Employers use the Australia Weekly Tax Table 2024 as a crucial tool to determine how much tax to withhold from their workers’ weekly wages. The Australia Taxation Office maintains this weekly tax table, which guarantees fairness and payment by displaying different tax rates based on individual income levels. This tax table is easy to use, crucial for processing salaries accurately, and safeguards against errors that might incur fines and penalties.

Employers can help their employees uphold the following tax laws by visiting the Australia Taxation Office’s official website, obtaining the text table in PDF format, and using it. This post will cover all the information you need about the Australia Weekly Tax Table 2024, including an overview of taxable users, withholding declarations, and more.

Australia Weekly Tax Table 2024:

The Australia Weekly Tax Table 2024 can assist employers all around Australia in streamlining the tax deduction procedure. Establishing precise guidelines for tax rates and caps encourages precision and equity in the pay administration. This readily available resource from the ATO website may help employers ensure that the right amount of tax is withheld from employees’ pay, reducing mistakes and fines.

In essence, it is a dependable instrument that supports the ATO’s equitable taxation policy. It is recommended that people check the Australia Taxation Office’s official website to learn more about any revisions regarding the Australia Weekly Tax Table 2024.

ATO Tax Codes and Rates for 2024:

The Australian Taxation Office (ATO) determines the tax rates in Australia. The annual ATO Tax Rates are subject to change. People can check the tax rates for the current year on the ATO’s approved website to learn more about the tax rates. Australia’s tax rates are determined by the taxable income of its residents, much like in several other nations.

| 0 to 18,200 dollars | No Tax |

| 18,201 dollars to 45,000 dollars | 19c for each 1 dollar over 18,200 dollars |

| 45,001 dollars to 120,000 dollars | 5,092 dollars plus 32.5c for each 1 dollar over 45,000 dollars |

| 120,001 dollars to 180,000 dollars | 29,467 dollars plus 37c for each 1 dollar over 120,000 dollars |

| 180,001 dollars and more | 51,667 dollars plus 45c for each 1 dollar over 180,000 dollars |

How is the Weekly Tax Table Australia 2024 used?

If the following are paid every week, you can utilize the Weekly Tax Table:

- earnings or salaries

- directors’ compensation

- government funding for training or education

- payments for sick leave or accidents, office holders’ allowances and wages, and payments to labour-hire personnel

- reimbursements for parental leave to religious professionals

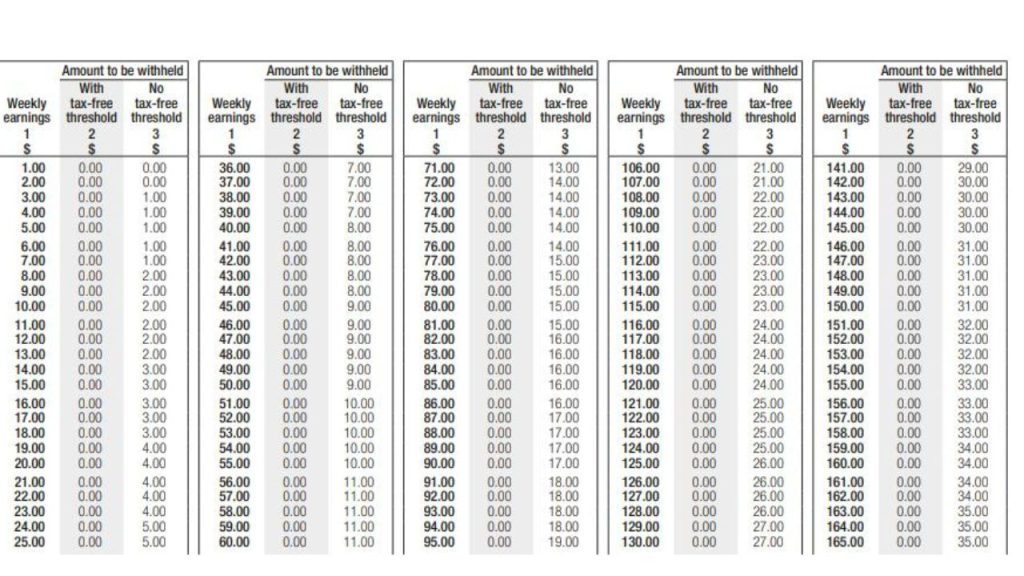

There are three columns in the Weekly Tax Table Australia: weekly earnings, tax-free threshold, and no tax-free threshold. Employers can use these fields to calculate the maximum amount they can deduct from employee paychecks based on weekly wages.

How To Verify The Withholding Amount?

- People must first compute their weekly earnings, including their basic salary and any allowances or incentives, to determine the tax withholding amount.

- Enter the computed amount in the withholding lookup tool to find the matching tax to withhold.

- Refer to the tax offsets to convert the yearly employee amount to its weekly payment for precise withholding.

- Subtract any necessary changes from the total amount now, and if more are needed, make them using the Medicare Levy.

- Add the Higher Educational Loan program’s computed amount to the withholding computations if appropriate.

| Article Name | Australia Weekly Tax Table 2024 |

| Organization | Australia Taxation Officer |

| Country | Australia |

| Tax Year | 2023-24 |

| Tax Table Purpose | To know the amount that has to be kept by the employers |

| Category | Government Aid |

| Official Website | https://ato.gov.au/ |

Regarding the Additional pay Period:

In rare circumstances, 53 payments are made throughout the fiscal year instead of the customary 52, meaning the taxpayer receives an extra sum. For example, those with weekly incomes between $875 and $2299 will receive an extra $3. They will receive an extra $5 if their weekly income is between $2300 and $3449 and an additional $10 if it is more than $3449. Even in the uncommon event of one more pay period, these measures guarantee that everyone receives equitable tax compensation.

If an employee does not furnish their Tax File Number (TFN), employers must deduct 47% of their resident employee’s compensation and 45% of their international resident employee’s income. This withholding is relevant in some situations, such as when the TFN has not yet been supplied, no request for an exemption from the TFN quotation has been submitted, and no guidance regarding the TFN application. Transparency in tax legislation is promoted by ensuring that the correct tax withholding procedures comply with these requirements.

The Australian tax table withholding declaration aids workers in figuring out how much tax should be withheld from their pay. Filling out this statement accurately helps employees ensure that the right amount of tax is withheld from their pay, which lessens stress throughout the tax year and keeps them out of trouble with the law.

Read Also – Awaiting April 2024 OAS Payments of $800 + $713: Get More Details