common loyalty currencies is the best way to generate more liquidity, making for happier, more engaged, and genuinely loyal customers.

How to issue loyalty points – or launch your own currency

Operating a loyalty program has historically depended on paying a lot of money to a third-party technology company, but it’s now becoming more affordable, whichever points you issue.

To issue your own points as a currency owner, brands would traditionally have licenced a loyalty platform. That platform would include a module called the loyalty points bank which is responsible for points issuance, recording transactions, and accounting. Modern, bundled loyalty platforms are more affordable, but it’s still a fairly heavy piece of technology. As a result, the total cost of ownership is still relatively high – and you end up with customer data spread across multiple CRM systems.

To issue a partner’s loyalty currency, brands would join a loyalty coalition – either one operated by a brand, such as an airline, or one operated by a third-party technology company, such as Air Miles.

Coalition loyalty programs, where many merchants issue a common loyalty currency, have been relatively successful over the past 20 years – especially in countries like Germany, the UK, South Africa, and Canada. They thrived because they delivered much greater freedom and choice to customers. So in principle, joining a loyalty coalition is a good idea.

However, existing coalition program operators have traditionally extracted very significant margins for their intermediary roles, preventing value flowing through to the customer.

These high costs also made it hard for medium and smaller companies to justify joining, and brands of all sizes experienced a loss of the personal touch, as brands felt they had less control over their loyalty strategy – due to dependency on a third party.

The good news is that brands can now easily achieve the same benefits, whichever currency they issue, without excessive fees or overdependence on other companies.

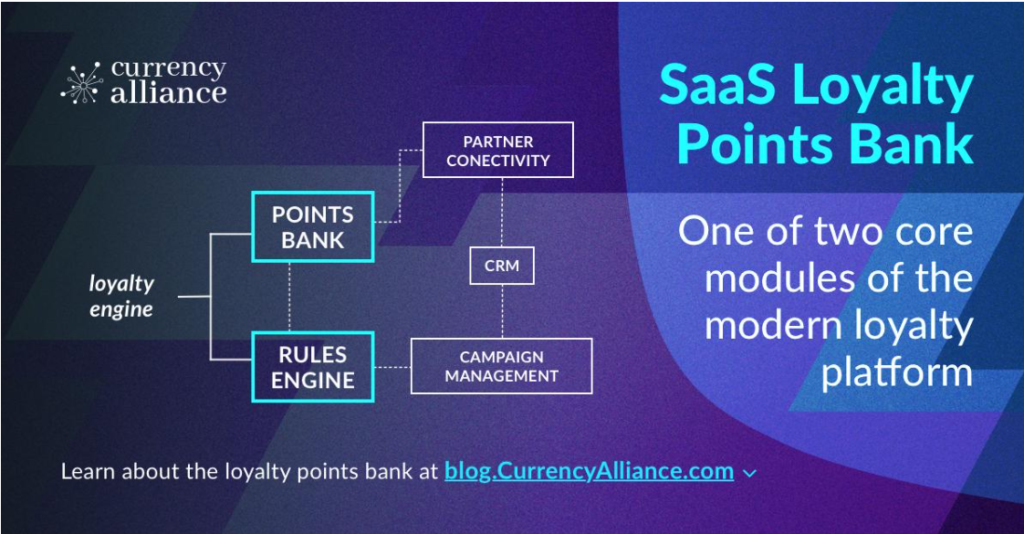

To issue your own loyalty currency: Currency Alliance offers an SaaS points bank which can easily integrate with your existing martech stack. Together, the points bank and the rules engine (also available from Currency Alliance as a standalone solution) form the core modules of a loyalty platform.

Integrating these with your existing CRM, campaign management tools, and your chosen ecommerce environment produces a complete loyalty platform, but without paying for technology that already existed in your business.

To issue another brand’s loyalty currency, you first need to agree a loyalty partnership with the currency owner. You then need to integrate your own commerce technology with the currency owner’s loyalty platform, and agree a rate at which to purchase the points.

