What is brand research?

Brand research – sometimes called brand market research – is the act of investigating the various aspects of a new or longstanding brand to gain insights that can help curate brand value.

Brands are the culmination of lots of different factors. Beyond the products and services it offers, a brand is also an ethos, a personality, a visual brand identity, a vision, and a feeling that people have when they think of it. But for every brand, there will naturally be an ideal version of how that overall branding is landing, and then there’ll be a reality as seen by its customers and the general public.

Brand research will help you answer questions like “Who knows about my brand? where have they heard about my brand? what are their perceptions and judgments about my brand? what is their relationship with my brand- from unknown to a devoted user?

Brand research, then, is when we dig into how each of those two versions matches up – either before a company launches its branding, or as an effort to understand how longstanding branding is working out.

An important element to brand research is the fact that it is always done in comparison to the competition. Your brand is only as good as what it’s being compared to: e.g. You may love McDonalds more than Burger King because you think it’s more for music fans given their latest promotions featuring musician celebrities.

Turn your brand into an icon with BrandXM

What’s the difference between brand research and brand analysis?

Research in this instance describes the act of studying what people think of your brand, by way of surveys, focus groups, social listening, etc. It’s research in its truest form, where we’re investigating to find answers to a set of clearly defined questions.

Brand analysis is essentially what we do with those answers. Brand analysis assumes that we’ve already conducted our brand research (or are doing so on a rolling basis), and can now analyze the results to draw conclusions and find actions that can point the brand in the right direction as part of our brand strategy.

Markets are changing quickly: new competitors are emerging and consumers are changing their preferences. This means that there’s more urgency to do better and more frequent brand research.

A good approach to brand research will have an ongoing approach (as shown in the diagram) to make sure that your brand is in alignment with your target audience.

Put simply, brand research is the work we put in, and brand analysis is the insights we get out.

What does brand research entail?

We’ll go into greater detail on how to conduct brand research later in the article, but you probably want to know how much effort’s involved, right? Well, brand research can be incredibly in-depth or fairly straightforward, depending on a range of factors like the age and size of the brand, your research goals, and – importantly – the tools at your disposal.

For the most part, the effort you put in will correlate to the level of insights your brand research will yield. For instance, running in-person focus groups will naturally require more effort than an online survey, but you’ll probably garner a more in-depth view of how your brand is being perceived from the former than the latter.

Whatever the case, your brand research efforts can be made infinitely easier and smarter with the right technology. Brand experience management suites, brand trackers and brand research tools can all help streamline and – crucially – formalize the process, bringing parity to sometimes disparate sets of results by analyzing them all for you.

What’s the reward for the effort?

Ultimately, the goal of all this research is to come away with actionable insights that can positively shape, curate, and grow your brand value. Brand research is how you’ll take the guesswork away from decision-making when it comes to brand building.

Brand research: Terms to understand

When conducting brand research, there are several verticals to look at that can give you an idea of where your brand stands – both in terms of the competition and the general consumer perception:

Brand awareness

Brand awareness is a measure of whether people know your brand, either prompted or unprompted. That can mean naming your brand when asked to list companies in a certain industry (or from a logo, which we call brand recognition), or it might mean brand recall; it’s about remembering your brand after buying a product or seeing an advertisement or other piece of marketing.

Brand associations

When people think about your brand, what else immediately springs to mind? Are you known for great customer service? Do people think your products are expensive? Are you synonymous with environmentalism? These are all associations around your brand, and you’ll want to measure them to see how the reality stacks up against your aims. Associations can be positive or negative, so it’s wise to be realistic and expect to find that customers harbor views on both sides of that coin.

Brand perception

Differing slightly from the broadly positive and negative aspects of brand associations, brand perceptions are the overall picture people have of your brand. Every time consumers interact with your brand – whether that’s passively by watching an advertisement, or actively through a purchase or customer support query – they make small judgments that build to overall brand perception.

![]()

Brand equity

Equity is the value – perceived or actual – that your brand has over others of similar standing. As an example, Coca-Cola has much higher equity than an off-brand cola, even if the ingredients are largely similar. Think also about something as simple as hayfever tablets. Thanks to marketing and branding efforts, name-brand tablets tend to have a higher standing than the pharmacy’s version, even if the ingredients and dosage are exactly the same. That’s brand equity, in a nutshell.

Brand loyalty

Brand loyalty leans on metrics like NPS and CSAT to determine how likely people are to buy from you again and recommend you to their friends. High brand loyalty is a strong indicator of the success of a number of smaller factors, like your products’ quality, your customer service, and your marketing efforts hitting their mark. Brand loyal customers are more loyal to choose you over a rival, even if there’s a more competitive product elsewhere.

Brand preference

Brand preference is a metric that shows how many people would prefer to choose your products over a competitor’s. Whereas brand loyalty focuses on customers who know and love your brand, brand preference is broader – giving insight into what even people who have never purchased from you before have to say. In that way, it’s similar to brand equity, where a preference for your brand shows that your marketing and branding are paying off.

What are the benefits of conducting brand research?