If the currency owner works with Currency Alliance – as do several hundred of the world’s most popular loyalty programs – that integration is free, and takes a matter of days. You only pay a transaction fee of 2% on the value of points issued (i.e., 2 cents on every dollar of points value given to customers). This means you are paying about 2 cents in transaction cost for every $100 of incremental revenue. That is almost nothing.

Allowing customers to exchange points between brands

Allowing customers to exchange their loyalty currency from one brand into another brings the benefits of coalition loyalty to the brand, while also allowing the brand to be a currency owner. It extends the brand’s reach beyond its immediate customer base. It introduces liquidity to the currencies being exchanged, making both currencies more useful and valuable to the customer, and it also allows both brands to share data insights and identify valuable customers.

In the past, a coalition loyalty program required all partners to issue the same loyalty currency (which was usually owned by the intermediary). Now, modern coalitions can exist where several brands have their own points/miles, and others simply issue one of the loyalty currencies available in the ecosystem of partners; we like to call these ‘open loyalty networks’. Therefore, it is no longer a requirement for a brand to abandon their own loyalty points just to join a coalition program.

Customers have demonstrated they are happy sharing their data if it means they get better service and special offers, so such initiatives should be well-received, as long as expectations are well-communicated.

Such exchange transactions previously resulted in some loss of value for the customer – to a large degree due to technology costs. The initial integration between the two brands’ loyalty systems would normally cost tens of thousands of dollars. The ongoing exchange of currencies then incurs administrative costs on reconciliation and settlement.

Currency Alliance was founded to solve this exact problem. Brands can connect in a matter of seconds via our Loyalty Partnerships Marketplace. The fee to exchange points is only 2%, which leaves plenty of value on the table for the customer – and for the currency owner to earn a margin if they wish.

Our mission is to get the cost of setting up new partnerships as close to zero as possible, so the ROI from the collaboration becomes positive almost immediately. We do that by making the technology easy, providing standard contracting templates for partners, and automating most of the routine partner management requirements – at scale and at low cost.

The way you issue points should be guided by customer value and customer frequency

These are not ‘either-or’ choices.

Many leading loyalty programs today (especially in hospitality) both issue their own currency, and allow customers to exchange their currency into a partner program.

The guiding principle is to issue the forms of loyalty value that are most appreciated by the broadest set of customers – while keeping costs low for the brand.

Relatively few brands today, except in hospitality, yet allow customers to choose which loyalty currency to earn, but this is a significant untapped opportunity. With modern technology, it’s relatively simple to allow customers to select which currency to use at the point of sale, online, via an app, or at an ePOS in-store.

A brand could even adjust the earning and redemption rules in order to influence the customer’s preference for earning or redeeming with specific companies, depending on the context of the transaction.

The evolution of the loyalty industry for the past 30 years has been towards greater liquidity, which creates greater perceived value, by enabling greater customer choice.

Most brands today, in the loyalty industry, are already pursuing loyalty partnerships at pace, so the effort to create this choice is happening anyway. Allowing greater liquidity of loyalty currencies comes at virtually no direct cost above these existing efforts – and at a far lower cost than any other form of customer acquisition or retention.

Today, switching costs for customers have fallen in nearly every industry. ‘Locking in’ customers is not an effective tactic when they can choose freely between multiple comparable service providers in nearly every category.

The same applies to loyalty programs.

At Currency Alliance, we don’t believe giving a customer some miles or points actually generates much loyalty. It may create a degree of ‘lock-in’ but the points themselves don’t create loyalty. Offering points is often expected in exchange for giving up personal data, but more importantly, giving some points in a loyalty program is the opportunity to start a dialog – and through that dialog, a brand can try to build affinity. Creating real loyalty is built through delivering overall value and providing a consistently good experience. The points will only affect the perceived value if the customer can do something with them.

A leading source of competitive value is now the freedom that you grant customers, to earn and burn their favorite points or miles widely across their favorite brands – because this enables frequency of customer engagement. Without frequent earning and burning, you miss out on touchpoints to influence behavior – and much of your loyalty investment goes to waste.

Whether this earning and burning takes place in your currency, or a partner’s, is largely insignificant in the goals of engaging with the widest audience of customers and building loyalty in your brand.