When companies invest millions of dollars into their brands it’s important to understand the output of that investment

The benefits are:

- Brand research can show how your brand has grown (e.g. in awareness or stronger perceptions) and tell you if your communications are working.

- Having more efficient tactics: When you know what’s working, you can concentrate on doing more of that and spend less time on tactics that don’t move the needle. When resources are constrained you’ll be able to use research to justify where you spend those resources

Actionable insight carries inherent value – if you know the areas you need to improve, it makes changing course infinitely easier.

Beyond this, however, brand research is the first step along the path to enhancing the customer experience. As we’ve discussed, research leads to analysis, which leads to action. And that action should make things more appealing to your target audience. When you improve the customer and brand experience, you’ll improve customer retention – and when you do that, you’ll move the needle with brand awareness and brand loyalty.

So this kind of research is cyclical. It ultimately benefits the metrics you monitor in the first place, on a path of continuous improvement.

In fact, research from HingeMarketing shows that continuous research yields strong profitability:

At the end of the day, your exact ROI on performing brand research will vary, but the investment will generally yield branding decisions that drive higher sales and revenue.

How to conduct brand research

Ok, so how do you put all this into practice? There are several clearly-defined ways to conduct qualitative and quantitative brand and marketing research around your brand. Here are the core brand research methods:

Survey research

Surveys remain a great way to solicit feedback on your brand, whether it’s via email, an online form, or on the phone. There’s no limit to the kinds of questions you can ask, and you can collect survey feedback at any time if you include a survey as part of the purchase process.

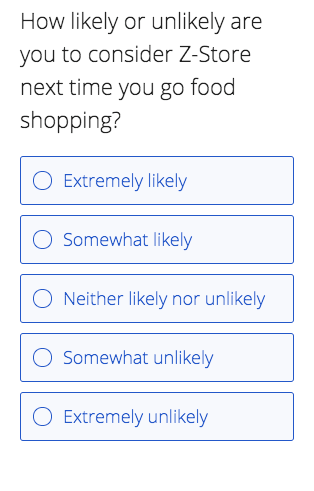

One common survey type for brand-based research is the Net Promoter Score (NPS), which asks the customer how they feel about the brand concerning willingness to recommend it. But email and online surveys can also be used to assess things like brand awareness and brand perception if you’re aiming it at people who haven’t necessarily already bought something from you. It’s all about choosing the right questions.

Example questions to ask:

- How likely would you be to recommend [BRAND]?

- What words come to mind when you think of [BRAND]?

- When you think of [PRODUCT CATEGORY], what brands come to mind?

- When was the last time you bought a product from [BRAND]?

- What led to that decision?

- What brand is the most recognizable in [PRODUCT CATEGORY]?

- If [BRAND] was a person, how would you describe them?

- Have you seen [brand name]’s advertisements?

- If so, where?

- What did they make you think?

- List five words you would choose to describe [BRAND]

Focus groups

Focus groups, whether in a room together on in a digital space, allow for more in-depth answers to common brand research questions. You can use these groups to dive a little deeper into qualitative insights – like brand perception and brand associations.

Focus groups can be organized in person by finding willing local participants (for example, by contacting existing customers or by advertising on social media), or they can be conducted online. For example, Twitter Insiders acts as a way to solicit feedback and insights from thousands of online users. Traditionally, these groups offer incentives to participants.

There are also plenty of focus group and research panel providers out there; if you’re thinking of using one, here are a couple of things to look for:

1. A large respondent pool

It sounds obvious, but they need to be able to provide the right people at the right time. The best providers will have a vast range of possible respondents across different countries and demographic and social groups.

2. Support when you need it

A great provider will do more than just deliver the sample. They’ll be on hand to support you with questions about designing your survey, running the process, and conducting the right analysis afterward.

Digital listening

If you want to know what people are saying about your brand, you just have to listen! People will be talking about your organization on social media, on third-party review sites, over email, and on the phone to your contact center agents; the smartest brands are the ones who know how to piece all that information together.

An intelligent brand experience management suite can listen to all these disparate conversations for you, bring them together in one place, and use AI and natural language processing to assign qualitative values like emotion and sentiment – and then turn all that information into useful, actionable suggestions.

BrandXM, for example, can both listen and engage with consumers – passively and proactively – on a continuous basis. Our brand tracking tools then assign meaning to those interactions, painting a vivid picture of your brand perception, awareness, loyalty, and more.

Research as part of ongoing brand tracking

Research like this should never be seen as a one-and-done tactic. Instead, it’s a core part of building brand value on an ongoing basis. The insights you glean from your research will be inherently more accurate and useful if they derive from real-time listening and frequent questioning, so it’s crucial to think of research as one part of a permanent improvement strategy.

Identify the greatest areas of opportunity for your brand, so you can focus on strengthening the attributes that drive consumers and differentiate you from the competition

Make decisions faster, with real-time access to the brand insights and the ability to drill down whenever curiosity strikes

Simulate scenarios for your brand so you can anticipate how your tactics can move key metrics like awareness or equity

Understand the business value of your rebranding efforts and discover the factors that drive your success, easily replicating positive action

Turn your brand into an icon with BrandXM